Maersk Tankers far behind competitors

Maersk Tanker's has emerged as one of the major losers, earnings-wise, in the second quarter of 2017 when compared with leading product tanker carriers such as Torm, Norden, Hafnia Tankers and Ardmore Shipping.

The four carriers have all delivered a significantly better result than the Maersk-owned carrier, which besides significant USD 464 million impairment on the worth of its fleet, also emerged from the quarter with a USD 17 million deficit.

The remarkably poor result comes one year before Maersk Tankers is due to submit a concrete and final plan for the carriers' future as an independent company beyond Maersk's core business. Among the possibilities are an IPO, a merger or participation in joint ventures.

Unlike several of its competitors, Maersk Tankers has not published precise figures for its daily earnings in the fleet, while the carrier's CEO Christian M. Ingerslev has said to ShippingWatch that the negative result is explained by a 27 percent decline in the average vessel earnings, TCE and a misguided positioning of vessels:

"We have not seen full utilization of the temporary regional recovery in the market. We made a tactical decision to place the majority of our fleet in the Eastern markets, which did not provide the expected results. An increase in the waiting time in the Bosphorus strait and a stronger demand from West Africa and Latin America means that the Eastern market developed at a weaker rate than the Western over the quarter," he says.

In comparison, Norden, which operates its tanker fleet in the Norient Product Pool, booked a USD 3 million profit in a weak international tanker market for refined oil products. According to Norden, the earnings, which sat at 13 percent in the quarter, are over benchmark in the market with a TCE earning of USD 14,871 per day for the carrier's MR vessels and USD 12,800 for the smaller handysize ships.

Torm's quarterly result showed an EBIT of USD 36 million and a minus USD 2 million result. The MR fleet, which is Torm's core business, booked TCE earnings of USD 14,066 per day while handysize vessels earned USD 11, 418.

Hafnia Tankers published a USD 3.7 million net deficit for the second quarter.

Meanwhile, Italian d'Amico International Shipping booked red figures on the bottom line with a USD 8 million minus.

Scorpio Tankers announced in May of this year that the company will merge with Navig8. With the merger, Scorpio Tankers will become the biggest owner of product tanker vessels listed in New York, totalling 105 vessels. Due to the transaction, the company has delayed the release of its quarterly and half-yearly report until September.

Maersk Tankers is bottom of the list

Maersk Tankers, which has 160 vessels, of which 55 are owned by other shipowners, operates one of the world's largest fleets in product tanker and already seems to have the worst result of all the pure play owners in product tankers.

The major USD 464 million impairment is attributed to a 25 percent decline in ship values over 2016, which Maersk first opted to take up in the second quarter this year. Several players in the sector have interpreted the significant impairment as part of the carrier's ongoing process of creating a "clean slate" in the balance in connection with the coming sale and merger possibilities.

Six months ago, Maersk Tankers also attracted unwelcome attention when two US companies, Diamond S Shipping and OSG, pulled out their vessels from the Maersk-led Handytankers pool, because the results did not live up to expectations.

Instead, Diamond S. Shipping placed its vessels in Norden's Norient Product Pool.

"It is naturally upsetting that Diamond and OSG have opted to abandon our pool. This is attributed to the fact that at the beginning of 2015, we opted to enter TC-out agreements to what were very favourable rates at that point in time. However, rates increased further, which made it less attractive to be in our pool."

"Now, like many of our competitors, we have opted to invest more on the spot market. Not least as we have developed some strong analytical tools as part of our strategy, which offer a good insight into rate development and where it is most geographically optimal to be," was the explanation from Maersk Tankers at the time.

A few months after the two US tanker carriers pulled out from Maersk Tankers, Copenhagen-listed Nordic Shipholding also pulled out its five product tanker vessels from the Maersk pool.

2018 upswing?

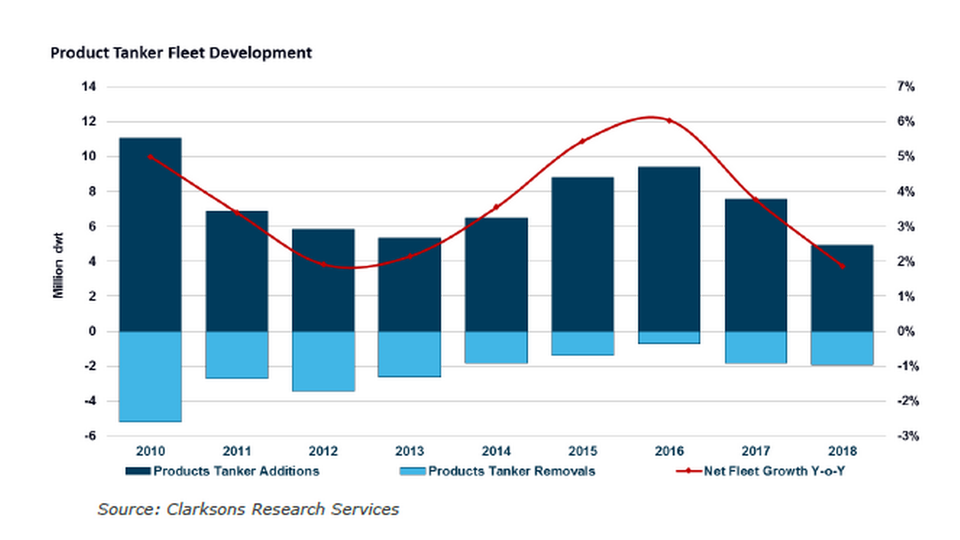

The weak product tanker market in the second quarter and across the different vessel types is attributed to a large supply of vessels with many newbuildings entering the market over the year. At the same time, stocks of oil products are at a high level with only a moderate growth in refinery production.

Source: Clarksons

In its latest analysis of the product market after the first five months of the year, Clarksons Platou expects a fleet growth of 3.8 percent for the entirety of 2017, which could become a challenging year for shipowners.

In the slightly long-term, in 2018, growth in the fleet is expected to plunge dramatically to what is perhaps the lowest level since 2002, which together with increased trade in oil products and longer sailings could unleash a long-awaited upswing in the market.

English Edit: Lena Rutkowski

Here is an overview of the Maersk Group Q2 results

Related articles

Here is an overview of the Maersk Group Q2 results

For subscribers

Maersk Tankers books huge impairment on vessels

For subscribers

Hafnia Tankers books deficit for Q2

For subscribers