Dry bulk meltdown could be a mere first warning

The crisis in the international dry bulk industry - the worst in 30 years - could become even more dire and bring a long list of carriers in deeper financial difficulties in 2015.

In the worst case scenario, the current crisis could turn out to be a mere first warning compared to the troubles that lie ahead due to fundamental changes in the Chinese economy.

A few days ago key numbers for China's economy, the main driving force in the dry bulk industry, pointed to a bigger slowdown than assumed so far, with the country's industrial production representing the biggest disappointment. Meanwhile analysts and economists fear that major Chinese banks could be under so much pressure that part of the country's bank sector will need to be recapitalized to the same extent as was the case 15 years ago, after many years with towering double-digit growth rates on lending.

"My concern could be that we might see an actual double-digit slide in transported volumes. Unlike the container market, which in 2008-2009 took a dive in cargo volumes, the dry bulk market - where the main problem is that there are far too many ships in the fleet - has not experienced declining volumes. If we assume that the dry bulk market sees for instance a 5-10 percent decline in freight volumes, then we'll be facing a very difficult market for the next several years," says Christopher Rex, chief analyst at Danish Ship Finance.

A long line of shipping analysts have lowered their forecasts for the Chinese dry bulk demand in the coming years, and financial institutions are keeping their eyes locked on several economic factors in China that could be cause for serious concerns in the years to come.

Lowered growth forecasts

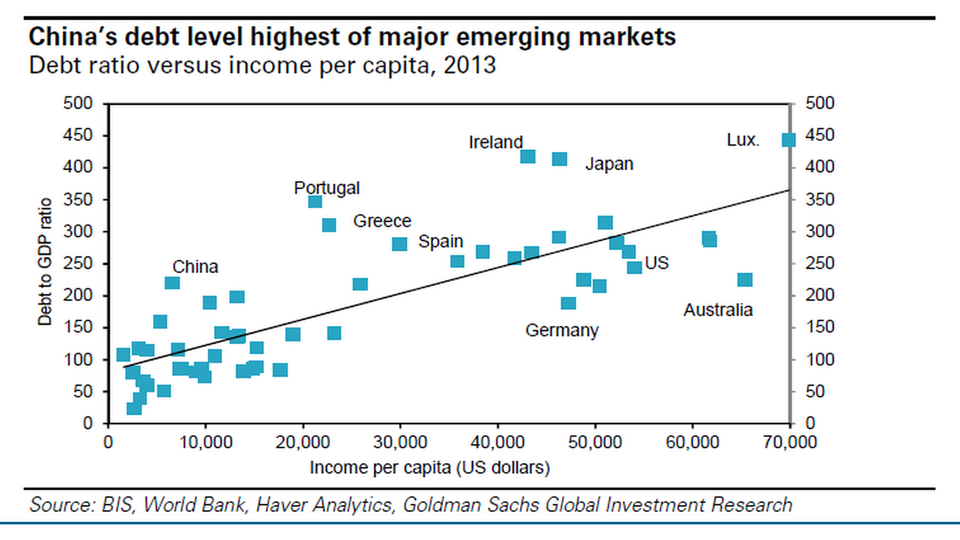

Goldman Sachs noted in January in a report on China that the country's debt buildup since the global financial crisis ranks among the biggest in recent history and that it represents a serious macroeconomic development for investors. The US-based investment bank does not expect that the problems in China, the size of the debt in relation to the country's GNP, will stabilize within the next 4-5 years.

A few months ago Deutsche Bank's US branch lowered its dry bulk demand forecast to 3.9 percent in 2015, from 5.6 percent before, while projections for 2016 currently stand at 3.2 percent, down from 4.5 percent before. The bank's growth forecast for 2017 still stands at a mere 2.8 percent.

The major German bank's shipping analyst Amit Mehrota also used the occasion to perform a significant downgrade of the share price targets across a broad swath of New York-listed dry bulk carriers, citing the companies' great dependence on the economic developments in China.

Norden lost USD 416 million in 2014

Another significant explanation for the uncertainty surrounding the Chinese growth in coming years - beyond pessimistic outlooks in the Chinese steel industry and a risk of negative growth - relates to uncertainties characterizing, among other sectors, a weaker Chinese real estate market.

A vicious spiral

Andy Xie, former chief economist for Morgan Stanley's Pacific-Asia division, has on several occasions voiced considerable concerns about the enormous debts in Chinese companies and the local authorities that permeate China's economy, along with the fact that Chinese banks could be facing serious difficulties. Among other things, Andy Xie has pointed out that certain local governments, if not all of them, take out loans in order to pay off interests on their debt, while many companies are inventing new projects so as to take additional loans that will be used to service existing debt.

"Debt and overcapacity combined makes for a vicious spiral," said Andy Xie in an editorial in 2014, where he also pointed out that the Chinese government's efforts to stimulate economic growth will not will not have a major impact on the country's economic development.

Consequences for dry bulk

Danish Ship Finance has for several years had severe reservations about developments in dry bulk, as opposed to many others - shipping analysts as well as the industry itself - who were gearing up for a gradual rebound in 2014, but the developments and the historically low rates have instead sent the entire dry bulk market tumbling in a deep crisis.

Investors pound dry bulk assets down 30 percent

In its most recent biannual forecast, Shipping Market Review published in 2014, Danish Ship Finance outlined what looked like the bleakest scenario from analysts yet for dry bulk developments over the next 2-3 years, where the only bright spot seemed to be a lower fleet growth now than in previous years.

The amount of tonnage headed for the fleet, and the number of ships in the fleet of less than five years, accounts for 57 percent, and in its analysis Danish Ship Finance found it difficult, in its words, to see an end to the major supply of ships.

Meanwhile, China's development toward a more consumer-oriented economy, less governed by the production, should represent a serious warning sign for the dry bulk industry, says Christopher Rex, who like Andy Xie and other economists is worried about the heavy debts in China and the pressure on the Chinese banks.

Danish Ship Finance also flashed the warning signs back in the spring of 2014 in terms of the long-term growth prospects that were outlined from numerous sides for the global dry bulk fleet. Not least because China was on the threshold of a switch toward a far more service-based economy aimed at private consumption instead of investments.

"This is a message we've been repeating for some years now, and now the development is underway," says Christopher Rex.

Deutsche Bank downgrades Star Bulk again

"We can't rule out the risk that China will have to recapitalize parts of its bank sector within the next 5-10 years. In that case, the most recent recapitalization will have lasted around 15 years. If the need arises, this must be considered an expensive price to pay for the achieved economic growth," says Christopher Rex:

"And keep in mind that the Chinese bank sector plays a more central role in society than banks generally do in the western part of the world, while it nevertheless plays a key part for us and in the West. But in terms of GNP, the bank sector is much bigger in China than it is in some of our economies, even though China has a major bond and stock market. The Chinese society depends far more on the banks than we do."

Scorpio Bulkers takes new beating on the stock exchange

Another solid indicator for how China's underlying economy will develop - and thus the prospects for the dry bulk carriers - is the country's energy consumption, which increased by around four percent in January this year.

"I think that the underlying economy, that is, the real growth in demand, is right now actually growing in step with the energy consumption. That represents a significantly worse scenario than what many investors are basing their forecasts on," says Christopher Rex.

Danish Ship Finance warns against another newbuilding wave

Major bulk carrier falters on the stock exchange

Klaveness turns a profit in all-time low dry bulk market

Related articles

Danish Ship Finance warns against another newbuilding wave

For subscribers

Major bulk carrier falters on the stock exchange

For subscribers

Klaveness turns a profit in all-time low dry bulk market

For subscribers