New tanker behemoth is a guidepost in consolidation wave

The product tanker market will now find out if large companies are actually what big investors want, says Hafnia Tankers CEO Mikael Skov, speaking to ShippingWatch after the news of competitors Scorpio Tankers and Navig8 joining forces to create a new tanker giant.

The merger, in which Scorpio Tankers will take over Navig8's fleet of 27 vessels, is the first move in a consolidation wave which several players, including Skov, have recently cited to ShippingWatch as crucial for the product tanker market.

"Something has happened now and it means that there is a data point. There's valuation, investor interest, and other things to start looking at, and in many ways, this will provide answers to some of the questions which have arisen," he says.

"It will definitely motivate others to look more seriously at the opportunities in consolidation," he says.

Providing guidelines

The total value of the newly merged company is USD 1.1 billion. This is the value that many parties have mentioned as the critical amount to garner investor interest.

And the merger is happening at a time when many players with plans for IPOs in the US are talking about the need for consolidation in the product tanker market.

In addition to Hafnia Tankers, Torm's Executive Director Jacob Meldgaard has also stated that he is open to consolidation. Clarksons Platou likewise eyes opportunities for a company like Torm, as consolidation could make the tanker carrier relevant in the global capital market.

Mikael Skov's assessment is that the market will see consolidation in various forms over the next 12-24 months, of which the merger between Scorpio Tankers and Navig8 has become the first example.

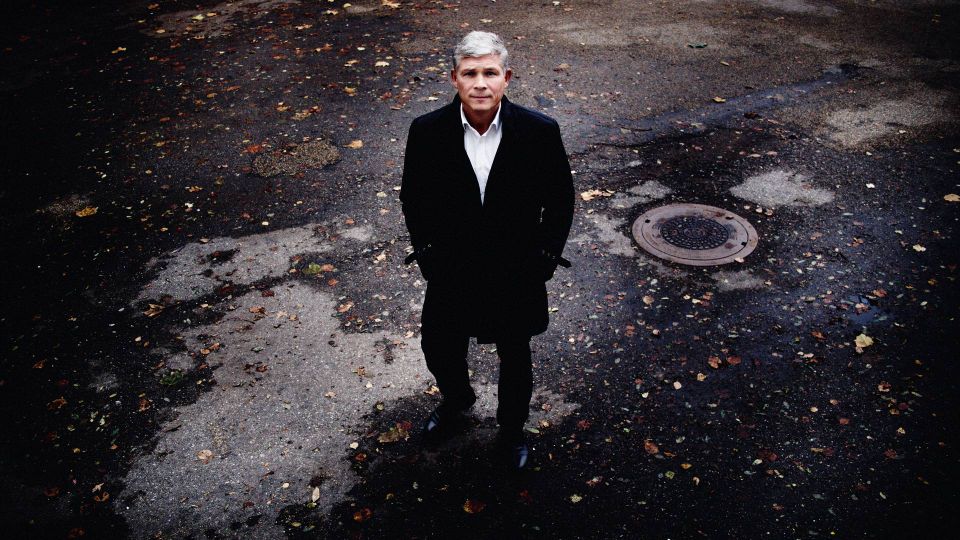

Mikael Skov has a positive outlook on consolidation in the product tanker market. Photo: Hafnia Tankers.

No pressure

Hafnia Tankers has its owns plans for an IPO in New York at some point, and the company is looking into its options, the CEO told ShippingWatch last week.

Does this type of acquisition put pressure on you and others in the industry?

"I wouldn't say pressure. It provides some guidelines for various players as to what could be the right model going forward. Of course, Scorpio is now much bigger than number 2, in terms of how much tonnage they have. I think this will change the mindset at the different companies about what the right model is going forward," says Skov, who thinks the deal makes sense for Scorpio and Navig8.

He adds that Hafnia Tankers is still focusing on its own strategy.

"We are constantly focusing on optimizing our operations and we are looking at the opportunities that continuously arise. We have not hidden that we feel size is also important in relation to our market, but on the other hand, there is no pressure on us nor on any of the others to do anything that we don't feel is right," he says.

According to VesselsValue, Navig8's ten owned product tankers involved in this deal, a mix of LR1 and LR2 tankers, are worth a total of 362.52 million USD today.

The other 17 involved in the deal are chartered in on bare boat from CSSC Shipping, China Merchants Bank, Bank of Communications and Ocean Yield ASA. They have a market value today of 661.64 million USD.

English Edit: Gretchen Deverell Pedersen

Scorpio Tankers merges with Navig8

Related articles

Scorpio Tankers merges with Navig8

For subscribers

Consolidation wave could be in store for product tanker

For subscribers

Stena Bulk takes full control of Stena Weco

For subscribers