Here are the winners and losers in the battle for 2020 gains

The most important deadline for the shipping industry lies ahead.

On Jan. 1, 2020 the hotly-discussed sulfur requirements will come into force and everyone in the industry will need to comply.

All corners of the shipping sector will be affected, from carriers, which must opt to either install scrubbers or sail on low-sulfur fuel, and refineries which will produce and sell the new types of fuel. Not to mention shipbuilders and equipment manufacturers.

In a detailed report, US-based investment bank UBS has analyzed the entire maritime ecosystem to draw conclusions about the biggest winners and losers arising from the new IMO regulations.

At the same time that the sulfur requirements are being introduced, the ballast water convention will come into force, which also has an impact on the huge sums that UBS calculates are at stake. Altogether the bank estimates that "green shipping" will end up accounting for a total budget of more than USD 250 billion in shipping industry investments.

Losers

UBS has divided the shipping industry into four areas – two of the groups stand to lose on the new rules, while the other two will reap the benefits.

Shipbuilders are the part of the shipping industry that will be hardest hit, but the impact differs from yard to yard leading up to the deadline.

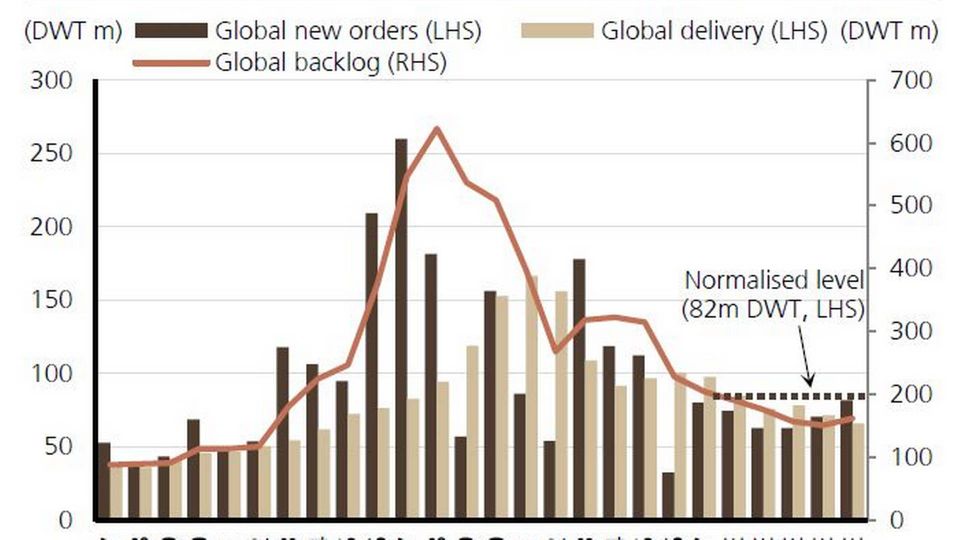

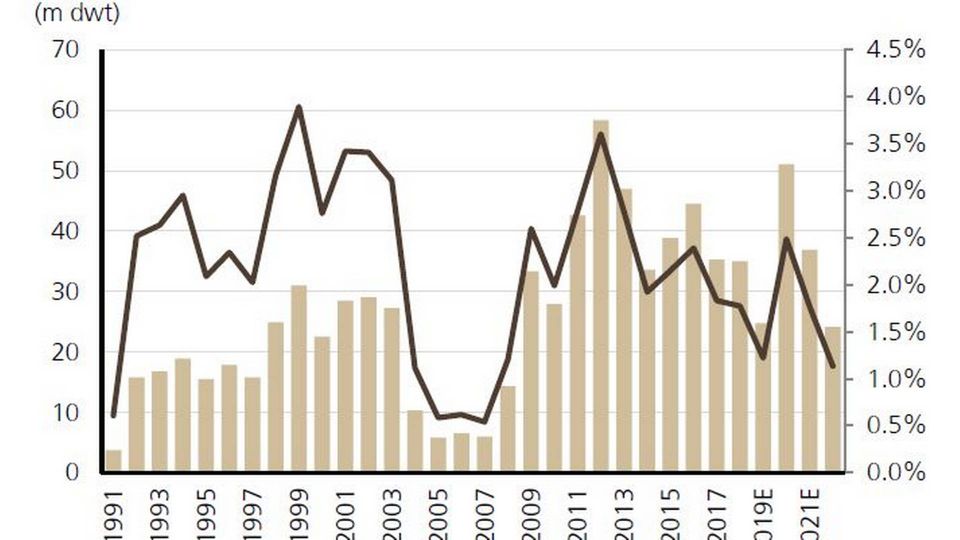

Finances will be impacted at the yards, as shipping companies hesitate to order new vessels, as many of them have yet to decide on which technology or solution they will adopt in order to comply with the sulfur cap and ballast water conventions.

UBS thus forecasts an order drought ahead to 2020, while orders will begin to flow again from 2021 when players have decided on their approach.

"We believe shipyards have invested in technology and capacity to build vessels that comply with environmental regulations. But the lack of ship orders will be negative for the yards' utilisation and profits. We expect large, high-cost Korea yards to be more impacted than smaller, low-cost China yards and offshore/repair yards in Singapore," writes UBS.

The investment bank points to Sembcorp and Keppel Corp as the yards which will perform best in 2020, while Hyundai Heavy Industries and Samsung Heavy Industries are expected to encounter problems.

Hapag-Lloyd at the bottom

Shipowners are the other part of the industry that looks slated to lose out under the new regime.

On the one hand, 2020 and the ballast water convention pose bad news for carriers, because they will now be using funds on new vessel installations. According to UBS, carriers are not prepared for the disruptive effect that the introduction of the rules in 2020 will have on the market.

