German shipowners lose ground in charter market

German companies' share of the global charter market for container ships has declined significantly during the financial crisis that erupted in 2008, according to a new survey by analysts Alphaliner, which also estimates that this development will gain strength in the years to come.

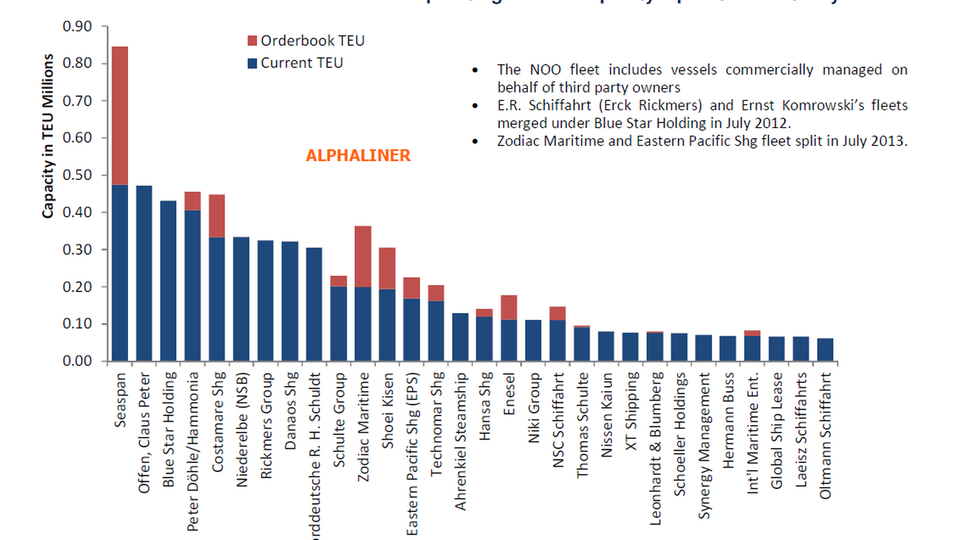

For the first time since the 1970's - when the charter market for container ships began to really pick up speed - it is not a German company that tops the international big-league of so-called NOO companies (Non-Operating Owner). Rather, this spot is now held by Canadia Seaspan, which due to a fairly young fleet with an average age of seven years, and an average size of 6,000 teu - and not least a significant orderbook - is expected to expand its global leading position even further.

The transformation of Hamburg Inc

Even though German NOO companies still control 51 percent of the combined capacity in the charter market their influence is declining. The share has dropped from 61 percent in 2008 and German owners' share of the total orderbook for the charter market currently stands at a mere eight percent.

Right now 14 of the 30 largest NOO companies have non-German owners, and 87 percent of the total global orderbook in the Top 30 will conquer further market shares from these going forward. Meanwhile, the German companies' share is expected to decrease as the companies are getting rid of older vessels.

Source: Alphaliner

Click here for larger graphics

Seaspan, which is listed on the New York Stock Exchange, has now displaced Claus Peter Offen as the world's biggest NOO company, though other of Germany's traditionally big shipowners, including NSB Niederelbe, have according to Alphaliner seen their fleets shrink in the past five years and after the financial crisis - which erupted in September 2008 - destroyed the charter market with dramatically declining rates and overcapacity. Furthermore, the entire German financing base collapsed through the so-called KG houses, a development that resulted in a sudden stop for new German orders, though alternative capital sources - especially from the US - have taken over part of the financing for some German owners, including Rickmers.

The rise and fall of German shipping

In the meantime Seaspan and several Greek shipowners such as Enesel, International Maritime Enterprises and Costamare Shipping have filled the holes left following the German collapse. At the same time, state-run financial institutions in China, including CIMC, BoCom and Minsheng - which together constitute the largest group of investors in new container ships - have built a massive orderbook of more than 500,000 teu in the last three years.

Seaspan was listed on the New York Stock Exchange in August 2005. The company's fleet stands at a total 78 units per July 2014, for 474,000 teu, making the Canadian company number the biggest NOO company in the world measured by capacity. Seaspan also has the biggest orderbook, at a total of 31 newbuildings, corresponding to 371,000 teu.

Seaspan's combined fleet is expected to reach more than 100 container ships by 2016, and Seaspan as well as Costamare are collaborating with private equity funds, Carlyle Group and York Capital, respectively.

Seaspan distances itself from German shipowners

Rickmers Maritime: The next two years could hurt

Struggling German owners hang on to product tank

Related articles

Seaspan distances itself from German shipowners

For subscribers

Rickmers Maritime: The next two years could hurt

For subscribers

Deutsche Bank: Eco-designs will cut ship values in half

For subscribers