Bertram Rickmers could lose his entire empire

Although the future is unclear for Rickmers Group, which recently filed for insolvency, the German shipping group looks to be on track to become one of the biggest victims yet in the deep crisis in the container sector and the rest of the industry.

After HSH Nordbank rejected a proposal for a financial rescue plan from the group, owner Bertram Rickmers could lose his entire stake in connection with a restructuring of the company, estimates Alphaliner.

In this plan, where Rickmers itself attempted to gain approval from HSH Nordbank, Bertram Rickmers would keep an ownership share of almost 25 percent. A plan, which the bank swept off the table on June 1 of this year.

Should Rickmers collapse, it will be a historic moment for German shipping which has been struggling since the beginning of the global financial crisis.

Besides shipowners and management companies, the financial crisis and downturn in global shipping has pulled the rug out from under German shipping banks and unleashed a veritable collapse in the German shipping financing system of KG funds, whereby private investors with tax incentives have invested huge sums in ships.

Rickmers and his brother Erck Rickmers, who have both operated two different companies, are the fifth generation in the Rickmers family and have to an extent characterized and symbolized German shipping.

"We are witnessing an endgame for shipping in Hamburg right now. Values are being distributed, and the sector may have to fall even further. We don't know when there'll be a new wave in shipping, but right now it's like the time after 2011 when we suddenly saw the market change quickly," Torsten Teichert, CEO of capital fund Lloyd Fonds, recently told ShippingWatch.

Rickmers Group

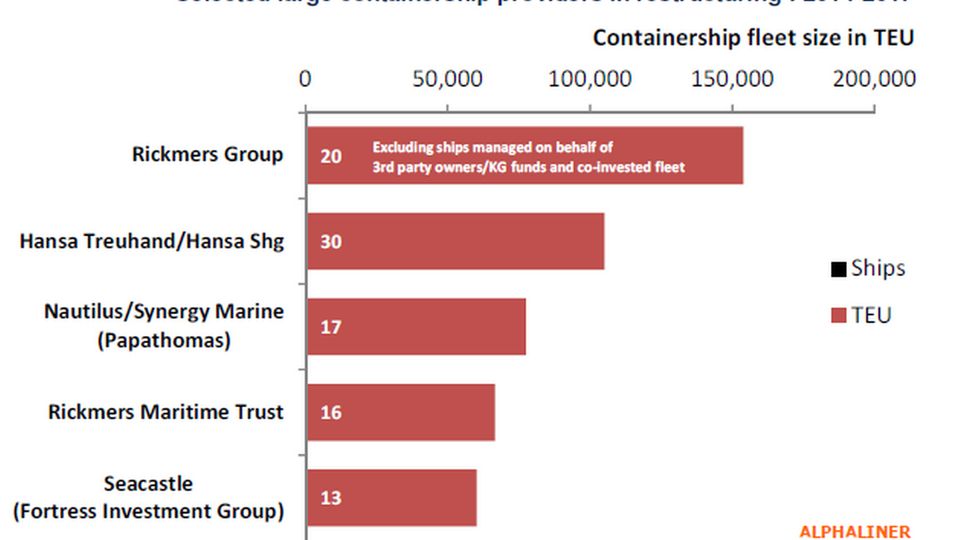

Today, Rickmers Group owns 20 container vessels with a total capacity of 154, 000 teu. Rickmers also owns nine multipurpose vessels, two car carriers and has invested in a further 14 container ships betwee 2,200 and 9,400 teu through joint ventures with capital fund Apollo Global Management.

Source: Alphaliner

Rickmers Group also operates 40 container vessels for KG funds and other owners, of which some have already pulled their vessels out of Rickmers.

Earlier this year, listed Rickmers Maritime Trust in Singapore, which is independent of Rickmers Group, launched the sale of the company's 14 container vessels to Greek carrier Navios as part of winding down the company. The process was launched after bondholders refused to approve a restructuring of a bond of up to 100 million dollars, due for repayment last month.

And in January, another known shipowner in Germany, and the owner and founder of Hansa Treuhand, Hermann Ebel, had to apply for personal bankrtupcy.

According to Alphaliner, Hansa Treuhand's current fleet of approximately 30 container vessels has been reduced by scrapping vessels, while creditors are expected to take control of the remaining vessels.

More bankruptcies

Earlier under the crisis, creditors have taken over vessels from high-profile owners such as Nautilus and Seacastle, while a large number of KG funds, which have typically owned a single vessel, have folded.

All have been affected by the long-lasting record low rates on vessels chartered out, while extremely low ship values have forced them down.

Germany's biggest shipowner, Hamburg-based Claus-Peter Offen, announced in March this year that it would acquire the Conti Group in Munich.

After the acquisition, Offen Group owns a fleet of 95 container ships, 37 bulk vessels and 37 product tankers.

Several analysts, including SeaIntel, believe that other owners of container ships which are rented out to shipowners are guarding against difficulties.

"The charter owners are the next big risk elements in the industry, as they will feel the brunt of the cascading effect of the new vessels being delivered in the coming years, as carriers re-deliver charter vessels being replaced by new or cascaded vessels. While RMT looks to be winded down in a somewhat controlled fashion, this could possibly be just the first charter-victim, as considerable tonnage is likely to be delivered over the coming years," wrote SeaIntel in April this year.

English Edit: Lena Rutkowski

Rickmers Holding working to settle restructuring

Rickmers Group surrenders in struggle to keep business alive

Related articles

Rickmers Holding working to settle restructuring

For subscribers

Rickmers Group surrenders in struggle to keep business alive

For subscribers

HSH Nordbank rejects Rickmers Group's rescue plan

For subscribers