Alphabulk: Shipping uses tax shelters on a large scale

A big part of the international merchant fleet is registered to tax shelter nations and many shipowners are presumed to have utilized the controversial law firm Mossack Fonseca in Panama or similar law firms, assesses media- and analyst agency Alphabulk.

The law firm Mossack Fonseca is at the center of the so-called Panama Papers scandal regarding thousands of internal documents which were leaked earlier this year to a long line of international media containing the names of persons and companies that have established companies in tax havens. A leak which spurred major international indignation.

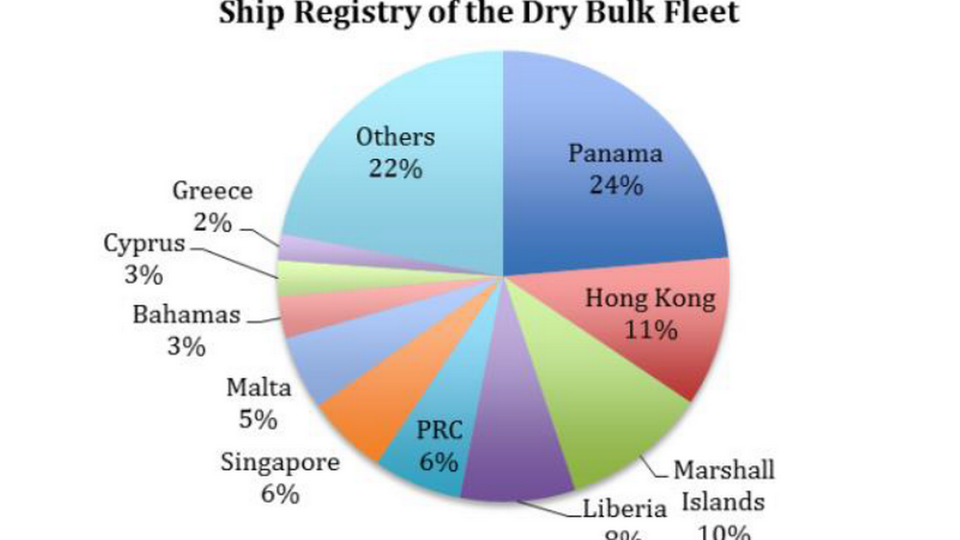

Half of the almost 12,000 dry bulk vessels in the world alone are flagged in countries such as Panama, the Marshall Islands, Liberia, the Bahamas, and other exotic nations. In other words, half of the world's dry bulk fleet, according to Alphabulk, is owned by potential customers of Mossack Fonseca or similar law firms which specialize in establishing offshore companies in tax shelters.

Maersk rejects all notions of tax speculation

Politicians and the general public across the board reacted strongly to the leak of many documents form Mossack Fonseca, which became infamous overnight as one of the leading and most utilized law firms in the establishment of offshore companies where the motivation among the firm's customers is often to dodge taxes.

Tax authorities around the world are currently scrutinizing the many leaked documents from Mossack Fonseca, but according to Alphabulk, the situation for shipping in particular is different from other industries where companies pay regular corporate taxes. Carriers to a large extent do not pay corporate taxes as in the case of many EU countries such as Denmark, Greece, and Norway, which implemented the tonnage tax many years ago to avoid carriers flying foreign flags.

EU challenges taxation for Greek shipping

A potential flagging back to the origin nation as a consequence of tightened international legislation would therefore have a limited effect on carriers, Alphabulk assesses:

"It remains to be seen if public opinion, which can understand levelling the playing field by having shipping companies paying no corporate tax, will have greater difficulty comprehending the arguments for the ultimate beneficiary shipowners."

Source: Alphabulk

Mossack Fonseca was involved in the establishment of 210,000 offshore companies in 21 different countries over the past 40 years, and the Panamanian law firm ranks among the top five leading firms in the establishment of these companies. An activity, which peaked in the middle of the 1990s and in the period leading up to the financial crisis in 2008.

In Europe, Greece has inspired many other countries to implement advantageous tonnage taxation, but in relation to the country's major economic problems, the EU Commission and international creditors demanded that the Greek government increased the taxation of the country's shipowners.

Greek shipowners: Higher taxes will trigger out-flagging

This is how much Greek shipowners voluntarily paid in taxes

Related articles

Greek shipowners: Higher taxes will trigger out-flagging

For subscribers

This is how much Greek shipowners voluntarily paid in taxes

For subscribers

EU puts pressure on Greece in tax dispute

For subscribers