The shipping industry counts down to August 13th

Next week is Maersk week. The major shipping group will present its financial report on August 13th, and especially two questions will be answered here. How much has the general rate decrease on the container market affected the world's largest line carrier Maersk Line? And how much has the decline in the energy sector affected the group's companies in the oil sector.

Try a free 40-day trial subscription to ShippingWatch

Furthermore, this week will also offer half-year interim reports from several of the most significant Danish carriers, namely Torm, Norden and J. Lauritzen. ShippingWatch is getting ready for a bustling week of financial reports:

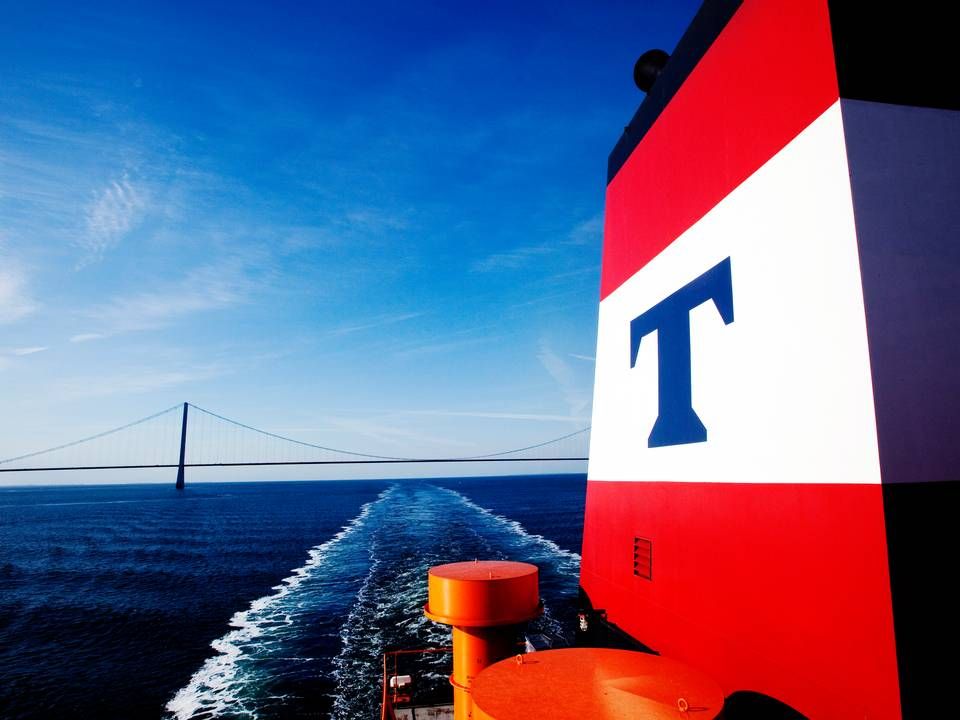

Torm - August 12th

In July, the tanker carrier Torm could finally put the last touches on the protracted restructuring process which has kept the company busy since 2012.

The restructuring deal also means that Torm's debt will be reduced by USD 500 million to USD 873 million so that the carrier's debt will correspond to the value of Torm's vessels. The new majority shareholder in Torm is the equity fund Oaktree Capital Management which now owns 62 percent of the ordinary A shares and additionally has a "golden" C share that provides the right to choose all but one member of the board and control most of the articles of association.

Oaktree has used this right to suggest Canadian Christopher Helmut Boehringer as chairman and also the former Lauritzen executive Torben Janholt as well as Pär Göran Trapp as new members. The entire current board at Torm will step down during an extraordinary general assembly on the 25th of August.

Try a free 40-day trial subscription to ShippingWatch

Torm presented a profit in the first three months of the year, for the first time in five years, with a pre-tax profit of USD 8.6 million. During the same period in 2014, the company suffered a deficit of USD 222.6 million - and Torm announced on the first of July 2015, that for the first six months of the year, the company expected a positive operating result (EBITDA) of about USD 95-100 million and a result before taxes of USD 5-10 million.

