Noble Group is fighting hard to survive

Noble Group has effectively been in the process of restructuring for several years, and one might think that the company, which is listed in Singapore, would be unable to surprise investors and its own shareholders.

Noble Group was founded in Hong Kong by now-former Chairman Richard Elman and the company was recently slammed by a deficit in 2015. However, it did achieve an improved result last year with a small profit. For this reason many parties expected the company, which buys, trades, and transports commodities, to survive the downturn.

Yet a few weeks ago, the company had to submit a filing to the Singapore Stock Exchange that the first quarter looked set to end with a loss of USD 130 million.

Major share price decline

This prompted the shares to tumble on the exchange and when rating agency Standard & Poor's lowered its rating a few days later with three notches to CCC+, the lack of support for the company seemed to be overwhelming. S&P does not think Noble Group is able to pay back the debt which is due within the next 12 months.

And Noble Group's explanation for the development as well as the presentation of its plans for turning things around on May 11, has seemingly had no effect.

Foreign shipping workers leave Singapore during perfect storm

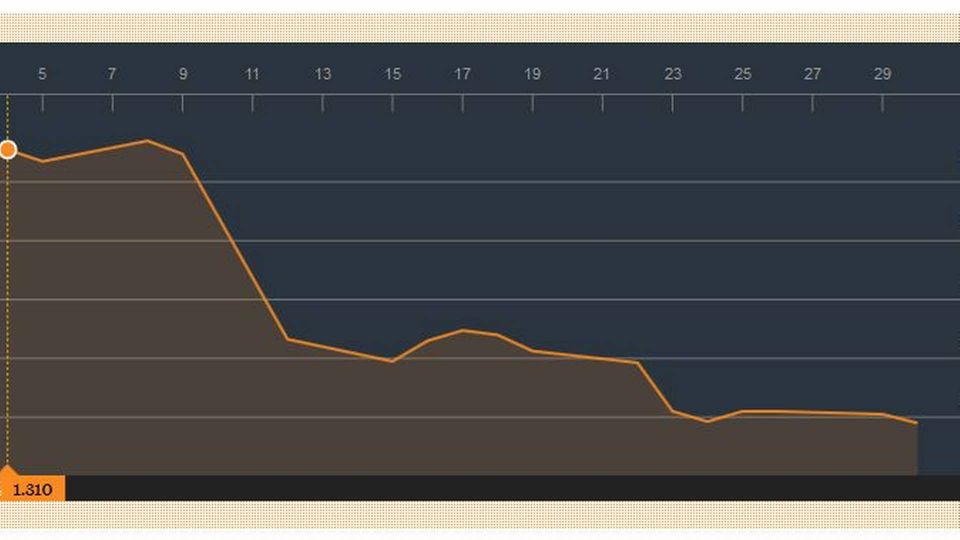

Last week the shares fell 32 percent to the low point of 40 Singaporean cents on the exchange which decided to suspend trade. This year alone, the share dropped 75 percent after a loss last year of 44 percent.

The share price for Noble Group over the past month. Source: Bloomberg Markets.

According to Bloomberg, not only the loans due during the next year, but just as much the loans to be repaid over coming years, make up the major challenge for the company. Along with the deficits generated by the firm.

"Over the next three years, it's got huge amounts of debt maturing and right now the company is deeply trapped, unable to make any profit," Margaret Yang, a strategist at CMC Markets in Singapore, tells Bloomberg.

Chinese players could be the rescue

There is broad agreement that Noble Group needs fresh funds and Chinese investors are mentioned as possibilities. The company has confirmed that meetings are being held with banks to find a solution. It rings slightly hollow, however, as not long ago management "looked to 2017 with confidence". And even last year, Noble made large strides to avoid more losses. In 2016, staff was reduced by 480 people and assets of USD 4.8 billion were cut loose.

Subsidiary Noble Chartering, headed by Michael Nagler, has found itself in a process of restructuring for a few years. This relocated the company from Hong Kong to Singapore one year ago and also entailed staff reductions.

"Since I took over the reins two years ago, I've restructured and cleaned out our chartering unit so that we are currently 30 employees compared to 106 in 2014," explained Nagler to ShippingWatch in April 2016.

With 120 operated vessels, Noble Chartering is a significant player in the industry and carries cargo for both its parent company and for external customers. In this way, the carrier is subject to the rough fluctuations in the bulk sector over recent years, just like its competitors.

Wave of problem companies

The downturn for Noble Group arrives at a time in which many Asian-based companies in the maritime industry have already given up or reached out for a lifeline via US Chapter 11 bankruptcy protection. In Singapore, companies such as Swiber, Ezra, and Rickmers Maritime have been pushed over the edge. With Noble Group's listing on the Singapore Stock Exchange, there is more bad news for the stock market, which had otherwise hoped for recovery after the acquisition of Baltic Dry.

ShippingWatch recently spoke with representatives from several banks in Singapore, who all mentioned Noble as the dark horse at risk of joining the group of "bad debt companies". Banks have already lost money on the other companies and a lot of attention is directed at announcements from Noble Group these days.

Default fears resurface over Singapore's looming debt wall

There is little faith in the future of Noble Group if you ask the share analysts that know the company well.

"Noble is fighting to survive right now. We are not sure how long this could continue without someone saving them," said Owen Gallimore, Head of Credit Strategy at Australia & New Zealand Banking Group, which has covered the company's share since 2008.

Make sure to read Noble Group's explanation for why the coal market developed differently than expected.

English Edit: Gretchen Deverell Pedersen

Bondholders have become Rickmers' worst opponent

Related articles

Bondholders have become Rickmers' worst opponent

For subscribers

Top analyst shoots down container carrier optimism

For subscribers