The 'new' Seadrill estimated to be worth 1.2 billion dollars

(Added August 20: Seadrill has not gain the full support for its restructuring, but only obtained support from a majority of creditors)

Seadrill, controlled by Norwegian-Cypriot John Fredriksen, has been under bankruptcy protection in the US since February this year. This weekend the drilling company announced that they have landed a rescue plan.

Analysts at SEB now estimate that the restructured Seadrill will have a "fair equity value" of approximately USD 1.2 billion.

"Existing shareholders are left with 0.25 percent of the restructured equity. Based on our fair value estimate of the restructured equity of approx. 1.2 billion, we see a fair value for the traded shares of NOK 0.25 – 0.28, or down approx. 94 percent from current share price of NOK 4.18," according to a SEB statement shared with ShippingWatch.

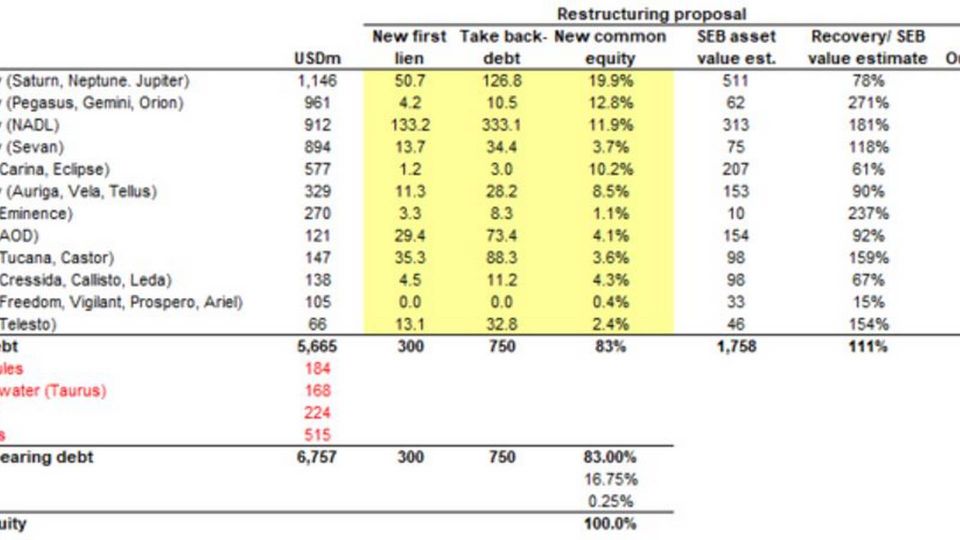

The rescue plan will reduce USD 5 billion of debt and convert it into equity. The company also needs to secure USD 350 million of fresh capital, where 300 million will come from its lenders and 50 million from Fredriksen himself.

The drilling company has been in the restructuring process since the beginning of the year and it has not been smooth sailing. The current plan has been in the works since early April. In May, the company announced the hiring of Grant Creed and Leif Nelson as its new CFO and COO.

Later the same month, Seadrill sold five rigs that were sent to Turkey for scrapping and then at the end of May Seadrill's chairman – Glen Ole Rødland – stepped down in the middle of the final stages of securing the rescue plan.

Plummeting stocks

Since the restructuring plan was announced, the drilling company's stock price plummeted significantly.

At the time of writing, the Seadrill share price is at 2.35 NOK. Down 21.83 percent.

Hemen Holding Limited, another Fredriksen company, announced today that it has sold 100,000 Seadrill shares. With that transaction, Hemen Holding has around 25.09 million shares in Seadrill, which means that Hemen Holding sits on about 25 percent of the shares in the company.

Company in the misery

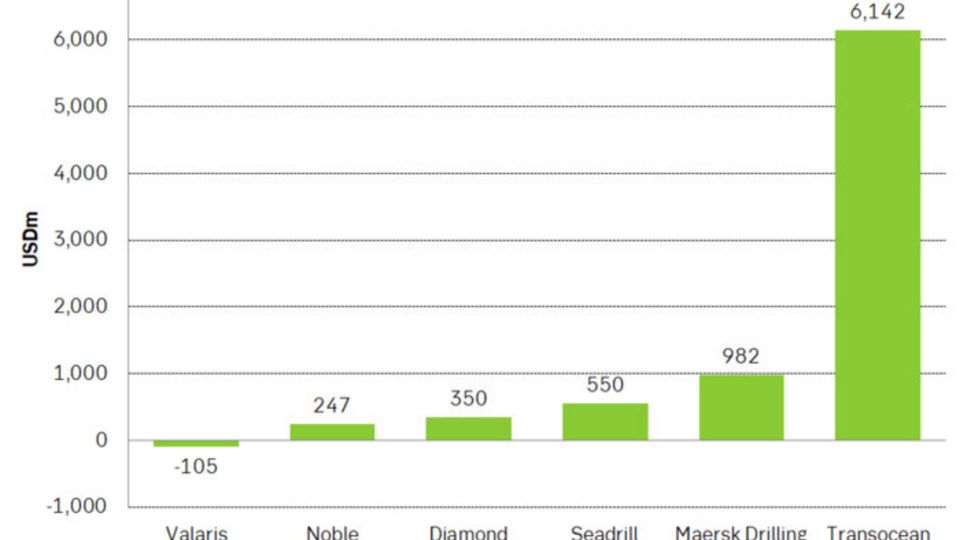

Seadrill is not alone in its struggles and misery. Several other drilling and offshore companies such as Valaris, Diamond Offshore and Noble Corp also entered Chapter 11 in the US to protect their businesses and have since emerged.

In contrast to those other companies, Seadrill will come out of the restructuring with a little higher net debt, according to SEB.

"We estimate Seadrill to be left with a net debt position of approx. USD 550m, somewhat above the level seen from the recent restructurings at Valaris (USD -105m), Noble (USD 247m) and Diamond Offshore (USD 350). We estimate total interest cost of USD 118m per annum, of which USD 62m is cash payments," the bank states.

SEB points out that the fair equity value of Seadrill is "excluding any impact from the ongoing restructuring of Seadrill NSN". The restructuring plan is still to be approved by the bankruptcy court in the US.

Seadrill lands comprehensive restructuring deal

Seadrill chairman steps down amid restructuring

Related articles

Seadrill lands comprehensive restructuring deal

For subscribers

Seadrill chairman steps down amid restructuring

For subscribers

Seadrill sells five rigs for scrapping

For subscribers