Lauritzen CEO: On the right track, but it will take time

J. Lauritzen was able to improve its results in the third quarter of 2017, a period in which the carrier launched several strategic initiatives, though the Danish dry bulk carrier suffered another deficit.

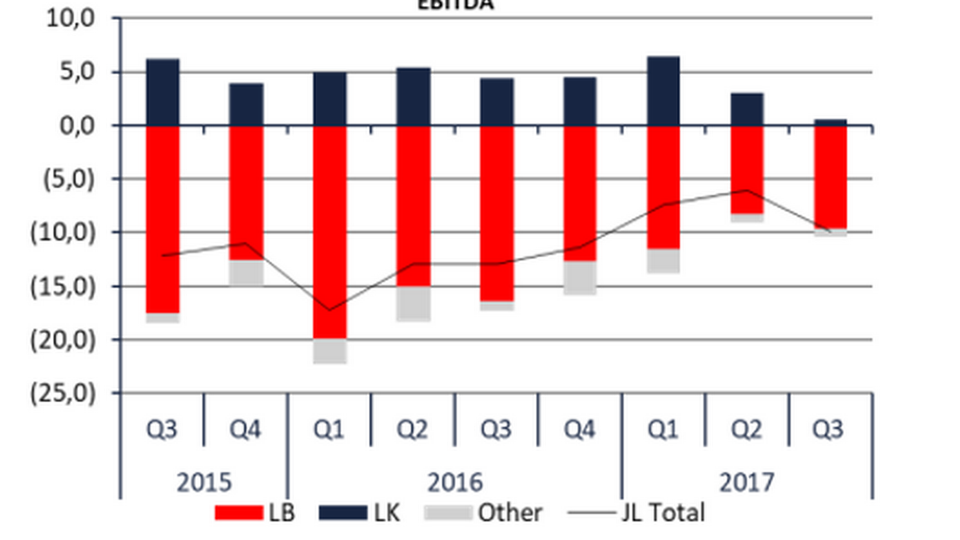

In a quarterly update, the carrier reports an operating deficit (EBITDA) of USD 9.8 million in the third quarter, an improvement of USD 3.1 million compared to the same period last year. The result covers the carrier's tanker as well as dry bulk activities.

"We're still losing money, and one can never be pleased with that. But it's good to see that the dry bulk market is partially normalized now, and we see a growing capacity utilization. At any rate, it feels like there's some light at the of the tunnel in this market," CEO Mads P. Zacho tells ShippingWatch.

He notes in the interim report that it will take some time for the dry bulk market to return to balance.

Looking toward the first quarter 2018

The stronger rates benefited the carrier in September, says Zacho, and seeing as several of the carrier's vessels are already sailing on contracts entered at a time of lower rates, the higher rates will have a delayed impact, he tells ShippingWatch.

"It will probably be the first quarter 2018 before we get the full effect of this. We see a better balance and improved capacity utilization entering next year, as the supply side is stronger. Many ships were delivered in 2017, but we only expect a fleet of slight more than one percent next year. And that's important," says Zacho, adding that his expectations for improved demand depend on China not altering its course and reducing iron ore and coal imports.When do you expect J. Lauritzen to deliver a profit?

"We still have some baggage from a series of expensive time charters we signed a few years ago, so I'm not going to list a specific date for when we cross over and achieve a positive bottom line. We're on the right track, but it'll take some time yet."

In addition to the dry bulk business, the carrier's gas tankers are still negatively affected by the weak market conditions for even larger gas tanker vessels. As such, the operating profit for gas unit Lauritzen Kosan took a big dive in the third quarter.

(Article continues below)

Dark columns are the results for Lauritzen Kosan, while red is for dry bulk. Source: J. Lauritzen's interim report.

For the first nine months of the year, the operating deficit came to USD 23.2 million, an improvement of close to USD 20 million from a deficit of USD 43.1 million in the same period last year.

New strategy launched

In October, Zacho told ShippingWatch that the carrier had launched several initiatives aimed at lowering costs and boosting earnings.

"We want to recreate profitability and we can actually do a lot in this respect, such as reducing costs. We are working to utilize the information that we get from our own operations much more actively. For example, our new predictable maintenance system, which continuously tells us when the fleet needs hulls cleaned, so that this is done before it starts costing money. We have also become better at managing the crew with the information we receive. These sound like small things but they can save us millions of dollars," said Zacho:

"Digital input such as weather conditions and data about the harvest constitute other digital information that can strengthen work for freighters, so it is easier to choose the right cargo," he added.

J. Lauritzen received a capital injection from owner Lauritzen Fonden in the third quarter, and by the end of the quarter the carrier's cash holdings stood at USD 139 million against USD 93 million by the end of the second quarter this year. This development is mainly attributed to the USD 80 million in fresh capital from the owners, which intervened after a dispute with a large group of bondholders who, back in the spring, blocked a deferral on the repayment of part of a loan.

Following the capital injection, the corporate bond JLA02 as well as related security debt were paid in October 2017, writes Lauritzen in the report.

English Edit: Daniel Logan Berg-Munch

J. Lauritzen CEO: The carrier's future is smaller vessels

Related articles

J. Lauritzen CEO: The carrier's future is smaller vessels

For subscribers

Lauritzen Kosan changes crew management for 26 gas vessels

For subscribers

Dry bulk industry only halfway through the crisis

For subscribers