Dan-Bunkering has millions tied up in collapsed British shipping company

Dan-Bunkering is one of the biggest creditors to a collapsed UK shipping company and is now working to claw back the money.

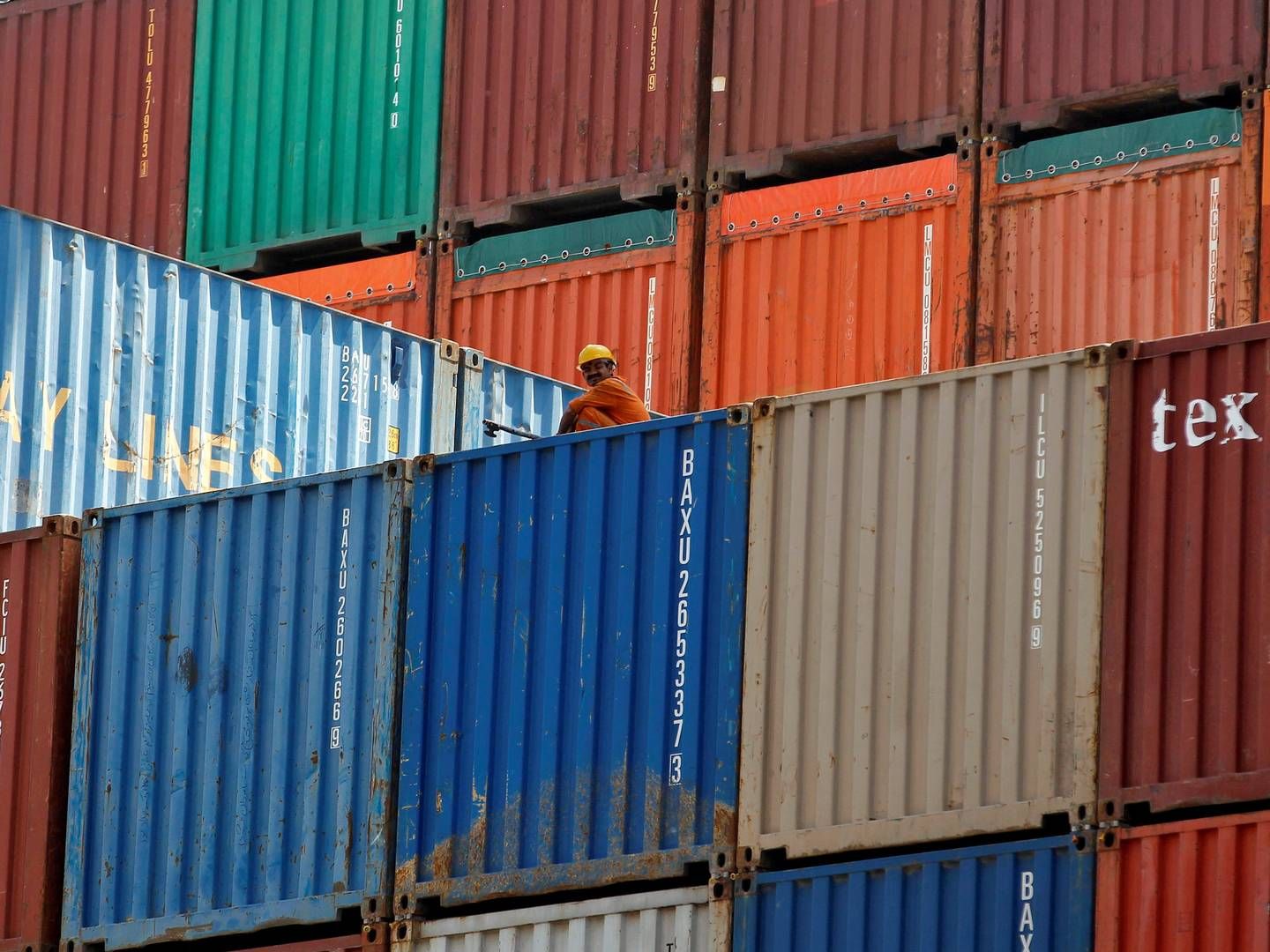

Allseas Global Project Logistics (AGPL) was launched in 2021 to exploit the booming freight market during the Covid-19 crisis where prices soared due to increases in online shopping and congestion at ports.

However, the company’s business fell apart once container rates began to plummet last summer.

A new creditor report shows that Dan-Bunkering has millions tied up in the container carrier.

”Dan-Bunkering confirms that we are a creditor to the party and that we are currently taking the necessary precautions to ensure that we are paid what we are owed in full,” remarks COO Morten Eggert in a response to ShippingWatch.

According to the report, the Danish bunker company is lacking payments totaling just over GBP 4m for supplied fuels.

The report also states that it was concrete threats of a petition for wind-down proceedings from a bunker creditor that prompted the shipping company’s management to apply for court-ordered administration in October 2022.

According to sources, the bunker company in question is most likely Dan-Bunkering. However, ShippingWatch has not been able to confirm this.

Newcomers rushed in

UK carrier AGPL was one of several new entrants when container freight prices from Asia to Europe and the US suddenly exploded.

From the beginning of the pandemic in March 2020 to the peak period in January 2022, spot prices on shipping a so-called 40-foot container from the Far East to North Europe increased by approx. 860 percent.

Newcomers reaped big profits to begin with and leased a high number of ships in order to expand business.

Many companies got into serious trouble, though, when freight rates suddenly began dropping in mid-2022 due to inflation, high interest rates and the widespread energy crisis.

The price decline meant that what newcomers paid to charter their ships was often higher than what customers were willing to pay to get their containers aboard.

At the same time, marine fuel prices surged due to Russia’s invasion of Ukraine in February 2022, increasing costs for operating vessels even further.

The administrator report describes in detail how AGPL got off to a very strong start, but since had to see its plans fall apart as prices began their steep descend.

”2022 brought an insurmountable amount of bad luck which became too much for AGPL to manage and creditors ran out of patience,” the report states.

The administrator expects to complete the estate within 12 months. Creditors are likely to receive capital, but specific amounts so far remain unclear.

English edit: Christian Radich Hoffman & Kristoffer Grønbæk

Related articles

Carriers confirm downturn: Party came to a halt in the fall

For subscribers