Norden - August 12th

DS Norden was hit hard by the dry bulk crisis in the first quarter of the year, where the carrier achieved revenue of USD 455 million, a significant setback from the same period 2014, where the revenue came to USD 557.5 million.

But contrary to many other dry bulk players, Norden managed to present an improved result in the first three months of the year, at USD 38.6 million compared to a deficit of USD 26.5 million the year before.

However, this was mostly due to the carrier's strategy of betting on the tanker market parallel to dry bulk, Executive VP Martin Badsted told ShippingWatch following the financial report.

Martin Badsted. Photo: Norden

In June, Norden increased expectations for the operating profit (EBIT) for 2015 to USD 50-90 million compared to previous projections of a result between minus USD 40 and a surplus of USD 40 million. The upgrade is attributed to a tanker market that is still characterized by a broad recovery with strong rates in all regions. Based on this, the tanker business is projected to generate an operating result of USD 75-100 million compared to the previous estimate of USD 35-65 million.

Danske Bank Markets this week knocked the share in Norden up a notch, to USD 30.7 per share from the previous USD 29.9 per share, and the banks analysts also pointed to the fact that dry bulk had reached rock bottom

Maersk Group - August 13th

Maersk could be it on several fronts in its interim report report next week.

Maersk Supply Service, Maersk Drilling and Maersk Oil are all three struggling with the extremely weak offshore market, where the low oil price has sent the oil companies into investment stops and budget cuts across the sector.

Maersk Line's container market is also in a difficult situation with rates under pressure and massive overcapacity. The world's largest container carrier maintains the traditional goal of surpassing last year's result, but this may prove difficult in the second quarter of the year - especially according to a number of analysts who last week told Danish newspaper Berlingske Business that Maersk Line's tough market could the group lower its guidance.

Maersk Group CEO Nils Smedegaard Andersen. Photo: Jens Dresling

Maersk Line finished the first quarter 2015 with a profit of USD 714 million compared to USD 455 million in the same quarter 2014. However revenue dropped to USD 6.3 billion from USD 6.5 billion in the first quarter 2014. And the carrier was not pleased with this performance:

"Global container demand is expected to have grown around one percent in Q1 2015 compared to Q1 2014. Maersk Line volumes decreased by 1.6 percent in Q1 2015 underlining challenging market conditions and a less than satisfactory development in volumes and vessel utilization. Maersk Line's strategy remains to grow with the market and also to ensure satisfactory vessel utilization," noted the group in the interim report.

Try a free 40-day trial subscription to ShippingWatch

For the full year, Maersk Line expected after the first quarter to achieve a profit better than in 2014, which finished at USD 2.2 billion.

The whole Maersk Group expects a result of about USD 4 billion for 2015.

J. Lauritzen - August 13th

A horrific interim report from J. Lauritzen after the first three months of the year in the nightmarish dry bulk market caused the Danish carrier to downgrade the total expectation for the fiscal year of 2015, to a total deficit of USD 50-100 million.

The company suffered a first quarter 2015 net deficit of USD 27 million, down from a small profit of USD 1.9 million in the same period 2014. EBITDA for the first three months came to a deficit of USD 9.5 million, a USD 19.1 million setback from the first quarter last year.

"The dry cargo markets in Q1 turned out to be weakest for the last 30 years and substantially weaker than expected at the beginning of the year. Less demand growth than projected at the end of 2014 amplifying the already known oversupply of carrying capacity have lead to a downward revision of our earnings forecast for the full year (2015)," said CEO Jan Kastrup-Nielsen in the report.

Hafnia Tankers - August 14th

The Danish-based product tanker carrier Hafnia Tankers has taken the first step of preparation towards an IPO in New York with a formal application to the US stock authorities earlier this year. With the current boom in the market for oil products, which a number of financial report have shown over the past few weeks, Hafnia Tankers will most likely present a strong result in the past quarter and the first half of the year.

Torm replaces entire board of directors

Related articles

Torm replaces entire board of directors

For subscribers

J. Lauritzen makes more impairments due to terminated deal

For subscribers

DNB: Maersk is looking to exit tanker market completely

For subscribers