Hapag-Lloyd shareholder confirms French approach

France's CMA CGM has on several occasions contacted Klaus-Michael Kühne, said the German major shareholder in Hapag-Lloyd the liner company's general assembly on Tuesday.

"They (CMA CGM) have contacted me and made several attempts to negotiate, but we didn't feel the proposal made any sense. We won't be part of it," he told German media NDR, thus confirming that the French liner shipping company saw a merger between the two carriers as a good idea.

Reuters reported on Monday that CMA CGM has in recent months been in talks with Hapag-Lloyd for a future merger, though the German owners have so far rejected the idea. Commenting to ShippingWatch, Hapag-Lloyd's Communications Director Nils Haupt has rejected that a merger is underway and said that there is "not the tiniest piece of truth to the story."

At the general assembly, Kühne, who owns 25 percent of the company, stressed to the more than 100 shareholders that the company "will not let itself be taken over by the French."

"At best, we should take over the French," he said according to NDR.

Hapag-Lloyd's shares increased Monday by 11 percent to EUR 35 before falling to EUR 32.82 when the stock exchange closed, reports Alphaliner. The increase comes after a significant slide last week when the liner shipping company lowered its full-year guidance due to weak markets and rising fuel costs. The share dropped to EUR 28.12.

But the merger rumors have boosted Hapag-Lloyd, which when trading closed on Monday July 9 had a market value of EUR 5.65 billion. The German company has a debt of EUR 6.05 billion, says Alphaliner on the basis of numbers from late March.

"Apart from the hefty price tag, any potential bid for Hapag-Lloyd would have to contend with the diverse ownership structure of the company. The five largest shareholders control 85.5 percent of the carrier and each appears to have very different investment objectives. This would make it difficult to structure a deal that is be attractive to all parties involved," writes Alphaliner.

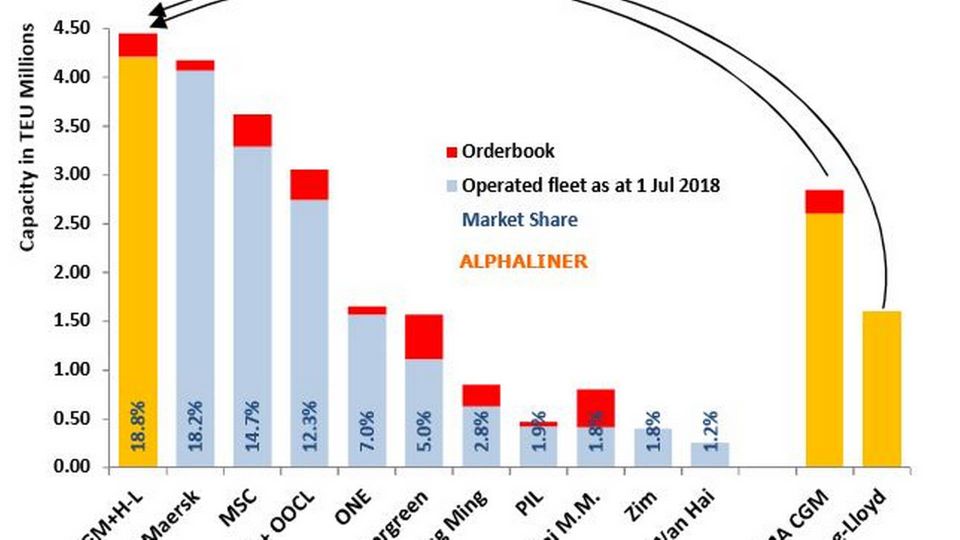

A merger of the two liner companies would create the world's largest container carrier with a total fleet of 4.2 million teu, thus surpassing Maersk Line's current fleet of 4.1 million teu.

English Edit: Daniel Logan Berg-Munch

Media: CMA CGM wanted merger – Hapag-Lloyd dismisses rumor

Related articles

Media: CMA CGM wanted merger – Hapag-Lloyd dismisses rumor

For subscribers

EU reviews container carriers' unique competitive edge

For subscribers