"We expect ship owners to be hesitant about investing large sums to comply with the 0.5 percent SOx regulation in January 2020, not only because of the uncertainty surrounding additional regulations and the best technology to comply with these follow-up rules, but also due to a lack of capital given a weak shipping market," writes UBS.

On the other hand, 2020 is not only negative for shipping companies. As capacity will be limited with fewer players placing orders for vessels, freight rates will be push up in 2020 and 2021.

UBS predicts that shares for container carriers such as Cosco and Mitsui OSK will perform well from 2020, while Hapag-Llloyd and K-Line will be weaker.

Two big winners

Meanwhile, the winners from the 2020 rules will be refineries and equipment suppliers.

UBS argues that refineries will see increased activity in the sale of new types of fuels, while equipment manufacturers will have a completely new kind of business in the sale of scrubbers and ballast water management systems as a result of the new regulations.

However, not all refineries will see the same impacts. Refinery shares such as SKI and IRPC will perform well, while Rosneft, for instance, could experience setbacks.

"This will benefit complex refiners, in particular those set up to produce more middle distillates, while simple refiners will struggle," writes UBS, adding that refineries will not be entirely ready by 2020:

"The window of opportunity to bring new units on stream in time for 2020 was narrow for refiners, given the long lead times. Refiners are developing a new 0.5 percent sulfur fuel product but there is no standardised fuel for the time being."

Within manufacturing, UBS says the big winners will be the three major players will be Sweden's Alfa Laval, Finnish Wärtsilä and Rolls-Royce, while Cargotec will not perform nearly as well.

However, equipment manufacturers will generally come out on top as they will see more business activity emerge from the environmental requirements despite a decline in orders in the coming years. And the business does not stop right away.

"We expect scrubber orders momentum to continue beyond the Jan. 2020 deadline, as we expect only 1- 2 percent of the global fleet to be scrubber-equipped by then," writes UBS.

English Edit: Lena Rutkowski

More than 2000 vessels will get scrubbers before 2020

Golden Ocean chooses scrubbers for 16 vessels

Related articles

Golden Ocean chooses scrubbers for 16 vessels

For subscribers

Torm calculates with a 2020 boost of five percent

For subscribers