SeaIntel: Baltic Sea ports seem to dodge sanctions

The EU's and US' economic sanctions against Russia and the subsequent Russian import ban on a long list of food items from the West seems not to have had a crucial impact on the amount of containers shipped in and out of ports in the eastern part of the Baltic Sea, according to a study performed by analysts SeaIntel on container volumes handled by these ports.

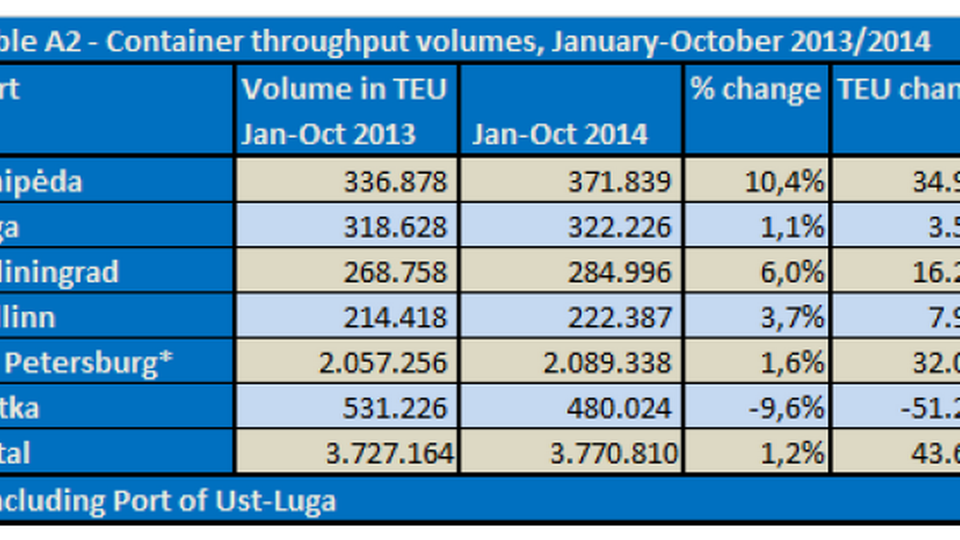

The combined volume of containers handled by these ports increased in the period from January to October, both in comparison to developments for 2013 as a whole and in terms of the first seven months of the year, according to the numbers. However, the numbers do not indicate a reason for this growth, says SeaIntel.

St. Petersburg

The overall growth in the biggest Baltic Sea ports is mainly driven by developments in St. Petersburg. Growth in this port means that the combined container volume for the region has increased 3.2 percent since August.

According to SeaIntel, this alone is not a particularly significant growth achievement, but the increasing volumes in St. Petersburg could indicate that Russian shippers are focused on sending their containers through the country's own primary ports rather than using other ports in the region.

Source: SeaIntel Maritime Analysis

SeaIntel performed a similar analysis in October last year of container developments in major ports in East Europe from January to August 2014 in order to determine whether there were serious consequences of the Russian import ban on food items from the EU, US, Canada, Australia and Norway. And the analysis at the time also failed to supply solid indicators that this was the case.

Acquisitions of smaller container operators gaining ground

An important part of this scenario concerns the fact that total container volumes declined two percent in the period from January to July 2014, compared to the same period 2013, and with the biggest ports - St. Petersburg and Kotka - registering declines of 5 and 9.8 percent, respectively - though the ports in Klaipeda and Kaliningrad saw container volumes grow significantly in this same period.

The most relevant ports in the eastern Baltic Sea, in relation to Russia's import and export, are Klaipeda in Lithuania, Tallinn in Estonia, Riga in Latvia, Kaliningrad and St. Petersburg in Russia and Kotka in Finland.

The EU and the US introduced additional sanctions against Russia last month, primarily aimed at Crimea, and these sanctions mean that the EU has banned all investments on the peninsula that has been annexed by Russia.

Weak euro hits Seago Line - and its customers

The Russian economy is hit hard by the sliding oil price, just as the consequences of the economic sanctions seem to be gaining in strength.

Jakob Bomholt, CEO of Maersk Line's European feeder and shortsea carrier Seago Line, said recently in an interview with ShippingWatch that the crisis in Russia has led to a descending trend in volumes shipped from Europe to Russia, especially from Poland to Russia - though he added that countries outside of the EU, which has been hit by the Russian boycott against, for instance, Poland, have compensated for the missing trade.

SeaIntel: Few Baltic ports hit by Russian import ban

Maersk's Russian port company plummets on the stock exchange

Related articles

SeaIntel: Few Baltic ports hit by Russian import ban

For subscribers

Russian prestige project gets billion-dollar subsidies

For subscribers