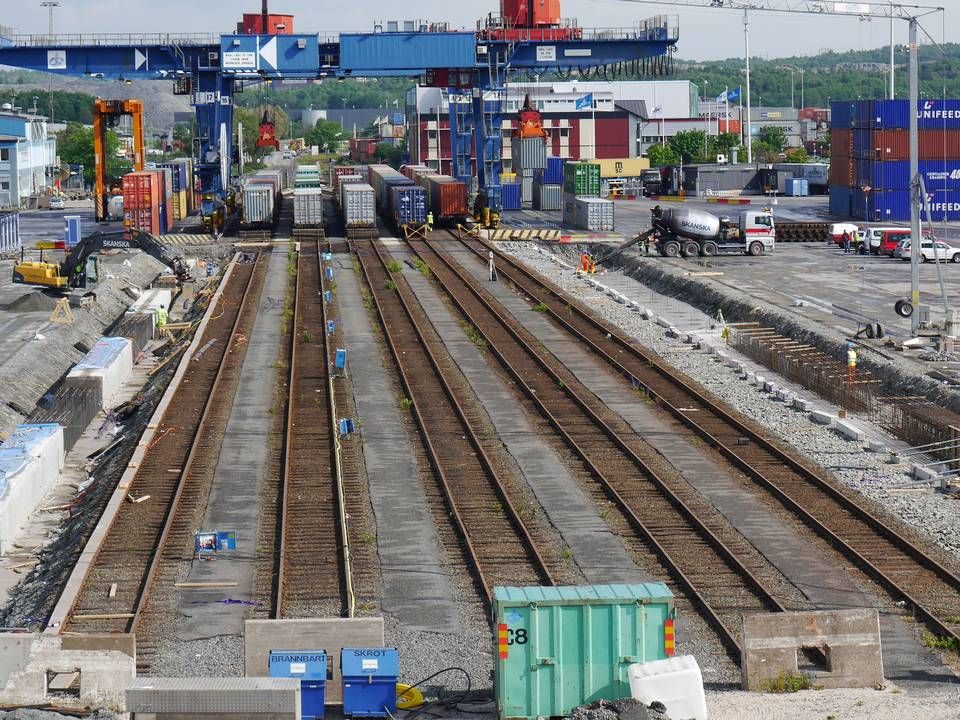

APM Terminals on layoffs: Conflict has cost one in five containers

The announcement from APM Terminals that the port will lay off 160 of its employees in Gothenburg, more than a third of the workforce, is the only way the company sees to move forward in the conflict with dockworkers.

The company stresses that it sees no other solution than to "make major changes to our operation."

Lost 20 percent of revenue

According to Swedish newspaper Göteborgs-Posten, reporting live from a press conference held by APM Terminals and the Port of Gothenburg, the recent months of conflict have cost 20 percent of the container volumes in APM Terminals.

This happens after a 7 percent decline in revenue in 2016. CEO of APM Terminals in Gothenburg, Henrik Kristensen, has previously told ShippingWatch that the conflict is behind this decline in revenue.

Mainly the dockworkers in the terminal are at risk of layoffs, but according to board member Erik Helgeson in Hanm4an, which organizes around 85 percent of the employees in APM Terminals in Gothenburg, a small number of clerical workers will also be laid off.

Robert Karlsson, part of Hamn4an's management, says at the press conference, according to Göteborgs-Posten, that dockworkers were informed of the redundancies today, Tuesday, and are "shocked" about the development in the conflict, which follows five weeks of lockout from APM Terminals against the dockworkers.

Layoffs to be settled over coming weeks

Who will be fired is a matter to be settled as soon as possible, according to APM Terminals.

"Our objective is that the negotiations will take place promptly and we hope to complete them within a couple of weeks, so that we can then inform the members of staff affected," the terminal company writes in the update to its customers.

Understand the gridlocked conflict in the Port of Gothenburg

The announcement of the layoffs comes the day after the two parties in the conflict were supposed to meet in Sweden's settlement institute. This would be the latest meeting in the institution in a long line of meetings, and a process in which the public mediator recently announced that he had given up on the conflict.

Large customers, including Lindex and Akzo Nobel, have been impacted by the conflict and recently Maersk Line's 2M partner, MSC, threatened to pull around half of its calls to Gothenburg if a solution was not found to the conflict.

This has, to a certain extent, happened now, but the terminal is still far from operating at full capacity.

"The operation will be reshaped to ensure that direct calls will have the best possible conditions in Gothenburg. Under these conditions, we would expect to be able to handle 65 per cent of our normal capacity," writes APM Terminals.

English Edit: Gretchen Deverell Pedersen

APM Terminals lays off 160 employees in Gothenburg

Related articles

APM Terminals lays off 160 employees in Gothenburg

For subscribers

Strikes permanently move cargo from European ports

For subscribers