Will an impeachment of Roussef shatter Brazil's oil dreams?

2016 was supposed to be a triumphant year for Brazil.

In the past decade, the country has been through a thriving development with enviable growth rates, and this summer the achievement was to have culminated with the Olympics being held in Rio de Janeiro. But when the eyes of the world are fixed on Brazil a few months from now, the dream scenario will have cracked.

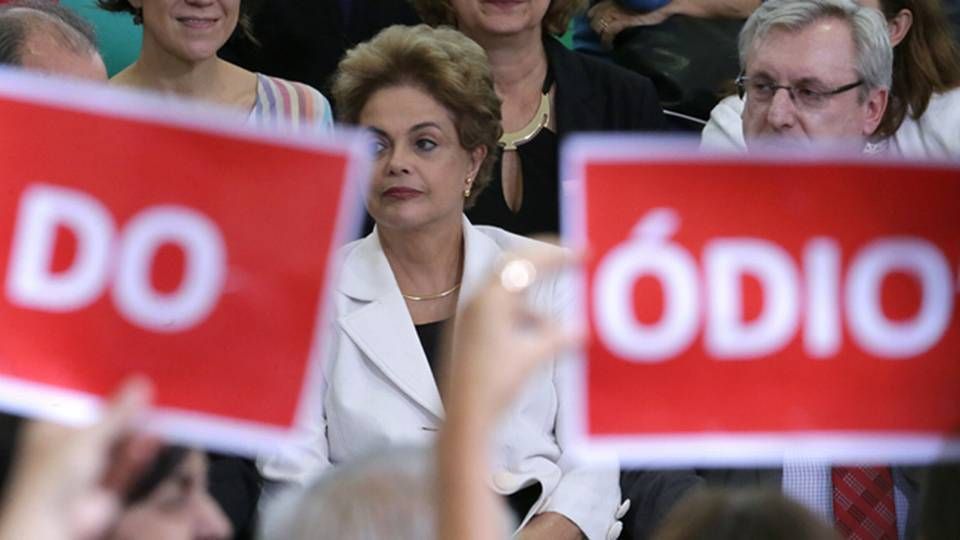

In just a few years, the South American nation has gone from growth hope to deep recession, and the crisis could become total on Sunday if a majority in the Lower House votes to impeach president Dilma Roussef.

The once-popular president is fighting tooth and nail to save her political life in an intricate case concerning budget transgressions which could end up forcing her to step down after heading the country for five years.

"It's been a long and messy process, and no one knows what's going to happen. It creates an enormous uncertainty in the market, which impacts the willingness to invest among Brazilian as well as foreign companies, while it also worries the country's citizens," Peter Efland, vice consul at the Danish Consulate in Rio de Janeiro, tells ShippingWatch.

"There's a lack of transparency and calm to get the daily political work done. Brazil is in the midst of its biggest recession in recent memory, so the country needs reforms and a government that can act, but this won't happen until the political situation is somewhat clarified," he says.

The political standstill is not least hurting the country's otherwise promising oil industry. The sector is already hit hard by the corruption scandal at state-owned oil major Petrobras, while the low oil price has not exactly made things better.

Meanwhile, foreign oil majors who previously flocked to Brazil have scaled their activities down big-time in the country. Statoil and Shell have both shelved projects, and the Maersk Group opted to impair its oil activities in the country by a little over a billion dollars two years ago.

The sector must be revived

Brazil's offshore industry was flowing over with optimism when it in 2006 discovered an enormous reservoir off the coast of Rio de Janeiro and Sao Paolo. The deepwater fields lie under a thick salt layer and are estimated to hold around 50 billion barrels of oil. At the time, this discovery made scores of international oil players turn their eyes to Brazil.

To ensure that the profits from the fields remain in the country, the government introduced new legislation in 2010 which states that Petrobras must be sole operator and control at least 30 percent of every single pre-salt field.

The proceeds were to be spent on things such as better schools and other welfare services for the Brazilian people, according to the government at the time, headed by the country's labor party and president Luiz Inácio da Lula, who even had one of the fields named after him.

President Lula (left) has had a pre-salt oil field named after him, the so-called Lula Field, which is located 250 kilometers off the coast of Rio de Janeiro. Photo: Ricardo Stuckert/AP/Polfoto/Arkiv.

