Will scrubbers make sense five years from now?

Five years from now, it could prove completely pointless to have a scrubber installed on a vessel.

Namely due to the fact that by then it could be very difficult to procure the traditional heavy fuel oil that shipowners can use if they have scrubbers installed on their vessels, says Mel Larson, principal consultant at firm KBC Advanced Technologies, which services the oil industry and the major oil companies.

"If you install a scrubber today, and you can have the investment paid off before 2022, it can still pay off to have a scrubber installed, as it's cheap to operate. But after that point it's no longer a sustainable solution," he tells ShippingWatch.

Window closing

When the global sulfur directive comes into force on Jan. 1 2020, shipowners face a choice of sailing on low-sulfur IMO compliant fuel with a sulfur content of less than 0.5 percent, or installing scrubbers that can clean the sulfur from ships' emissions when sailing on heavy fuel oil or other high-sulfur fuels.

The argument for installing a scrubber rather than bunkering low-sulfur fuel has, according to scrubber suppliers and shipowners who have opted for this solution, been the large savings that can be achieved by sailing on high-sulfur fuel. The difference in price between low-sulfur fuel and traditional heavy fuel will be so big that it will make solid financial sense to use the latter, the pro-scrubber side argues.

But Larson notes that the window for when a scrubber represents a financially sustainable solution is closing.

Starting in 2020 it will no longer be profitable for refineries to produce the traditional high sulfur heavy fuel, he explains.

"From Jan. 1 2020 and just prior to that date, the price of heavy fuel oil will drop significantly. This is of course good for shipowners, but the refineries which produce this fuel will lose a lot of money," says Larson:

"The thing is, the refineries will entirely lose the incentive to sell the traditional fuel. They will lose so much money on producing it that they will either get completely rid of heavy fuel oil or just stop producing it."

Difficult to find heavy fuel oil a few years from now

In his view, it could thus already a few years after the global sulfur directive comes into force become difficult for shipping companies to get the right fuel.

Charlotte Røjgaard, Global Technical Manager at Bureau Veritas' Marine Fuel Services division, also projects a much lower availability of heavy fuel oil.

"If there's no demand at the right price, there'll be no supply. One will probably be able to get heavy fuel oil in the biggest bunker ports, but I don't expect it to be widely available," she tells ShippingWatch.

As such, shipping companies should already try to safeguard themselves by coordinating fuel supply with their suppliers.

"The key thing for shipowners betting on scrubbers is probably to ensure a long-term supply arrangement with their suppliers, and to look at their trade routes and how much time is spent outside of emission control areas, as there can be savings to be made on scrubbing even from 0.5 percent to 0.1 percent," says Røjgaard.

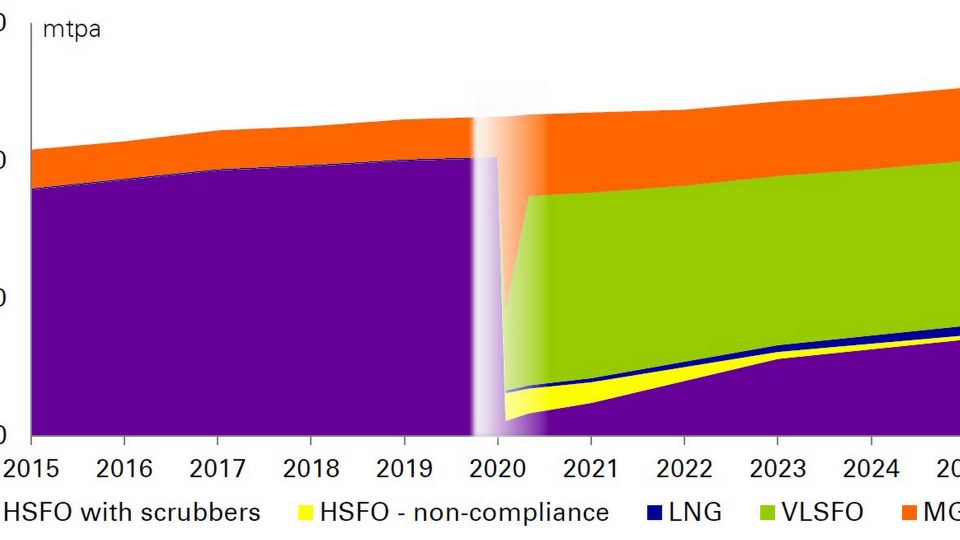

Oil major BP has made projections for the shipowners' expected fuel consumption from 2020 and on, and the decline in heavy fuel is clearly reflected in the forecast.

Meanwhile, bunker suppliers will also see a change, says Larson of KBC Advanced Technologies.

"Many bunker companies will no longer provide high sulfur heavy fuel oil, as it won't pay off for them to sell it on, and also because they don't have the logistics needed to differ between the various fuel types on board, and the traditional fuel will thus be the obvious choice to move away from," he says.

Announcing eco choices

He anticipates that with time it will become increasingly unlikely that ships can tank high sulfur heavy fuel oil across the globe, even though there will be regional differences in terms of how easily it can be procured.

Another development also factors in. Ahead of 2030, the industry will prepare for the tighter environmental requirements, for instance in terms of reduced CO2 emissions, and this will make more stakeholders switch to LNG as alternative fuel, while slow steaming will be increasingly used as part of the efforts to reduce greenhouse gas emissions.

All of this combined will make the refineries lower their output, says Larson.

Many of the world's largest and pace-setting shipping companies have in the past six months begun to announce which solutions they will pick or reject.

Maersk announced in the spring of 2017 that scrubbers will not be the solution tapped for the carrier's many ships, while a shipping company such as Norden recently announced that it will invest in scrubbers for its newbuilds. Another major company, Teekay Tankers, also made its approach known by stating that it will rely on distillates to comply with the sulfur cap.

Several of the major scrubber suppliers, including Alfa Laval and Wärtsilä, have in recent years reported that shipping companies have been more hesitant than expected to order scrubbers.

But Alfa Laval's annual report for 2017 showed that the company's order backlog for the environmental technology was growing, and Wärtsilä's annual report noted that the company now expects more orders for scrubbers.

The number of ships with scrubbers installed currently stands at around 500.

English Edit: Daniel Logan Berg-Munch

ICS warns of several issues ahead of global sulfur directive

Related articles

ICS warns of several issues ahead of global sulfur directive

For subscribers

IMO agrees to global sulfur ban

For subscribers