Western Bulk: Even strong companies can fail

Concerns and low expectations for the future represent the basic atmosphere at Western Bulk.

Partially because the company yesterday, Wednesday, published an annual report with a USD 57 million deficit for 2014. And partially because the basic conditions in the dry bulk industry look set to remain miserable. And the weak market has started to claim its first victims, such as Danish Copenship, leading to insecurities among competitors and colleagues.

"We don't feel that 2014 was a good year. We were far too optimistic and we fell into the same hole as most other players in our business sector. We believed that 2014 would be an exiting year, and it turned out to the complete opposite of that. We are in no way pleased with these numbers" CEO Jens Ismar tells ShippingWatch in a comment on the annual report.

He now hopes that things will develop more positively in 2015, though the year does not exactly indicate improved dry bulk rates or reduced orderbooks. Western Bulk's underlying result came to a USD 11,8 million deficit when accounting for the fact that a big part of the bottom line loss was caused by costs related to bunker hedging for future periods. This figure will be significantly lower in the first half of the year.

"A majority of this additional expense will be recovered in the new year. And we've entered 2015 with a much better balance between number of ships and cargo volumes than in 2014. Our contract coverage is much higher this year than last year, and we actually have more cargo than ships. This means that we're prepared for tough times, which is what we expect going forward," says Jens Ismar.

Base case this year

A big factor behind Western Bulk's deficit in 2014 on underlying operations was the lower margins from the operating business, as Western Bulk's net time-charter charter result decreased a total of USD 21.9 million from 2013 to 2014.

With an improved balance between number of ships and cargo volumes, Western Bulk looks to have a better footing in 2015, but the basic conditions in the market, which triggered the carrier's deficit, will not change.

"The dry bulk market is in a worse state today than it was last year. 2015 looks like a base case that will be very challenging. Also there seems to be a consensus among analysts that things will not get better, and that the tonnage balance will also not improve," he says.

2015 could in fact become much worse than the crisis year 2008.

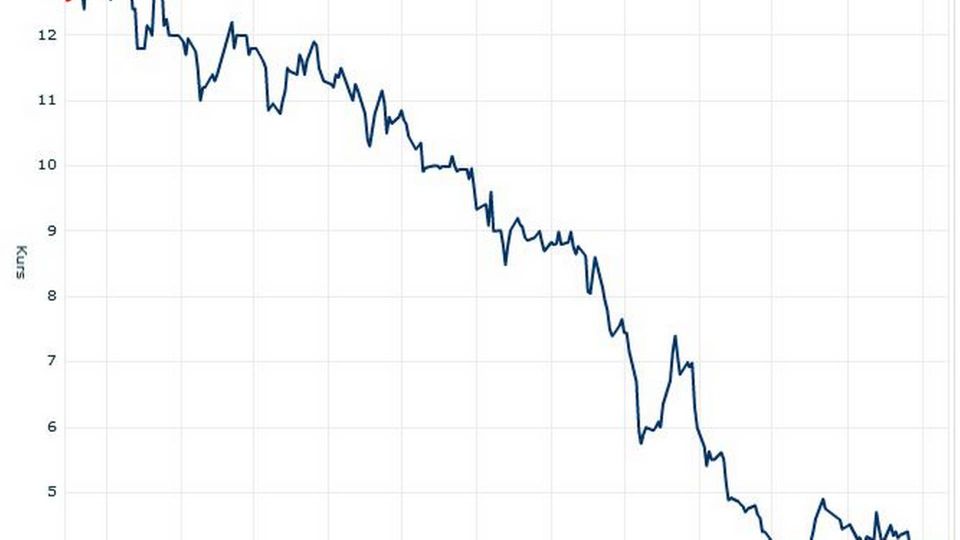

Western Bulk's share price over the past year. Source: Oslo Stock Exchange

"We were extremely attentive in 2008, and now we're even more attentive. We're nervous all the time, which means we have to focus broadly at risks all the time," says Jens Ismar, adding:

"Following the fall of Copenship and other carriers, we've become extra concerned about our counterparts and we are paying more attention to our risk model. Problems could come from all sides and from companies you wouldn't expect. The pressure on current rate developments mean that even companies that look strong can fail. We're trying to be prepared for that."

The CEO is confident that Western Bulk, in spite of massive distrust from investors - who let the Norwegian carrier's share price slide on the Oslo Stock Exchange ahead of the New Year - will be able to keep its head well above water.

"We maintain solid operations and we have a good coverage. We haven't been panic-booking our ships and we have a platform that we can make money on. We're entering the year with a very strong cash balance, and that's the key thing necessary to survive in this tough market. We absolutely see this as an advantage," says Jens Ismar.

Western Bulk's market value on the Oslo Stock Exchange currently stands at USD 85.5 million, with a share price at USD 0.54. The share has dropped by more than 72 percent over the past year, and by 3.47 percent in the past month.

Western Bulk suffered USD 57 million deficit in 2014

Western Bulk CEO: 2014 was a five-year low

These are the dry bulk losers entering 2015

Norwegian bulk carrier surprises with profit in dreadful year

Related articles

Western Bulk suffered USD 57 million deficit in 2014

For subscribers

Western Bulk CEO: 2014 was a five-year low

For subscribers

These are the dry bulk losers entering 2015

For subscribers