Since then the oil price has declined significantly, while it has been revealed that CEOs, suppliers and politicians illegally siphoned more than two billion dollars out of Petrobras. This fraud, which happened while Dilma Roussef chaired the oil company, has forced Petrobras to its knees.

"The challenges confronting the Brazilian offshore sector are multiple, and the whole situation is quite complicated right now," RoseAnne Franco, who heads the Oil & Gas risk division at analyst agency Verisk Maplecroft, tells ShippingWatch. She describes the situation as a perfect storm.

"It is maybe a cliché, but you have the political crisis that’s compounding by the economic recession. At the same time the law has slowed down development of the offshore sector, because it has been largely contingent on Petrobras," she says.

In the middle of the dark times, an upside could be on the far horizon for the offshore industry, which could develop into a solid business for international offshore companies and subcontractors.

Petrobras has its hands full

Despite the fact that the political work has long been weighed down by the government crisis, the Senate managed to vote a piece of legislation through that could have a major long-term impact on the oil and gas sector.

The bill is now subject to a vote at the Lower House, but if passed, the new legislation will open the door for foreign oil companies who have in the past been denied full access to the so-called pre-salt fields.

The corruption scandal, however, means that Petrobras is now struggling to comply with its financial commitments as well as developing new fields, which was part of the legislation from 2010 that also provided the company with unique exclusive rights.

As such, strong opposition forces are looking to make it possible for foreign companies to sidestep Petrobras and thus own and operate their own fields in the country. And this could become a profitable business opportunity for international offshore companies.

"Considering Petrobras is so tied up in its own problems, this could be a new source of energy for the sector in the sense that it opens possibilities in the oil sector for multinationals," says Marcello Hallake, partner at law firm Jones Day, where serves as consultant to energy companies in relation to international investments,

"It requires billions of dollars in investment to reach this deep underwater oil, and it's a very good thing for Brazil if these investments can be made by others than the local companies," he tells ShippingWatch.

Low oil price and fierce competition

But there are still numerous obstacles standing in the way of a revival of the Brazilian oil venture.

Though the new legislation would allow foreign-based companies to serve as operators on pre-salt fields, this is far from sufficient to turn the development around. Not least because the proposed legislation still favors Petrobras on a key issue.

The text contains a so-called first right of refusal, which gives the state-owned oil major a right to bid on operator tenders. And this scare off foreign-based oil companies, explains Marcello Hallake of John Day.

"Companies do not like to spend money and time on cultivating a project if they know Petrobras is ahead of them. And if Petrobras exercises their right of refusal, it could also give the impression that what is being offered is not so good," says the lawyer.

Furthermore, the pre-salt fields represent massive investments. According to The Guardian, it can cost upwards of USD 300 billion to develop one of the deepwater fields, and this is a dizzying amount of money at a time when the low oil price has made groups such as Shell, BP and Chevron scrutinize every penny spent.

At the same time, other and less risk-fraught opportunities are emerging, says RoseAnne Franco of Verisk Maplecroft.

"You need to look at the larger environment of a lower oil price and a lot of competition for investment dollars in the industry. Even if this legislation is passed and signed into law there are still a lot of opportunities offshore outside of Brazil – be it the US or Mexico," she notes.

Still a long way to go

And lastly, there is the political chaos in Brazil, which could continue for months and put a damper on the willingness to invest in the country.

Even if the Lower House decides to impeach president Dilma Roussef, it is far from certain that she will step down or call an election, and as such, Marcello Hallake of Jones Day cautions against believing that the international companies will trip over each other to make bids the next time a pre-salt field is up for auction.

"The multinationals are looking at the big picture, and there are a lot of political and economic problems, so this is by no means an easy thing. It’s a good measure, but it comes a little late and it doesn't mean that everyone is going to be flocking into Brazil in the short term. It’s an expensive venture and it’s complicated," he tells ShippingWatch.

The most recent pre-salt auction was in 2013 and was held for the field Libra. The tender went to a consortium consisting of Shell, Total and Petro-China, which owns 20 percent of the field, while Petrobras owns the rest. The consortium's bid was the only one in play for the field.

Petrobras lost USD 10 billion in one quarter

Offshore carriers could face huge deroute in Brazil

Brazilian billionaire arrested in Petrobas case

Related articles

Petrobras lost USD 10 billion in one quarter

For subscribers

Offshore carriers could face huge deroute in Brazil

For subscribers

Brazilian billionaire arrested in Petrobas case

For subscribers