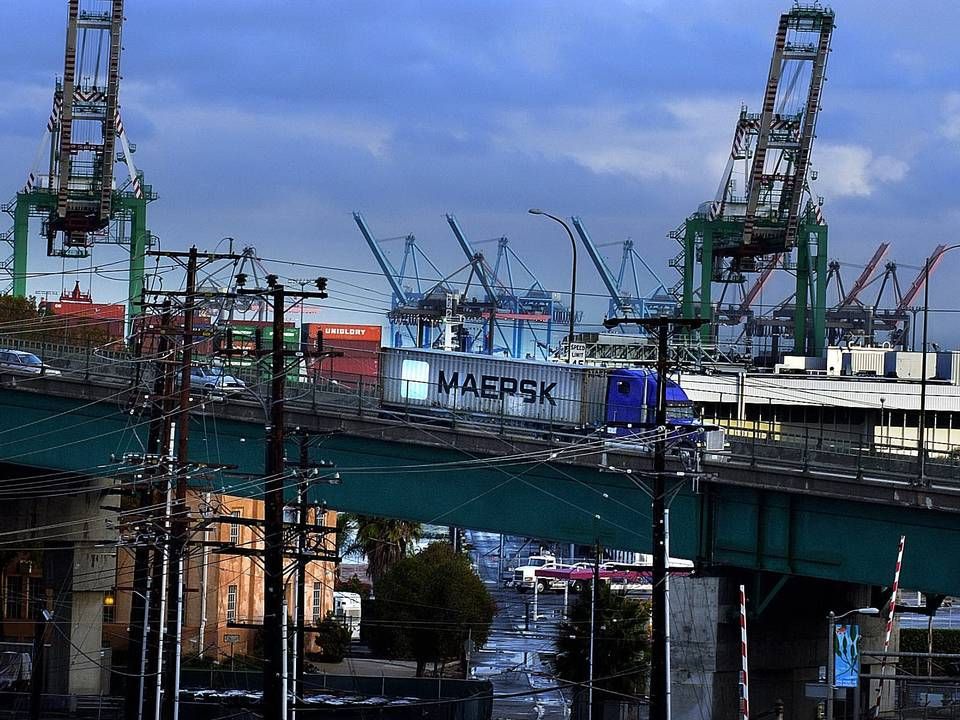

SeaIntel: California ports defy congestion

Shippers have not made changes to supply chains in LA ports, even though the ports are hit by the worst congestion in years. This is the current development in Los Angeles, Long Beach and Oakland, the three main ports in California, according to SeaIntel’s analysis.

2014 was the busiest year in Oakland, annually handling containers of almost 2.4 million teu. One might think this was due to shippers moving volume from LA ports, Los Angeles and Long Beach, to Oakland, but that is not the case, according to SeaIntel.

"However, the two LA ports’ combined annual throughput increased 3.3 percent Y/Y to 13.6 million TEU, which makes 2014 the fourth busiest year ever for the LA ports. Even though the increase might have been bigger had the LA ports not experienced severe congestion in 2014, the increase clearly shows that shippers have predominantly not moved their supply chains away from the LA port complex."

These three ports handle about 40 percent of all containers going in and out of the US. Although in 2014 the ports were plagued with problems following a conflict between port workers and shippers that began 8 months ago during contract negotiations.

Alternative routes

The result was a lack of truck drivers and capacity on land to handle the larger vessels as well as container ships lining up to enter the ports. Overall regarding the port development, SeaIntel writes:

"It could be that growth in the three ports would have been higher if congestion had not been an issue, but it is not something that has moved the majority of shippers. If the congestion keeps getting worse and the conflict between the PMA and ILWU continues, it must be expected that more and more shippers will start to choose alternative routes."

Last week both sides of the West Coast port conflict reached a temporary agreement regarding maintenance and monitoring of ship chassis. This agreement brings hope that a complete agreement will be reached soon.

Negotiations on US West Coast reach key milestone

Related articles

Negotiations on US West Coast reach key milestone

For subscribers

Shippers on US West Coast: We're approaching gridlock

For subscribers

Alphaliner: Conflict on US West Coast enters critical stage

For subscribers