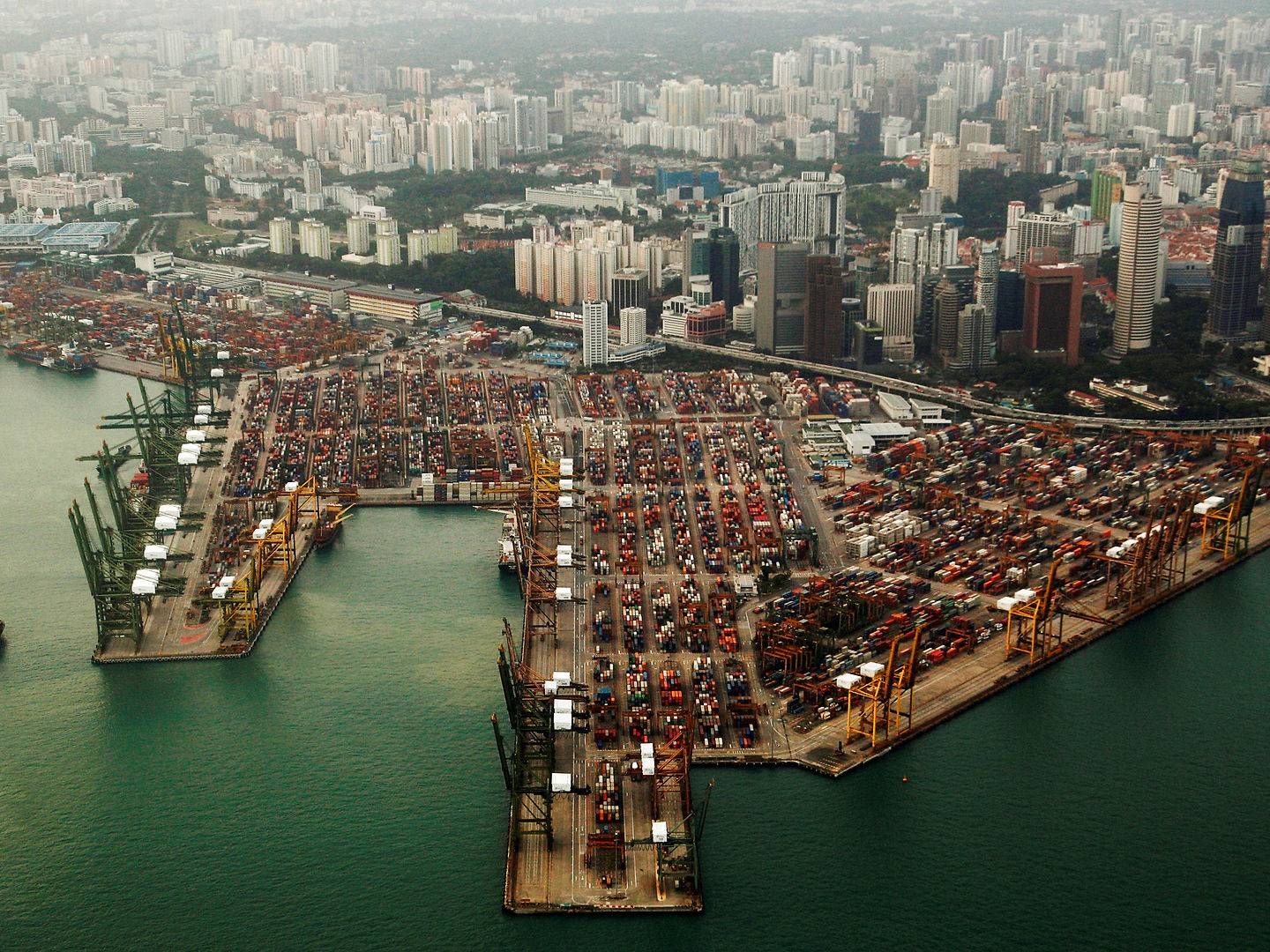

Banks face major losses on Hin Leong after potential buyers have withdrawn

Several large banks stand to get very little back if they do not succeed in finding a buyer to take over the remnants of collapsed commodity trader Hin Leong.

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Ocean Bunkering set to close shop after Hin Leong scandal

For subscribers

Singapore banks tighten control after oil trade scandals

For subscribers