Maersk Line's schedule reliability plunged big-time in Q1

The global container carriers' schedule reliability is plunging.

All of the 18 major container carriers saw their reliability drop in the first quarter 2017. The combined setback came to around 10 percentage points, according to a new survey by Seaintel.

The Danish container carrier's reliability dropped 7.1 percent compared to the same period 2016. Maersk Line now ranks 8th on the list of container carriers' schedule reliability.

However, the Maersk Group can be pleased to note that the most reliable carrier is its latest purchase, Hamburg Süd. Maersk recently acquired the German carrier in a transaction that is still awaiting final regulatory approval. Hamburg Süd arrived on time for 78.9 percent of its journeys. Meanwhile, least reliable container carrier was logged as APL.

Seaintel adds that it is normal for reliability to slightly decline in the first quarter before rising again in the coming quarters.

"This year however, with the new alliances rolling out, we may see a further decrease in reliability going into April until the new networks are streamlined. We do expect the on-time performance of the carriers to pick up over the following months," writes Seaintel.

Worrying development

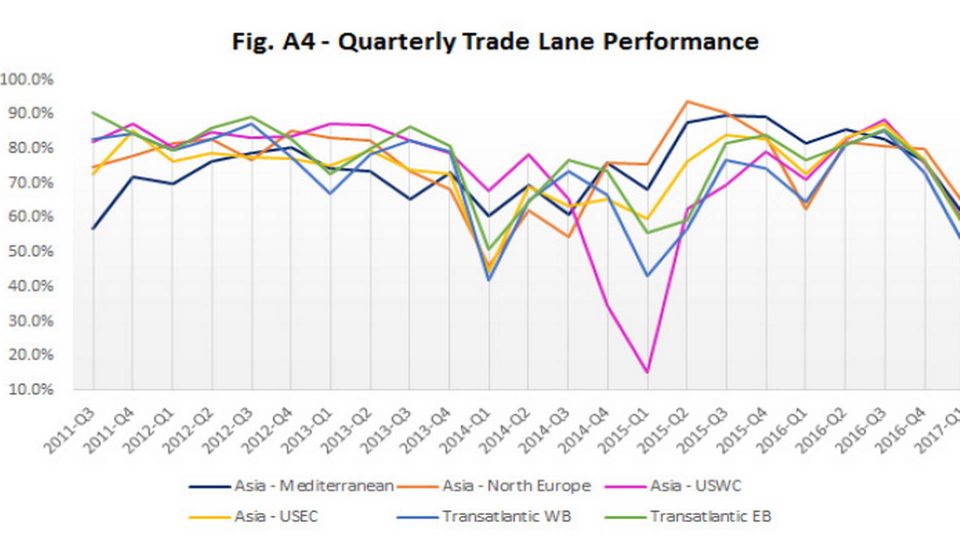

The analyst firm points to the fact that schedule reliability across all the major trades has been declining since the third quarter 2016 and now stands at the lowest level since the first quarter 2014.

This trend could be a result of the consolidation in the container sector combined with the preparation and implementation of the new alliances, writes the frim.

Quarterly reliability developments 2011-2017. Source: SeaIntel Maritime Analysis

Asian alliance best among the old players

The new alliances in the container market came into force on April 1 2017, namely 2M, Ocean Alliance, and The Alliance.

The analysis thus also covers a period in which four alliances were active in the global container sector, including CKYHE, which consisted of the Asian carriers Cosco, K Line, Yang Ming, Hanjin, and Evergreen.

CKYHE has traditionally had a strong schedule reliability on the major east-west tradelanes, and the container collaboration did in fact come out on top in SeaIntel's analysis before the new alliance scenario took over.

As such, CKYHE at no point went below the sector average, and the alliance had a reliability of 80.5 percent in March 2017, which was 17 percentage points better than Maersk Line and MSC in 2M.

Shippers displeased

The carriers' worsening ability to arrive on time comes at a time when several shippers have voiced disappointment in the services they buy from the carriers.

In March, a study by Drewry, ordered by European Shippers Council, showed that numerous shippers feel that service level has slipped significantly in the past year.

This criticism was boosted last week when logistics group Kuehne+Nagel's CEO lashed out at carriers at a conference in Singapore.

"The container industry has a problem. The information available today about shipments is notoriously poor. Sailings are canceled without us being told. There is a lack of perfection and information about actual reliability. The quality should be improved significantly," said CEO Detlef Trefzger to a large audience which included many shipowners.

English Edit: Daniel Logan Berg-Munch

Taiwanese carrier beats Maersk in reliability

Related articles

Taiwanese carrier beats Maersk in reliability

For subscribers

SeaIntel: Reliability plunges for third month in a row

For subscribers

Drewry: Container carrier reliability at rock bottom

For subscribers

![Photo: Pete (Wan Hai 206 At Hong Kong) [CC BY 2.0 (http://creativecommons.org/licenses/by/2.0)], via Wikimedia Commons](https://photos.watchmedier.dk/watchmedier/resize:fill:3840:0:0/plain/https://photos.watchmedier.dk/Images/article9344688.ece/ALTERNATES/schema-4_3/wanhai2.jpg)