Alphaliner: Difficult to justify extreme rate jumps

A number of container carriers, including Maersk Line, have announced rate increases from April first of over 100 percent to transport a container from the Far East to North Europe. This is the highest isolated price increase that has ever been announced on the container services between the two continents, and nonetheless hard to justify, says analyst agency Alphaliner on Tuesday in a critical review of the unilateral and repeated rate increases that shipowners have now announced for the fifth time this year.

"In which industry can you find sellers repeatedly announcing price increases of over 100 percent of the prevailing market price, while providing no reasonable justification for their actions? Container carriers on the Far Eeast-Europe trade are doing exactly that, for the fifth time this year," says Alphaliner, noting that although the four previous attempts this year have failed, this has not held shipowners back from implementing yet another unilateral general rate increase of up to USD 1,000 at a time, when the actual spot rate constitutes USD 600 per teu.

According to Alphaliner, the shipowners themselves have contributed to the current situation - with low rates and where the relationship between supply and demand is weak - by deploying newer and larger vessels from Asia to Europe. A total of 51 newbuildings from about 4,000 to 19,200 teu will be deployed on these services this year, where the head-haul from Asia to Europe is also expected to see a decline in the total freight rates in relation to a weakened Euro.

Rules of competition

The continuous rate increases, which according to SeaIntel Maritime Analysis are expected to take place every other month throughout 2015, are coming at a time when the EU Commission is scrutinizing 14 container carriers' practices and possible violation of competition regulations by publicly announcing and signaling price increases, press releases and information on the companies' websites, which are typically copied quickly by competitors.

"These announcements come several times a year and contain amounts for the price increase and the date for implementation, which generally is characteristic of all communicating companies," confirmed the EU-Commission in a statement in November 2013, where the Commission expressed skepticism towards the fact that companies are allowed to signal future price changes to each other, which can harm competition and the customers with increasing prices on freight of containers between Asia and Europe.

In an email to ShippingWatch Tuesday Maersk Line states that "there has not been any new development as the formal investigation that the EU Commission opened on the 21. of November 2013 has not yet been completed. Maersk Line continues to be at the EU Commission’s disposal."

The container carriers have previously and with a special group block exemption had the possibility of securing collective pricing through the so-called liner conferences, which the EU Commission put a stop to four and a half years ago. According to Alphaliner, it is debatable whether the large fluctuations in rates and the declining service for shippers can be attributed to the conference system, because the container industry during this time has ordered new vessels to a never-before seen extent, with the consequence that the supply of ships is much too big.

SeaIntel: Rate increases every other month in 2015

Related articles

SeaIntel: Rate increases every other month in 2015

For subscribers

Analysis: Container shipowners' profits far from sufficient

For subscribers

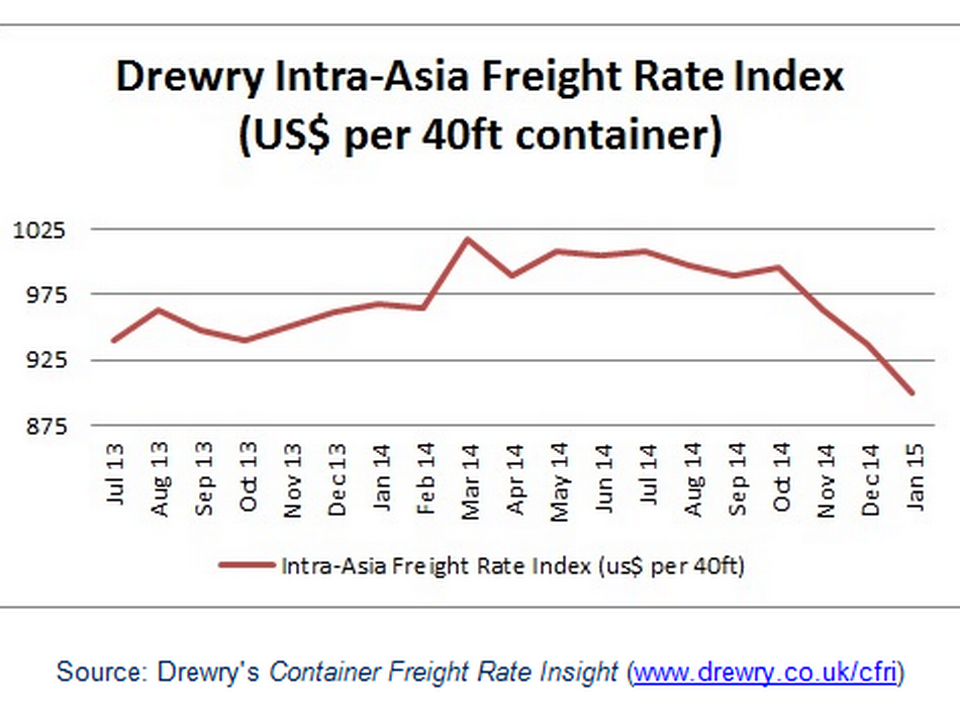

Drewry: Rate collapse on intra-Asian services

For subscribers