Korean Hyundai plans to divest assets worth billions

Korean Hyundai Group, which owns the country's second-largest shipping group, Hyundai Merchant Marine, is running out of capital, and the group is therefore preparing a giant sale of assets and companies to raise USD 3.1 billion, said the group in a statement on Sunday, and Hyundai thus joins the list of South Korean shipping companies like Hanjin and STX Pan Ocean, as well as airline Korean Air Lines, facing serious financial difficulties.

Hyundai Group plans to sell Hyundai Securities and two other financial companies in the hopes of raising USD 3.1 billion, while Hyundai Merchant Marine, which is - among other things - the world's 17th largest container carrier - plans to sell its terminal businesses and intends to restructure its entire dry bulk shipping operation, in a move to raise approximately half of the total figure.

Investors worried

“While the company has sufficient funds to last until the first half of next year, we’ve decided to come up with a restructuring plan to calm investors’ concerns. We plan to continue restructuring the group next year,” says Hyundai in a statement.

Management also announced that it will attempt to attract foreign investors to Hyundai Merchant along with plans to perform a share sale in Hyundai Logistics with shipping, logistics, machine industry as well as North Korean tourism as its future core businesses.

Hyundai Merchant plans to divest its South Korean container production along with real estate in the United States, Singapore, and China prior to the maturing of bond loans for close to one billion USD over the next two years, together with other loans for approx. USD 600 million.

Critical review

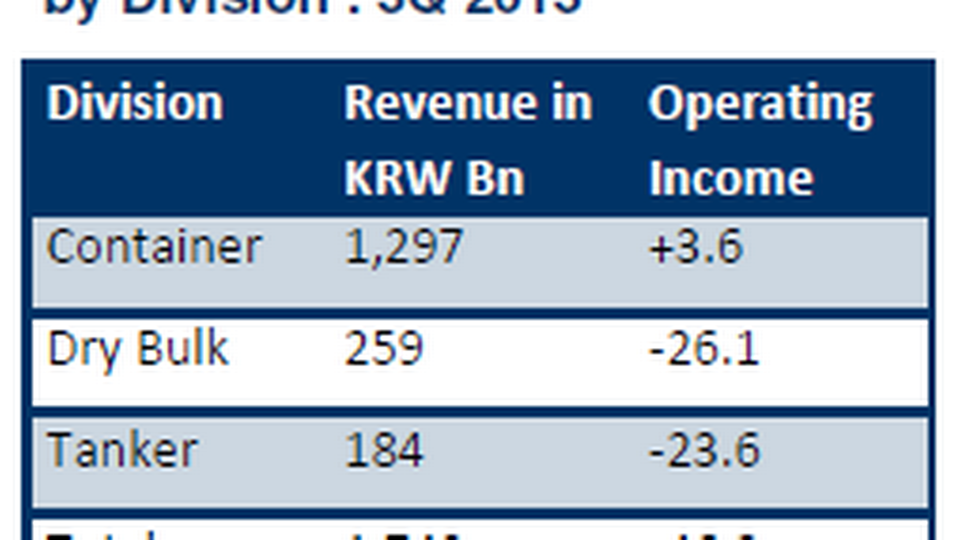

A few months ago, in August, analysts Drewry published a critical review of Hyundai Merchant Marine's financial conditions. The carrier operates a diversified fleet of some 160 ships, and 2013 sees the company headed for a third deficit in a row:

""Hyundai Merchant Marine Co Ltd (HMM) has posted two consecutive annual losses in FY11 and FY12 on the back of weak freight markets, a fragile global supply-demand environment, a high fixed cost base and high interest payments. Despite a minor recovery in freight markets, HMM failed to generate enough EBITDA to meet its interest expenses in FY12, and took on short-term debt to meet its financial and operational needs. We believe the near-term financial headwinds will persist, amid rising liquidity concerns," said Drewry, questioning whether HMM would be able to comply with group's financial covenants due to continued weak and difficult markets in especially container and bulk.

Shares in free fall

In a subsequent press release Hyundai responded to Drewry's critical analysis, which predicted that the Korean conglomerate would encounter difficulties in terms of raising new capital due to its poor financial conditions stemming from its massive debt.

Hyunday Merchant Marine countered that the conclusions of the analysis were strongly exaggerated, but the statement out of Seoul on Sunday seems to validate Drewry's estimates concerning the group's serious problems.

Since the beginning of the year the share values of the two biggest companies, Hanjin Shipping and Hyundai Merchant Marine have been in free fall, declining a total of USD 2.4 billion by late November, while the third-largest carrier, STX Pan Ocean, has suspended payments since June of this year.

"The cash-strapped Korean companies have seen their debt load spiral out of control while their equity base has been eroded due to persistent losses in their shipping operations even as they continued to take on newbuildings ordered both before and after the Lehman crisis in late 2008," said Alphaliner (note graphics) in an analysis last month.

Read more about Hyundai Merchant Marine (HMM)

Alphaliner: South Korea's major shipowners in deep crisis