Analysis: State-aid secured EU dominance in shipping

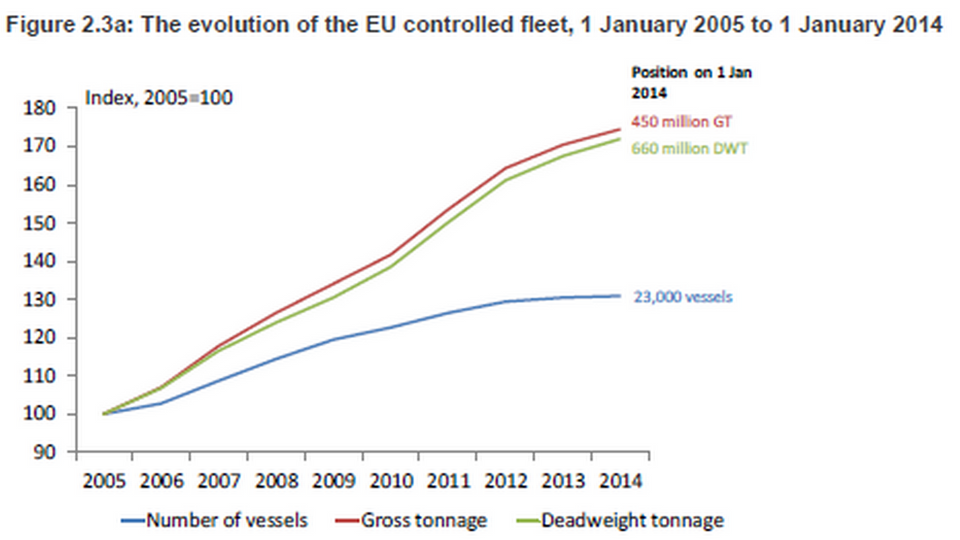

State aid for European carriers in the guise of favorable tax rules, such as the tonnage tax, has not only done so that shipowners from the EU countries today control more than 40 percent of the total tonnage in the global fleet. From 2005 to 2014, the EU-controlled fleet has grown by more than 70 percent in total tonnage, just as the European shipping industry since 2012 has contributed EUR 145 billion to the GNP.

These facts are revealed in a comprehensive mapping of the European shipping industry's impact on the economy, performed by analysts Oxford Economics for the European Community Shipowners' Association, ECSA. The analysis was published on Wednesday at a seminar in the EU Parliament in Brussels, with participants including the EU's Commissioner for Transport, Siim Kallas, among others.

Source: Clarkson Research

The analysis is presented after six tumultuous years in international shipping and at a time when European carriers, in particular, are facing a series of new environmental requirements concerning sulphur and NOx emissions from ships operating in Northern European waters, just as the EU Commission has to decide whether the three largest carriers in the world, Danish Maersk Line, Swiss MSC, and French CMA CGM should be allowed - within the framework of the treaty - to launch their planned alliance, which with 250 ships will control as much as 50 percent of all container transport between the Far East and Northern Europe. Approximately 60 percent of all tonnage in the container industry is owned by European companies, says the analysis.

More important than aviation

“The EU shipping industry continues to stay its ground in these hard times against fierce competition from third country shipping centres, particularly those in Asia and the Middle East, and the industry directly employs more workers than the aviation sector," ECSA Secretary General Patrick Verhoeven (photo), pointing to one of the analysis' conclusions about a direct link between the size of the massive EU fleet and state aid schemes - primarily the tonnage tax system - that several EU countries have adopted since the late 1990's.

Source: Clarkson Research

"The above mentioned economic contribution of EU shipping would have been much less prominent, possibly half as important as the one recorded in 2012 if those state aid measures had not been introduced," says Patrick Verhoeven.

ECSA calls for easier transport across land and sea

In addition to the tonnage tax scheme, the state aid schemes also include reduced - or non-existent - income taxation on seafarers as well as social contributions (such as the Danish International Ship Register, DIS).

The analysis explains the favorable framework conditions with the particular, mobile nature of the maritime industry in comparison to other industries, as carriers can quickly and easily relocate their activities to other countries with more beneficial conditions, just as the EU countries' aid can be reasoned out of a need for supply certainty, especially in terms of energy and military operations.

According to the analysis, direct employment in shipping has increased by 22 percent, to a total 2.3 million people, a development that has generated EUR 41 billion in tax revenue. Measured by GNP per employee, shipping is now far more productive than other industry averages in the EU - and significantly more productive than, for instance, aviation, says Oxford Economics.

The growth in total EU-controlled tonnage from 2005 to 2014 was strongest in offshore. The European-owned share of the global offshore fleet increased from 28 percent in 2005 to 37 percent in 2014, measured in gross tonnage.

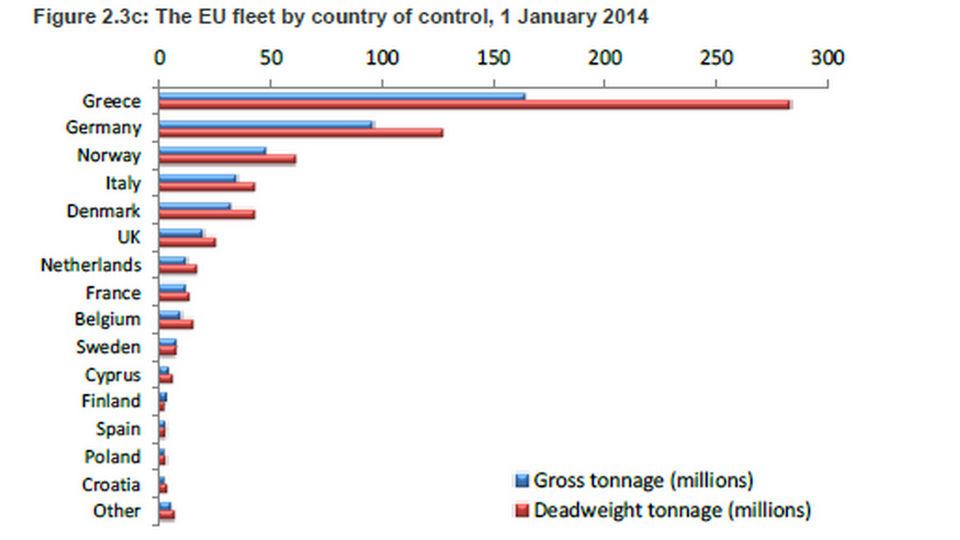

Greece still controls the biggest commercial fleet in Europe, with 36 percent of the gross tonnage, while German controls 21 percent.

EU Commission approves tonnage tax scheme

Related articles

Report: Ship management in Denmark must be strengthened

For subscribers

ECSA: EU watering down LNG network

For subscribers