Hapag-Lloyd CEO: Taxation of container profits at "unsustainable level"

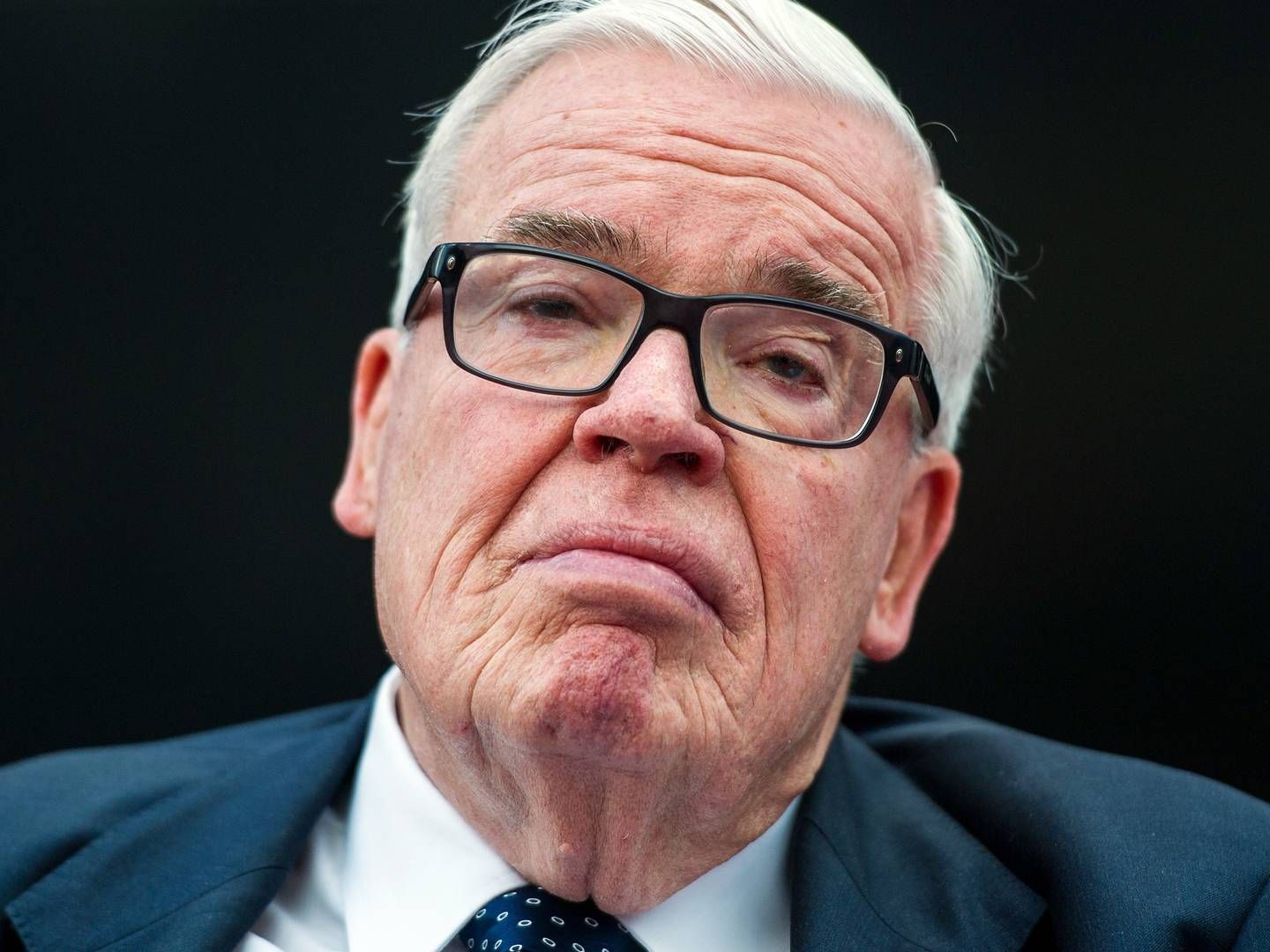

Major container shipping companies’ extraordinarily high profits of the past two years have been taxed so low that the situation won’t be tenable going forward, says Hapag-Lloyd Chief Executive Rolf Habben Jansen.

