IPO prospectus prices OW of up to 1 bln USD

OW Bunker has issued a prospectus ahead of the IPO long expected from the company, and the bunker supplier has set an indicative price of USD 820 million to USD 1.02 billion ahead of the listing.

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

OW Bunker: More than 30 percent growth in 2013

For subscribers

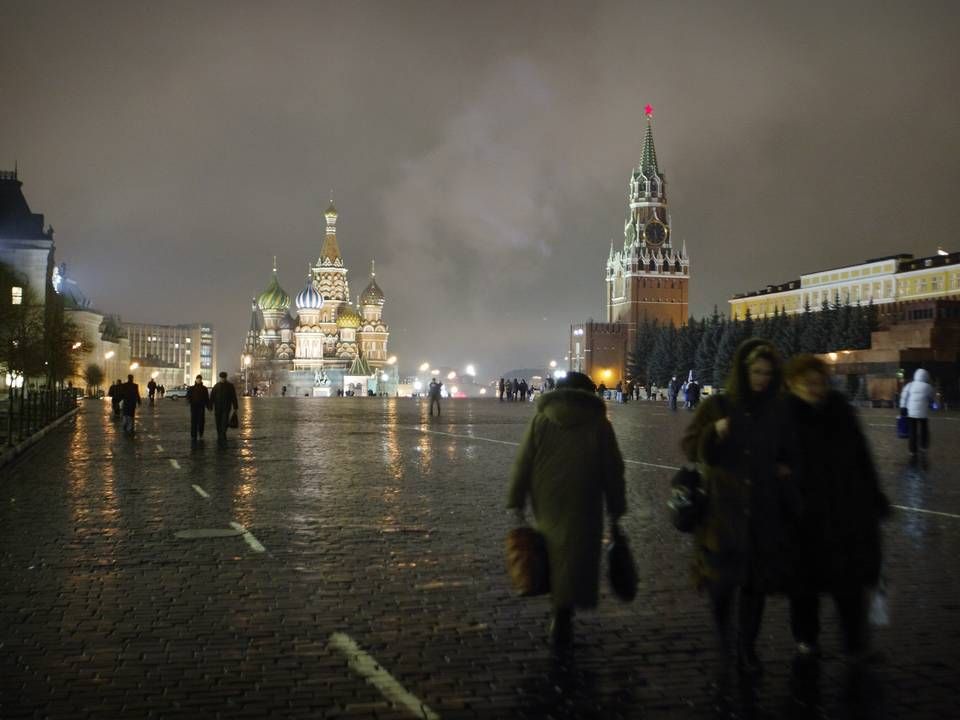

Crimea crisis could be poison to OW's IPO ambitions

For subscribers