Scorpio Bulkers books USD 500 million write-down on vessel values

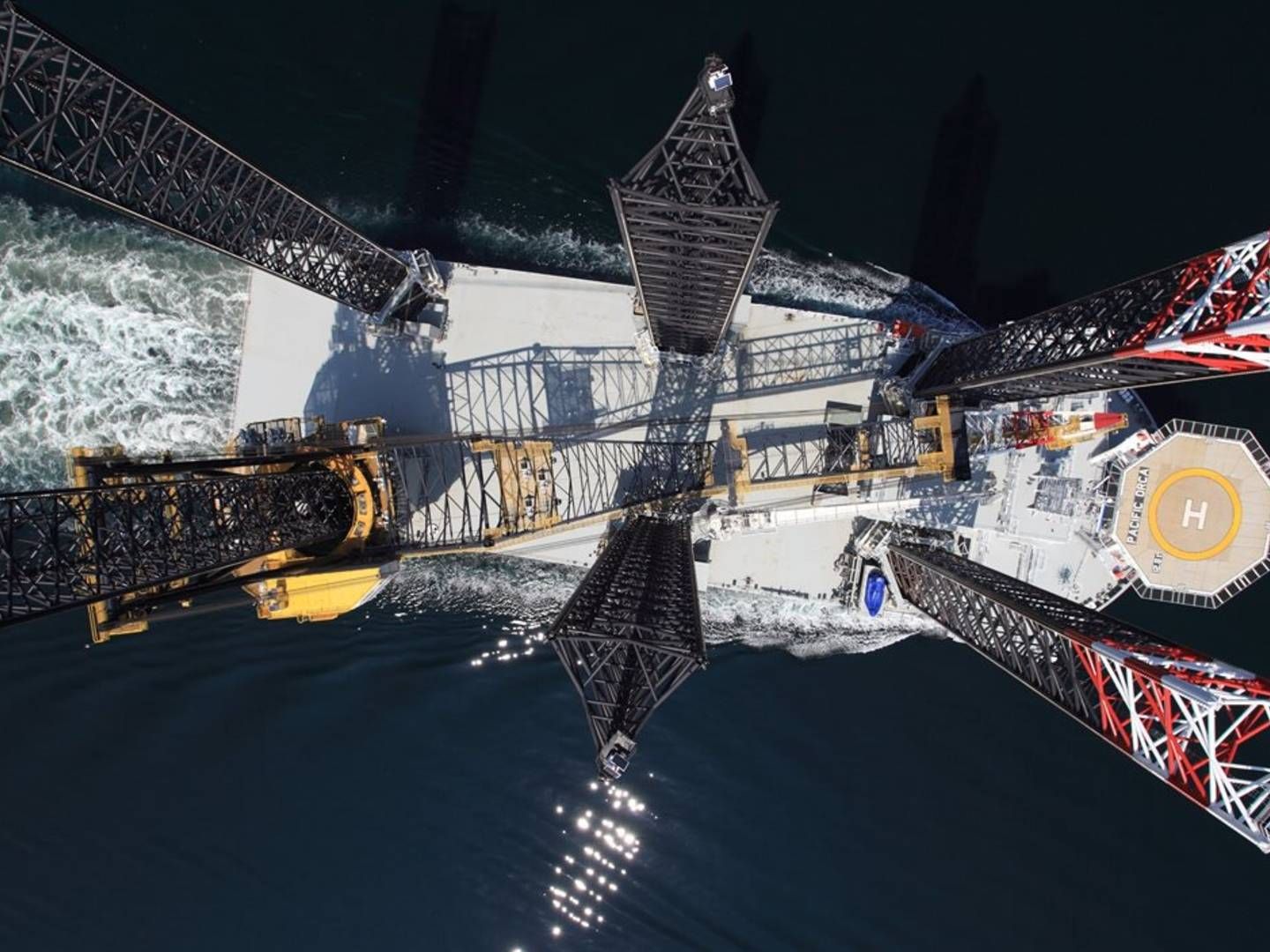

It will cost Scorpio Bulkers an additional USD 510 million to change its strategy and make its exit from the dry bulk market to instead focus on renewable energy and the offshore wind market.

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Scorpio Bulkers sells four ships to Pacific Basin

For subscribers

Robert Bugbee heralds Scorpio's full exit from dry bulk

For subscribers