DNB: Offshore market might not recover until 2018

With its Norwegian roots, it is no wonder that DNB is one of the world's leading lenders to the shipping and offshore industries. USD 25 billion has been offered in loans to carriers and offshore companies through syndicates with other banks. Half of the money has been lent to companies in Norway and the other half to companies from the rest of the world.

The bank is thus one of the players who have truly felt the effects of fluctuations and imbalances in the market in recent years. First, shipping took a turn for the worse, but that sector now looks more stabile. Bulk and container can still not really be characterized as balanced segments, but impairments and provisions in shipping are generally low. Offshore is now instead emerging as the next area to offer obstacles for companies, making it difficult for them to meet their financial obligations.

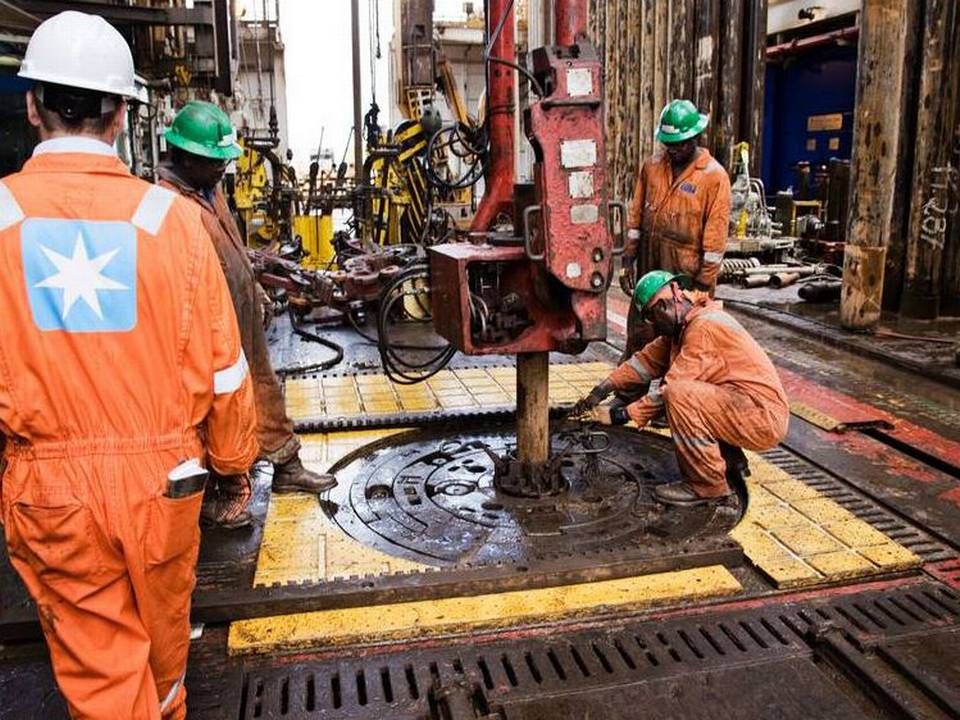

Maersk Oil downsizing could hurt Qatar prospects

The Global Head of DNB's Shipping, Offshore & Logistics Division, Kristin H. Holth, tells ShippingWatch in an interview that the current reduced activity level in the industry and the low oil price will undoubtedly add pressure to companies in the offshore sector, which could affect the extent of the bank's provisions. It has been spared so far, as the impairments it has been forced to make in 2015 have all been in shipping.

"There are many elements affecting the energy segment and, by extension, offshore. The low oil price is one of several factors which will determine developments. The pivotal factor will be the reduced search activity from oil companies. 2016 will be a difficult market and it could last until 2018 before we see a recovery. But we are a long-term financial partner for our customers, and we are working on finding balanced solutions to make it through this cycle. Companies will have to consider divesting assets as one of several elements in balanced solutions, aside from raising capital and reducing costs," Kristin H. Holth tells ShippingWatch.

Maersk Oil reduces workforce by 10-12 percent

The low oil price has already left its clear mark on a global scale, as budgets no longer tie in with the new conditions for breaking even which have become commonplace. A few days ago, Maersk Oil announced that it would be slashing one in ten jobs. Many suppliers, a lot of them based in Norway, have also been subjected to austerity measures.

The other day, major Korean shipyards reported slowing results, as delivering ships and equipment to the offshore industry is no longer the booming business it once was. And earlier today, Statoil announced a reduced profit in its third quarter, forcing the company to lower its guidance.

DNB has, however, begun to see a counter tendency from investors, as the prices on ships and companies are now so low that investors eye opportunities for discount purchases.

"Everyone is moving into position, and new opportunities crop up when someone divests,” Kristin H. Holth explains.

On a whole, DNB has seen increased activity in most of its business segments in 2015 so far, but offshore and supply have looked weaker than the other areas.

IEA projects oil flood far into 2016

DNB is moving toward offering a broader range of services to the customers it offers loans to. So in addition to loans, in the form of traditional loans or bond loans, the bank will also act as financial advisor, allowing customers to draw on its corporate finance and analysis departments. The bank wants to offer services that make its offerings more appealing to customers and also ensure that its risks and earnings on obligations come within what it sees as acceptable.

The announcement from DNB comes just days after another of the major players in offshore financing, Nordea, warned that the worst is yet to come for the offshore industry.

"If the oil price stays around 50, it will be a challenge for some and the weakest players could come under tremendous pressure. And if the oil price stays at that level for a couple of years, we will undoubtedly see bankruptcies. There is no telling how many we will see, but if you compare it to the development we have seen in shipping in recent years, companies with high loan to value ratios, low contract coverage, and low liquidity are in danger," Nordea’s Head of Shipping & Offshore, Hans Christian Kjelsrud, told ShippingWatch earlier in the week.

Nordea: Offshore can go from bad to worse in 2016

Related articles

Maersk Oil downsizing could hurt Qatar prospects

For subscribers

IEA projects oil flood far into 2016

For subscribers