The container CEO ”fully understands” policymakers in a range of countries who have sought a revision of the favorable taxation scheme for carriers via the so-called tonnage tax.

”I don’t think it [the tonnage tax, -ed.] is necessarily wrong. Of course, our effective tax burden has been very low in the past two years, and I would say, going forward, that I also believe it’s an unsustainable level,” Habben Jansen said Tuesday during a press briefing.

Examining tonnage tax scheme is fine

The CEO therefore views it as ”fine” that the tonnage tax scheme, which acts as a sort of weight fee on carriers’ fleets, is up for debate.

”It’s quite fine to look at it and say: ’How do we handle this in the future?’,” Habben Jansen said, though we warns against changing the scheme altogether.

”If you throw out a system that’s been functioning for 20 years on account of two extraordinary years, you need to think long and hard about how to replace it with something else that will create equal conditions for everyone, and which is potentially a better mechanism,” he said.

The tonnage tax scheme is a widespread form of taxation in the international shipping industry, and it’s come under political pressure as a consequence of the extremely high profits of container carriers in a freight market that’s been saturated with congestion and major delays resulting from the Covid-19 pandemic.

Low tax rates

Analyst firm Sea-Intelligence recently calculated that Hapag-Lloyd in the first quarter of 2021 paid a tax rate of 0.8% of its profit, and that the carrier’s tax rate fell to 0.5% in the second quarter this year, corresponding to payment of EUR 20.8 in tax.

Hapag-Lloyd tripled its earnings to EUR 4.5bn after tax in Q2 2022 compared to Q2 2021.

Similarly, Danish competitor Maersk had an effective tax rate of 3.9% in Q1 2021, which fell to 1.8% in Q2 2022, when Maersk paid USD 164m in taxes out of an operating result (EBIT) of USD 8.8bn.

Maersk expects the full-year result of 2022 to be USD 31bn before tax.

The OECD has previously calculated that the effective tax rate in global shipping lay at only 7% from 2005 to 2019, and following recent years’ giant profits, politicians in several countries are calling for a more just taxation of carriers – either by revising the tonnage tax or by taxing their abnormally large profits.

However, Habben Jansen thinks the tonnage tax has resulted in reasonable taxation of Hapag-Lloyd if one excludes the past two years.

”The scheme in place in most European countries has worked really well for us for a very long period of time,” Habben Jansen said, elaborating:

”If you look at the period 2008-2020, I believe we paid an average of 20-30% in taxes of the profits we had in that period.”

Hapag-Lloyd’s CEO warns against making hasty changes to the tonnage taxation, as the risk of replacing the existing model with one that leads to unequal market conditions is significant.

”Absolutely, and this question is therefore not trivial. If you want to make changes, you have to create a mechanism that at least creates equal terms, broadly speaking. You can never have one that is 100% right, but you should at least try to make one that is 70% or 80% right,” Habben Jansen said.

Dislikes low taxation

Recently, Hapag-Lloyd’s major shareholder, German business profile Klaus-Michael Kühne, who also controls logistics firm Kuehne + Nagel, said that he dislikes Hapag-Lloyd’s current earnings due to the extremely high rates on the container market.

”Yes, I don’t like that either. These are excesses I cannot fathom. But such is the free market. These huge gains are a result of supply and demand, of the above-normal freight rates that are just accepted,” stated Kühne to German media Frankfurter Allgemeine Zeitung.

English edit: Jonas Sahl Hollænder & Kristoffer Grønbæk

Maersk and Hapag-Lloyd to pay even less taxes as rate halved

Klaus-Michael Kühne believes Hapag-Lloyd makes too much money

Related articles

Maersk and Hapag-Lloyd to pay even less taxes as rate halved

For subscribers

Søren Skou counters tax criticism: Maersk is no parasite

For subscribers