Dry bulk shares plunged in turbulent 2018

The pacesetting dry bulk carriers finished 2018 with a significant decrease on the stock market. The year was particularly influenced by uncertainty about the trade war, brexit, new ballast water requirements and not least the upcoming sulfur regulations.

Whereas the dry bulk shipping companies benefited from higher rates and presented decent result at the beginning of 2018, the opposite was true for the last months of the year, as Bimco chief analyst Peter Sand recently told ShippingWatch.

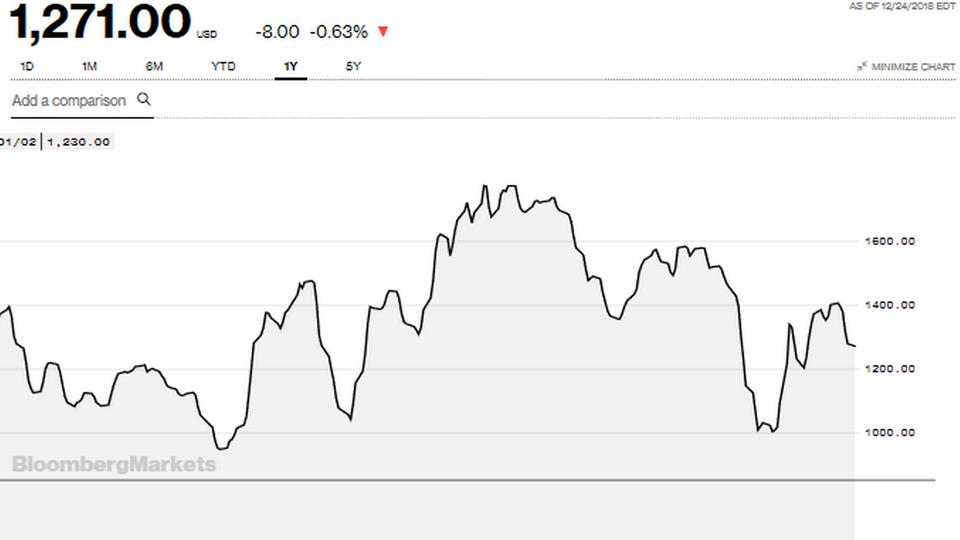

That analysis is evident in the stock prices at leading dry bulk carriers such as Scorpio Bulkers, Golden Ocean, Starbulk and Pacific Basin. In the first three quarters of the year, the companies' value grew, but on average the companies lost 30 percent of that value in the last three months.

Following the third quarter accounts, Golden Ocean's executive team predicted that especially capesize, which makes up the majority of the company's fleet and the Baltic Dry Index, would be very volatile. Average rates had already dropped significantly, the company noted.

In 2017, the Golden Ocean stock grew 80 percent, and that development continued into October with a 15 percent increase. From there, things went in the opposite direction and stock prices at the Norwegian carrier devalued almost 40 percent in the last three months of the year.

The situation was almost identical at competitors Scorpio Bulkers and the equity fund-controlled Star Bulk Carriers.

Starbulk, which doubled its share price in 2017, also benefited from the improved rates in 2018 and similarly presented a profit in the first three quarters of the year. In October, share prices at the Greek dry bulk company had grown almost a quarter since the beginning of the year, but the prices dropped more than 40 percent between October and December.

At Scorpio Bulkers, the share price dropped almost 25 percent in the last three months of the year, while the Pacific Basin share dropped nearly 20 percent in the same period. All of the carriers ended the year with a significant drop in share prices.

Dry bulk carrier Norden 'only' lost ten percent of its stock value in the fourth quarter. However, in comparison, Norden performed poorer on the stock market relatively speaking in the first months of the year, and Norden's stock thus also lost about a fifth of its value throughout 2018.

Pressure from trade war and Chinese reform policies

The dry bulk shipping companies' poor end of the year should be seen in connection with the fact that the expectation of exuberant growth dwindled as the trade dispute between Washington and Beijing intensified throughout 2018. In October, both the IMF and WTO lowered their expectations for continued growth.

"We are able to conclude that the trade conflict has become embedded in the bulk market," Bimco's Sand recently told ShippingWatch, referring to the conflict that among other things impacted the soy bean trade between the US and China, which is usually big in the dry bulk market's fourth quarter.

But the dry bulk carriers' decline was significantly bigger on the global stock market, MSCI World Index, which ended with a drop of approximately 11.5 percent. Bimco's chief analyst also stressed that factors other than the trade dispute had also pressured the dry bulk market.

China's import of iron ore for example, which has helped drive the dry bulk market in recent years and which is traditionally strongest in the fourth quarter has been replaced by a new-found love of scrap ore as part of a reform agenda aimed at making the country more sustainable, among other things. This especially pressured the capesize segment, which accounts for almost two fifths of the Baltic Dry Index.

Things were looking good

In 2017, dry bulk shares powered ahead and, although the market had not completely recovered following the historic low point in 2016, investors seemed to have regained faith in a continued recovery in the dry bulk market, which was supposed to continue into 2018.

And that analysis turned out to be true. At least to a certain extent.

The Baltic Dry Index, which continuously shows what it costs to transport commodities, was generally higher in the first half of 2017 and in August it reached more than USD 1,750, the highest level since early 2014.

And dry bulk shipping companies, such as John Fredriksen's Golden Ocean benefited from this. The Norwegian carrier was able to significantly grow its bottom line in the third quarter of 2018 and, like most of its competitors, reported a profit in both the first and second quarter.

Then things started going awry for the dry bulk market.

By the end of August, the Baltic Dry Index suddenly dropped and although the index regained some of it by mid-September, the index bottomed out in late October.

Contrary to the expected seasonal development, where rates are typically higher towards the end of the year. By mid-November, the Baltic index hovered around USD 1,000 compared to more than USD 1,350 in 2017.

Dry bulk carriers optimistic about 2019

The surprisingly weak fourth quarter in 2018 for dry bulk carriers, which surprised both the carriers and analysts, does not equal a weak 2019, chief executives of dry bulk carriers Golden Ocean and Klaveness told ShippingWatch in December.

Lasse Kristoffersen, CEO at Klaveness, estimates that the order book in the dry bulk market is at its lowest level in 15 years with a fleet growth limited to between 2 and 2,5 percent.

"We expect the demand growth to be higher, so we expect a structural recovery of the dry bulk market next year," Kristoffersen told ShippingWatch.

He also believes that fleet growth could be even lower because ships will exit the market in order to have scrubbers installed ahead of the Jan. 1 2020 sulfur regulations.

The year has only just begun. And so far stock prices have improved since the market opened again, but as last year proved, it can be difficult to predict where the year ends. CEOs at the two dry bulk carriers still expect to sail in a volatile market in 2019, while analyst firms such as Clarkson's Platou Securities and Fearnleys believe in a good year for all shipping stocks.

English Edit: Daniel Logan Berg-Munch & Ida Jacobsen

This is how much the shipping shares have plunged in 2018

Related articles

This is how much the shipping shares have plunged in 2018

For subscribers

Ten analysts list the losers among shipping shares

For subscribers

Oslo-listed shipping shares soar

For subscribers