One company kept venture investments in shipping afloat in 2019

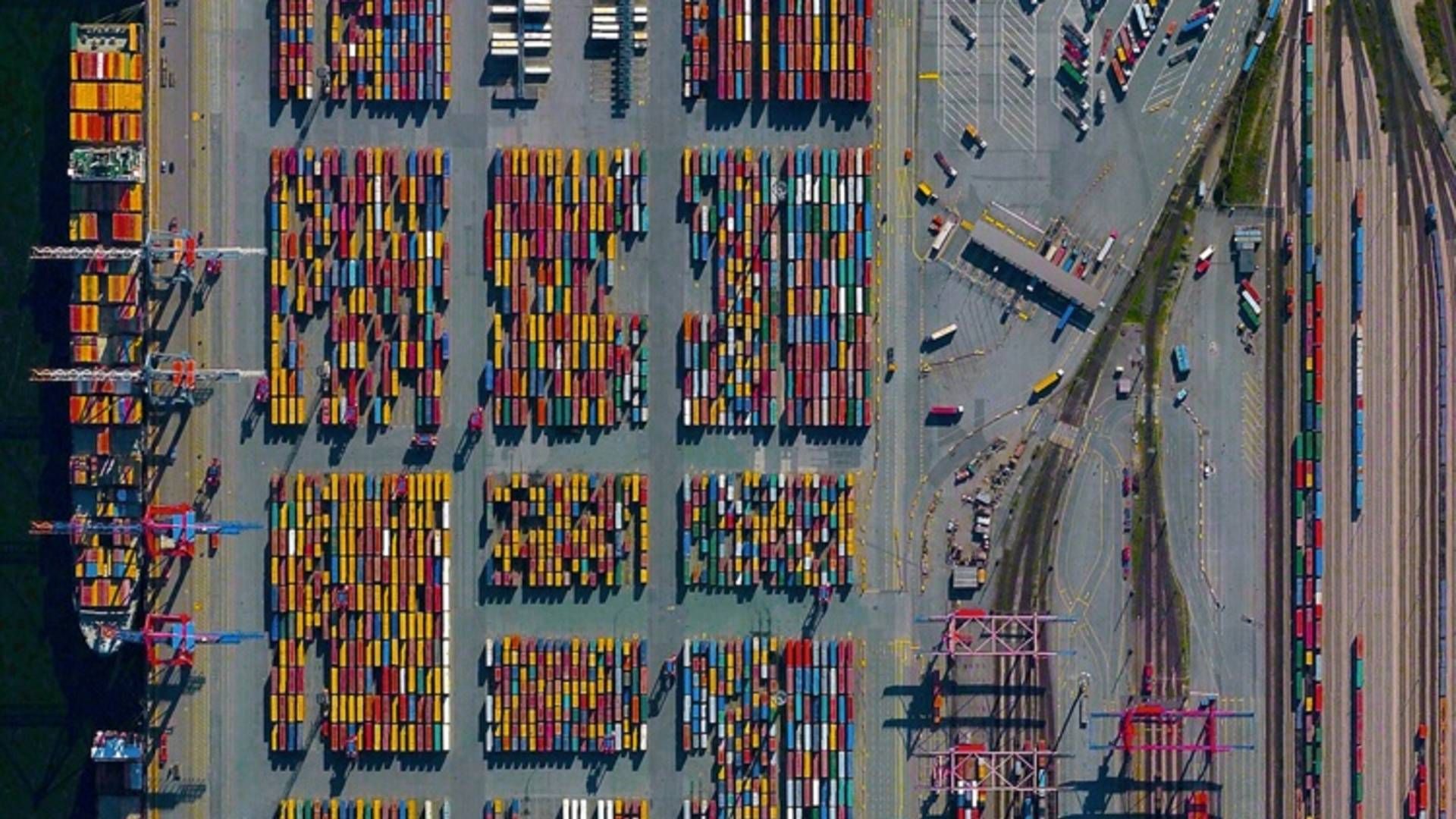

Venture investments in the shipping industry saw a total increase last year, but this was due exclusively to a billion-dollar investment in digital freight forwarder Flexport, shows new report.

Digital freight forwarder Flexport was the sole reason that total venture investments in maritime companies increased in 2019.

Already a subscriber?Log in here

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Teekay adjusts business to new investor demands

For subscribers