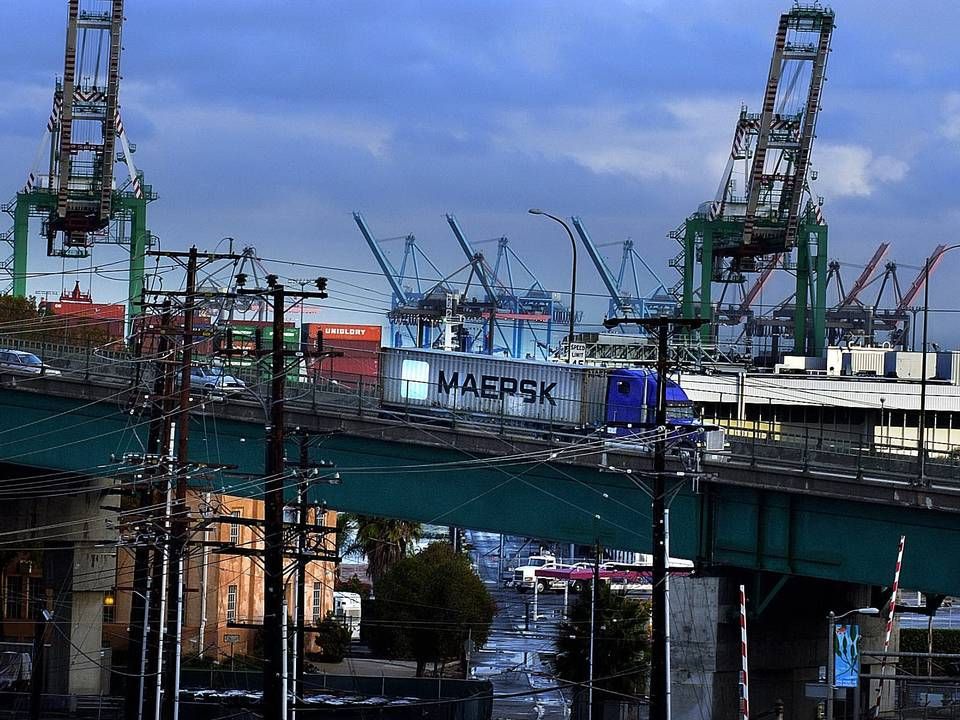

US port conflict creates historical chaos in shipping

The critical labor conflict in ports on the US West Coast, which since October last year has been causing near-chaotic conditions for carriers and shippers, is now forcing container carriers to use ships all the way down to 2,500 teu across the Pacific from Asia through the Panama Canal to the US East Coast in an effort to work around the conflct.

According to Alphaliner's newsletter, the delays for containers from Asia to the US ports in California - which handle more than half of the US' combined seafreight volumes and more than 70 percent of US imports from Asia - currently stand at five weeks.

"Demand for all sizes of above 2,000 teu has jumped significantly, even leading to Far East-US East Coast trips by several ships of 2,500-2,800 teu. Such small vessels are now rarely used on the transpacific trade, an indication of the desperate ad-hoc measures that carriers are taking to deal with the port congestion," notes Alphaliner.

Shippers on US West Coast: We're approaching gridlock

Meanwhile, many Asian exporters - under pressure from the current circumstances - have started using the far more expensive airfreight. New agency Reuters reports that major car manufacturers such as Japan's Honda Motor and Fuju Heavy Industry have begun using airfreight to transport key spare parts to the US, and Honda has announced that the group will scale down production at several of the company's factories in the US due to the port conflict.

US President Barack Obama is sending Secretary of Labor Tom Perez to San Francisco on Tuesday as part of his efforts to secure a new wage agreement between the US port workers and their employers, including carriers and terminal operators.

Container carriers' reliability plummets in the US

Idle fleet at record low

Following the growing demand, the idle container fleet has reached the lowest level since 2011, at 146,000 teu, while the rerouting of cargo to the US East Coast has sent rates from the Far East soaring to record high levels. The freight rates between Asia and the US East Coast are currently 50 percent higher than they were one year ago, and demand remains high ahead of the Chinese New Year, which begins on February 19th and lasts one week.

Alphaliner describes the current situation on the US West Coast as the worst ever in terms of congestion, delayed cargo as well as consequences for shippers. And if the parties do manage to agree on a new wage and labor agreement within the coming weeks, it will still take months to normalize the situation.

Schedule reliability in free fall

The California port conflict has also made the container carriers' schedule reliability plummet.

The big carriers' schedule reliability fell to a record-low average of 48.6 percent in January, according to analyst agency Drewry's latest Carrier Performance Insight. The total decline came to 9.6 percentage points compared to December 2014.

The Pacific Ocean was hit the hardest in this period, where reliability fell to 36 percent in January from 47 percent in December.

Maersk Line declines to comment specifically on the conflict, but Senior Press Officer Michael Storgaard states that the situation naturally affects the carrier's services to and from the US West Coast, and thus the customers as well:

"We are doing everything we can to minimize the negative consequences for our customers, but there are delays, and we've had to perform temporary changes to our sailing schedules. Another consequence is that we are experiencing growing demand on our services to and from the US East Coast. The rest of our network is not affected as such."

According to another global container carrier, which ShippingWatch has been in contact with, costs related to the US West Coast have gone up by one third as a consequence of the conflict.

US West Coast drove container reliability down in 2014

Port conflict paralyzes container carriers' reliability

Related articles

US West Coast drove container reliability down in 2014

For subscribers

Port conflict paralyzes container carriers' reliability

For subscribers

Negotiations on US West Coast reach key milestone

For subscribers