Maersk Line supports the Nicaragua Canal

Maersk Line now steps onto the field with support for the Nicaragua Canal, a project that has till now been surrounded by distrust from the outside world and, not least, from its competitor in Panama.

This represents the first time that one of the world's largest carriers - and the world's largest container carrier - publicly voices its support in favor of the colossal construction project, which will present a feasibility study on the project within the next few weeks.

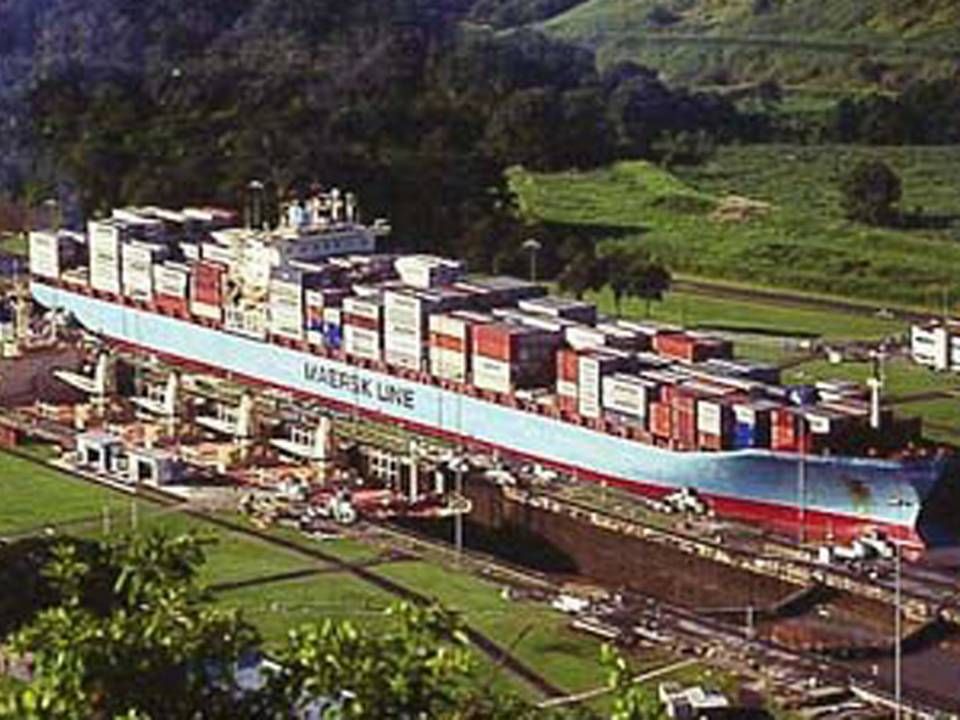

"Building a Nicaragua Canal seems to make good sense. The canal is projected to have room for the biggest ships, while also saving 800 kilometers on a journey from New York to Los Angeles. We generally support infrastructure improvements. It brings improved opportunities for transport, and thus trade. When we built container ships 20 years ago they were scaled according to the Panama Canal, but the ships today are bigger than the 4,500 teu that could fit on the biggest ships back then. Even after the expansion of the Panama Canal, the biggest ships won't fit there," Head of Daily Operations at Maersk Line, Keith Svendsen, tells ShippingWatch.

Ships of over 400 meters

He adds that there is currently a waiting period for sailing through the Panama Canal, and that the expansion of the canal - expected finished in early 2016 - will only make it possible to handle ships of up to 336 meters. Maersk Line's new Triple-E series clocks in at 400 meters, and estimates in the maritime community say that this magical barrier will soon be breached, so that ships will become even longer.

The Nicaragua Canal will be three times the length of the Panama Canal, and - according to plan - the new canal will cross the major Lago de Nicaragua, one of the largest freshwater reservoirs in the region, a fact that has led to criticism from various environmental organizations.

The somewhat unknown Chinese business man and investor Wang Jing, backed by several state-owned Chinese companies, has managed to win the 50-year concession for the canal, which is estimated to have a construction cost of USD 40 billion in 2014-prices. Estimates say that the feasibility studies alone are approaching a price of around USD 1 billion.

McKinsey looking at the finances

Less than one month ago ShippingWatch was able to report that several of the biggest Western infrastructure companies were working to evaluate the key elements necessary to realize the project. American McKinsey is looking at the finances of the project. Australian mining company MEC Mining is reviewing the scope of the digging work through the country's jungle, while British ERM is handling the environmental consequences, and consulting engineers SBE, of Belgium, will present a proposal for the dimensions of the massive water locks necessary to realize the project.

Latest reports indicate that the feasibility study will be ready for presentation by July 1st.

Plan for the Nicaragua Canal ready next month

Related articles

The dream of a Nicaragua Canal starting to crack

For subscribers

Construction on Panama-competitor to begin in 2014

For subscribers