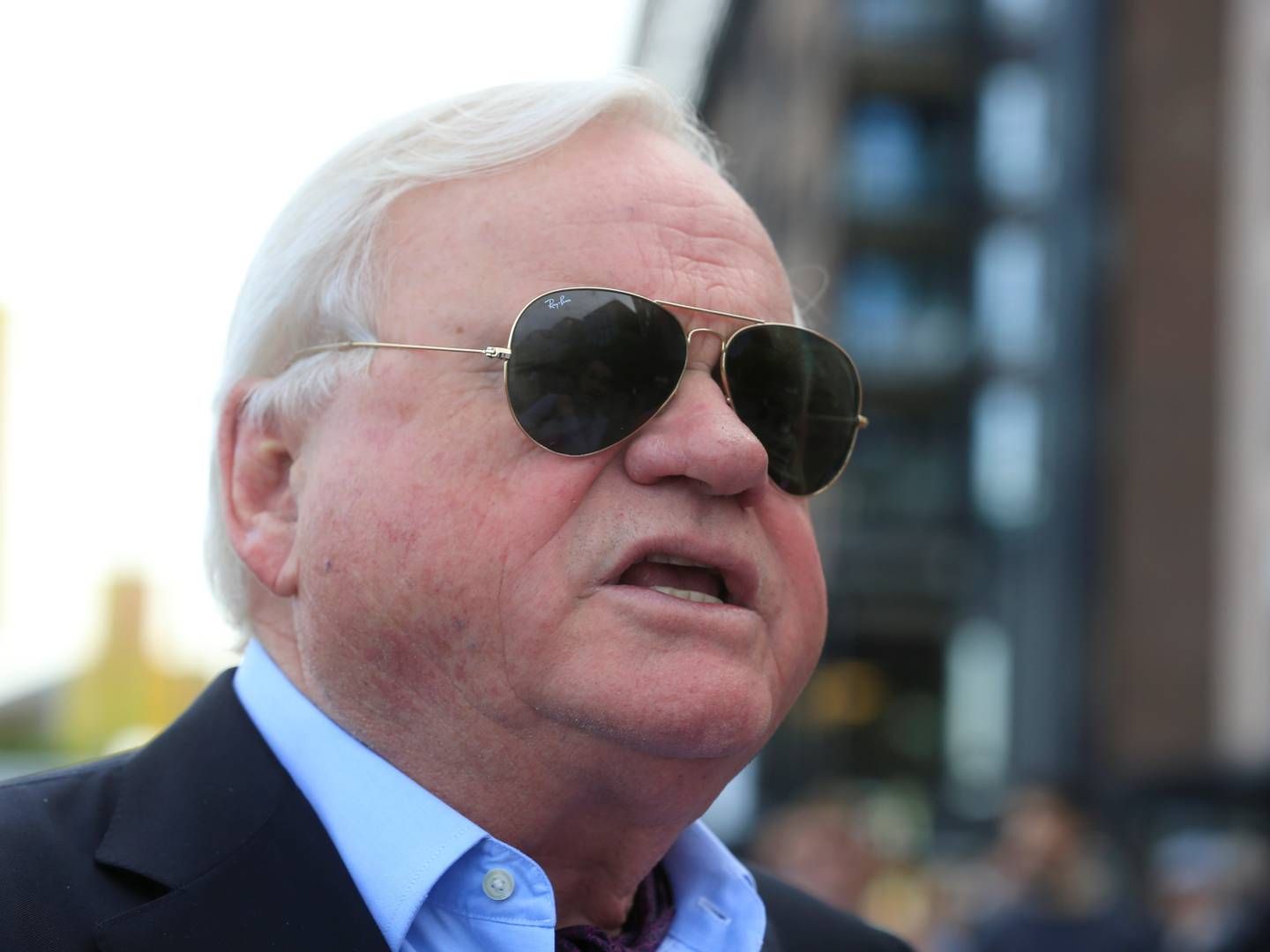

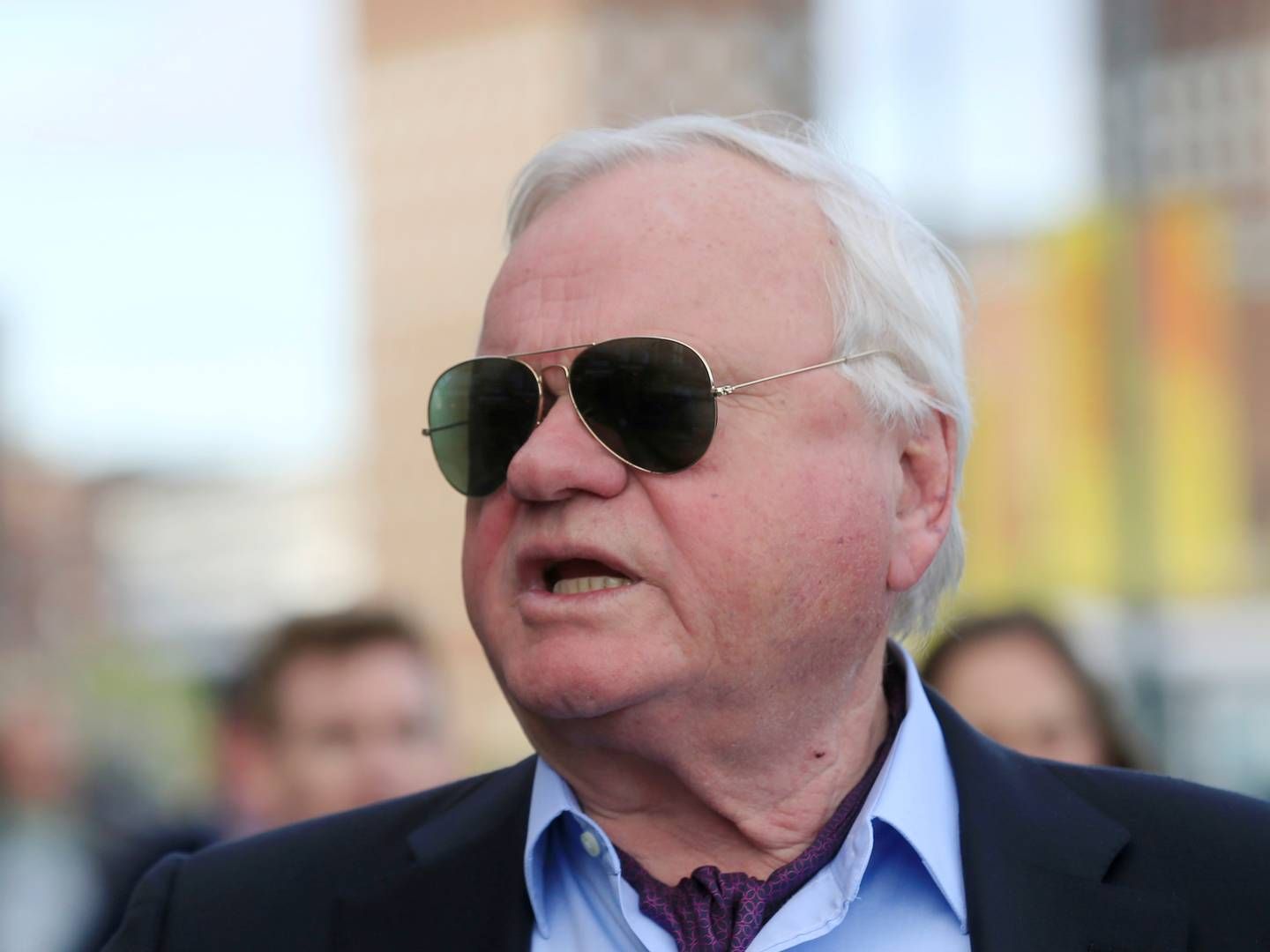

Billionaire John Fredriksen’s oil trader alta is winding down

Billionaire John Fredriksen’s boutique oil trading business is being wound down, people familiar with the matter said.

Alta Trading, which is effectively owned by the Norway-born tycoon, has been liquidating positions since the week before last, the people said, asking not to be named since the matter is confidential. The firm was previously called Arcadia Petroleum Ltd.

Gary Middleditch, the co-chief executive officer of Alta, declined to comment.

Volatility in oil prices surged this year as Russia’s invasion of Ukraine roiled markets and rampant inflation triggered worries about a global recession.

But since August, a period when many had been anticipating a surge related to western sanctions on Russia, Brent crude prices have slumped by almost a third. It’s not clear if Alta was affected by that.

Alta operates from a head office in London and offices in Houston.

It wasn’t immediately clear what the timeline has been for the shutdown, or whether a process liquidating outstanding positions has been completed.

There has long been a question over how Fredriksen, 78 and now a citizen of Cyprus, will handle succession of his businesses, which span everything from fish farms to vast fleets of different kinds of ship. He has two daughters, Kathrine and Cecilie.

Alta Trading had a net profit of USD 34.2m and sales of USD 705m in 12 months ended March 31, both sharply higher than the corresponding period a year earlier, a filing on the UK’s Companies House website shows.

John Fredriksen’s wealth boosted by tanker holdings

Frontline is confident in prolonged tanker upswing

Frontline with capital appeal to shareholders to get merger approval

Related articles

Frontline is confident in prolonged tanker upswing

For subscribers