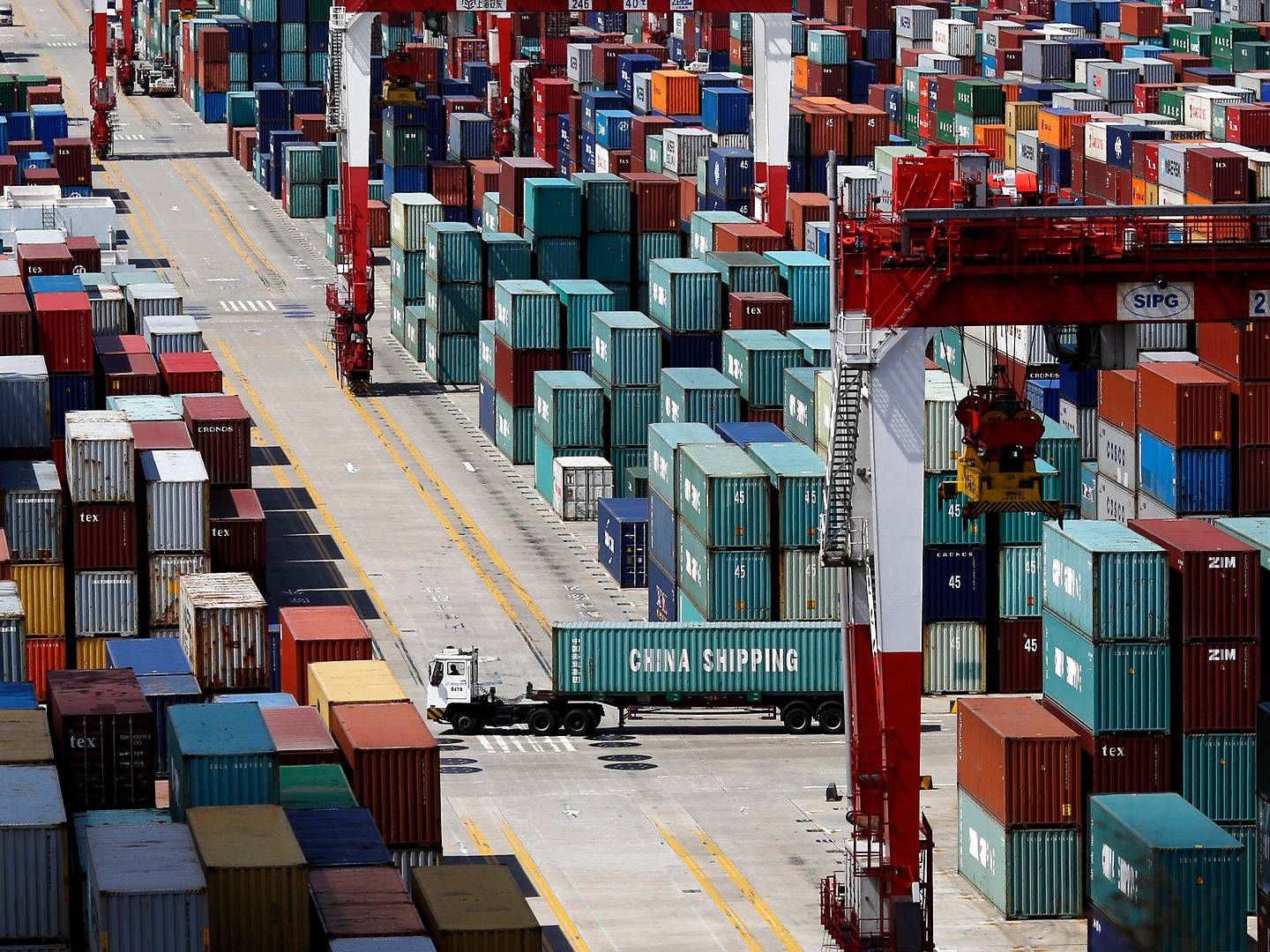

Shippers should expect high container rates all the way into 2024

Two years ago, it cost approximately USD 1,700 to ship a container from Asia to the US west coast or to northern Europe. Today, the long-term contract price is close to USD 6,000, and this level won't be getting lower for many months, likely years, to come. At least not according to someone who knows a lot about the container industry and the rates customers have to pay - and carriers can charge.

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.