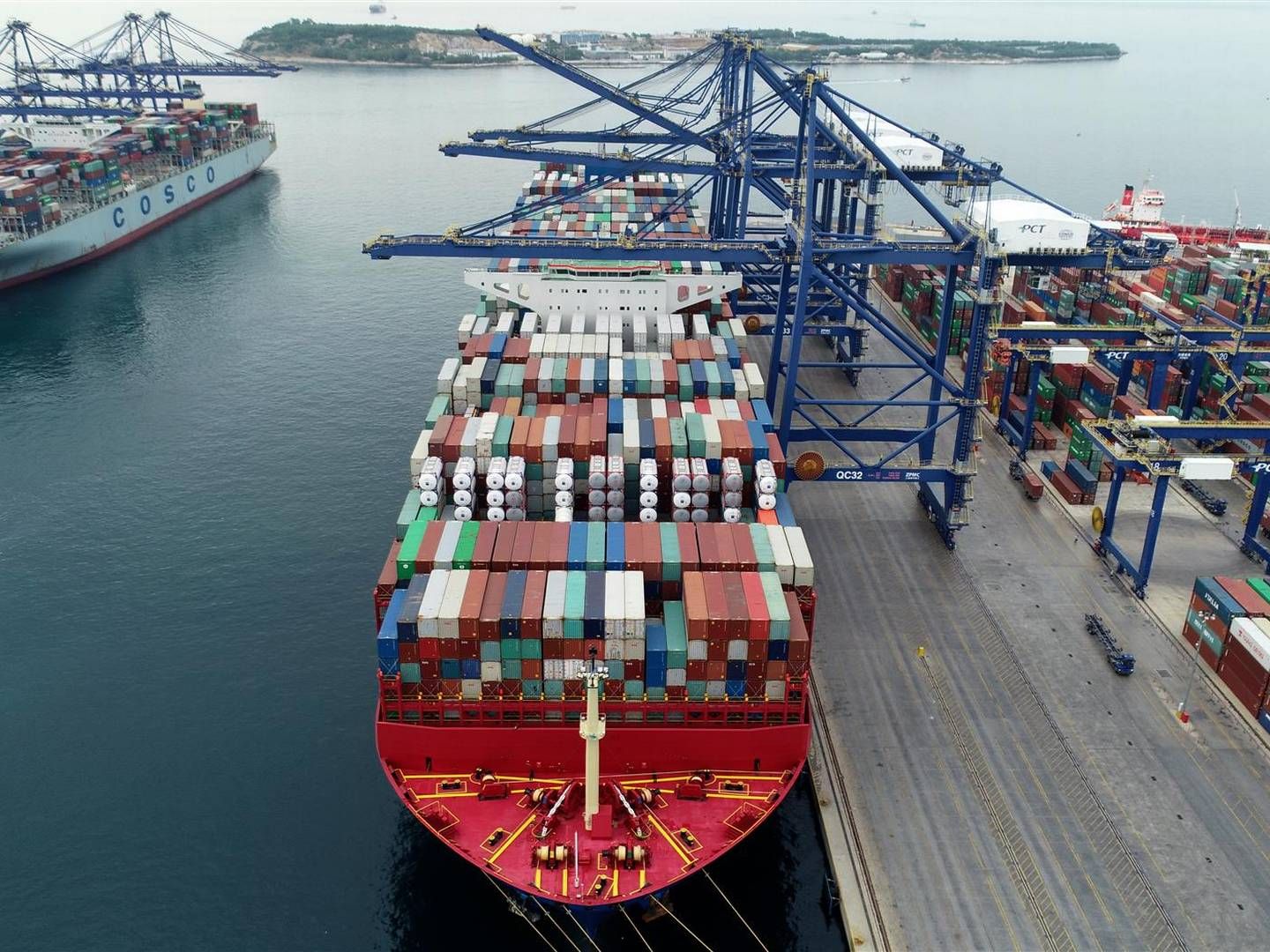

Newcomers withdraw from main routes after price collapse

Several of the new carriers crowding container markets during the Covid pandemic withdraw following the pressure of declining freight rates.

Analysts report this week that some of the soldiers of fortune either redeploy from main routes or fold entirely.

”The new entrants on the Transpacific and Asia-Europe routes are facing significant pressure after the collapse in freight rates, with limited options for redeploying the ships that they have on these routes,” writes Linerlytica in a market analysis.

In their latest newsletter, Alphaliner writes that carrier CULines has withdrawn from Asia-Europe routes because the company’s fleet of smaller container vessels is no longer able to compete.

A part of the ships will be redeployed to their original owner while the carrier allegedly contemplates focusing on shorter routes.

CULines’ departure follows another new carrier, Allseas Shipping Company’s announcement to shut down operations between China and Europe.

Linerlytica writes that Allseas Group filed for insolvency through UK courts in October, while four of the carrier’s six chartered vessels have been redeployed to rightful owners.

A slice of the pie

The new carriers entered the market at a time when the global pandemic caused capacity shortage on main routes going out of China.

Western consumers saw an increased cashflow during the crisis with many countries issuing aid packages. Additionally, widespread restrictions meant that money could not be spent on travels and amusements.

It all led to rising demand on consumer goods manufactured in Asia and shipped to US and Northern Europe.

As a result, a string of new carriers flushed the market looking for their slice of the pie.

In addition to CULines and Allseas Shipping Company, carriers including TS Lines, Sealead, and Tailwind Shipping Lines, owned by discount retailer Lidl, all made their way into the main routes.

Liner companies’ guard against a hard landing is starting to crumble

However, freight rates have plummeted with Dewry noting a 75-percent nosedive from last year’s historic levels.

Inflation, high energy costs, and surging interest rates have put a halt to consumer spending effectively minimizing the need for cargo transportation. At the same time, supply chains are up and running following recent years’ disruptions due to Covid.

As a consequence, small and new carriers who entered the market when ship rental costs were up now face significant pressure.

They all have to decide whether to fold while ahead or redeploy vessels to smaller routes free from the competition of major players.

English edit: Simon Øst Vejbæk

German retail group launches own shipping firm

Related articles

German retail group launches own shipping firm

For subscribers

IKEA stops chartering container vessels

For subscribers