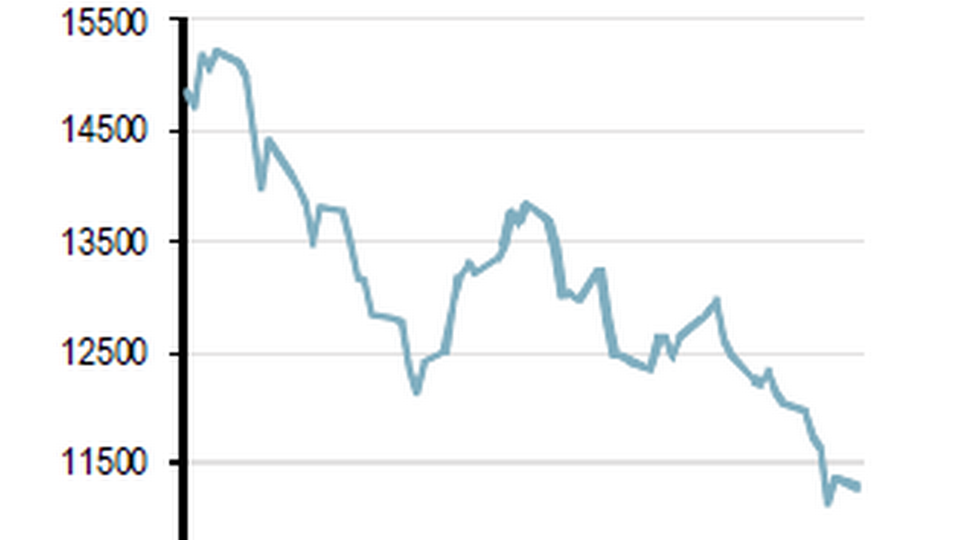

Maersk's market value down USD 13 billion

The sliding oil price has since mid-September forced the A.P. Moeller-Maersk share down 25 percent, corresponding to a USD 13 billion reduction in the company's market value. According to Nordea, this downturn does not look set to end anytime soon, and this comes at a time when investors value the Group's two major offshore companies, Maersk Oil and Maersk Drilling, at a big round zero.

"We see a risk that this pressure will continue on the short term," says Nordea in a stock report on Tuesday focusing on the drastic decline in the share since mid-September.

Source: Nordea and Bloomberg

Three months ago the Danish shipping and oil group's market value was around USD 53.7 billion. Today this figure has dropped to USD 40.6 billion.

Good value in the share

Nordea estimates that it will take time for the investors looking to secure gains from the share.

"If we are very conservative and set the value of Maersk Oil and Maersk Drilling at zero, that gives us a share price of USD 2,638, according to Nordea Markets' estimates. If we calculate with a group discount of 10 percent, as Nordea Markets uses, we get a share price of USD 2,362. That is higher than the current share price of USD 1,886."

"We believe that the two divisions do hold value, but this calculation shows that the stock market does not at this time attribute any value to these companies. So we see a good value in the share on the long term, even though it faces headwind on the short term," says Nordea.

Among other conglomerates there are also examples in which parts of a group that are hit by a crisis or struggling under various conditions are sent to rock-bottom by investors. In the current situation with Maersk, shipping makes the share attractive to investors.

Oil and gas down USD 27.5 billion on Oslo Stock Exchange

Major global oil companies have lost around USD 240.5 billion in value in less than five months as the oil price has plummeted by more than 40 percent since June, according to a survey of the companies' stock prices recently performed by Danish media Finans.

From profit to deficit

"When the oil price drops its impacts the companies' shares because investors quickly prepare for lower drilling rig utilization, lower prices etc. And in the oil business, things can change from profit to deficit in the blink of an eye, as the costs are very fixed while profits can vary a lot," says Per Hansen, investment economist at Nordnet.

Oil price sends offshore shares down in Oslo

And the companies are not the only ones being hit. The undergrowth of subcontractors are also hurt by the falling oil prices, as the oil companies are pushing prices up and because they no longer need the subcontractors.

On the Oslo Stock Exchange, the market value of John Fredriksen's drilling rig company Seadrill has also dropped significantly in the past three months, by around USD 3.4 billion, which means that the company's market value has been cut in half. Companies such as Statoil and subcontractor Kvaerner have also taken a beating on the stock exchange.

Norwegian oil workers fear mass layoffs

Stolt-Nielsen takes a beating on the Oslo Stock Exchange

Shipping shares plummet on the New York Stock Exchange

Related articles

Norwegian oil workers fear mass layoffs

For subscribers

Stolt-Nielsen takes a beating on the Oslo Stock Exchange

For subscribers

Shipping shares plummet on the New York Stock Exchange

For subscribers