Maersk Line gets Latin America as single biggest tradelane

Latin America will play a pivotal role in the future container business of Maersk Line after the acquisition of Hamburg Süd.

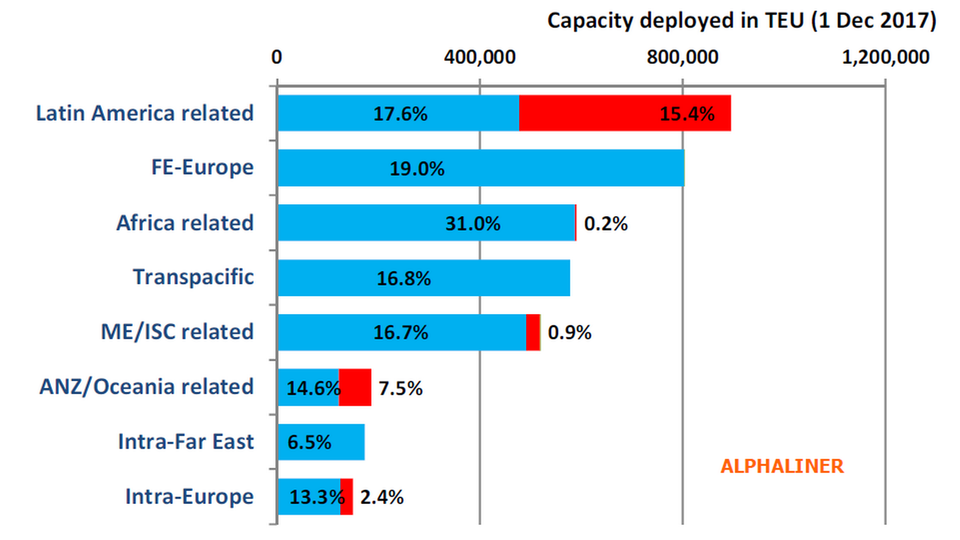

The Latin American trade services will be Maersk Line's largest single tradelane measured in total capacity, according to a review by analyst agency Alphaliner of the consequences that the sale of Hamburg Süd will have on the new combination of the two container carriers, which with a fleet of 777 ships and a combined market share of 19.4 of global capacity will cement Maersk Line's position as the world's largest container carrier.

The takeover, which cost Maersk Line USD 4.4 billion, was finalized on Nov. 30 after an extensive process of obtaining approvals from competition authorities around the world in a total of 23 jurisdictions. The approvals from the EU Commission, China, South Korea and South Africa came with a series of conditions.

Under former owner Oetker Group, Hamburg Süd built and developed its biggest business in Latin America, where 75 percent of the carrier's fleet is currently employed.

Towering dependence on North-South trades

The German container carrier and Maersk Line will have a total market share of 33 percent in Latin America, but according to Alphaliner, this share is expected to decline due to the conditions set by regulators and a natural departure of customers.

Maersk Line's acquisition of Hamburg Süd weakened by authorities

Maersk Line's overall dependence on freight volumes on the North-South routes, which besides Latin America cover countries in Africa as well as Australia, New Zealand and the Indian Subcontinent, will also significantly rise with the takeover Hamburg Süd.

The North-South trades accounted for almost half, at 49 percent, or around 5.2 million teu of Maersk Line's handled container volumes in the third quarter this year.

Adding Hamburg Süd's freight volumes in the same period, of around 1.1 million teu, Maersk's total exposure to North-South trades grows to around 55 percent. In comparison, Maersk Line's exposure on the key East-West routes between the Far East and Europe, which have historically been the carrier's largest market, came to a total 31 percent, and the exposure on intra-regional services was 14 percent.

Source: Alphaliner/Maersk Line and Hamburg Süd's market shares across regions.

Hamburg Süd will continue under its existing brand after the merger as a fully owned business unit in Maersk Line, but it will remain a commercially independent company with its own sales and marketing departments and customer service.

The most notable change will be the reflagging of 44 ships out of Hamburg Süd's fleet of 48 vessels, which are expected to be flagged in either Denmark or Singapore, Maersk Line and Hamburg Süd told ShippingWatch during an event at the carrier's HQ in Hamburg recently.

"It is the plan that all of the Hamburg Süd ships, except for the ones that are flying the Brazilian flag under the brand Alianca, will primarily go to the main flag states of Maersk which is Danish and Singaporean," Maersk Line's COO Søren Toft told ShippingWatch, while Hamburg Süd's CEO Arnt Vespermann added that this is a change that will take time.

Hamburg Süd owns a fleet consisting of 48 vessels. Of these, 15 sail under the German flag while the rest of the vessels are registered in flag states such as Liberia, Brazil, Madeira and Portugal.

Lower synergies than competitors

Maersk had previously announced that the incorporation of Hamburg Süd would trigger annual synergy benefits on operations from 2019 and beyond of USD 350-400 million.

According to Alphaliner, this is a relatively small amount compared to other recent mergers, where Hapag-Lloyd for example expects to gain around USD 435 million from the acquisition of Arab UASC, while French CMA CGM has announced synergies of around USD 500 million a year on the takeover of Singapore-based APL.

English Edit: Gretchen Deverell Pedersen

Major carriers take larger piece of the US market pie

Hamburg Süd CEO after Maersk sale: Hamburg is still a maritime hub

Related articles

Major carriers take larger piece of the US market pie

For subscribers

Maersk Line will close acquisition of Hamburg Süd this week

For subscribers