Analysis: Container merger looks dead in the water

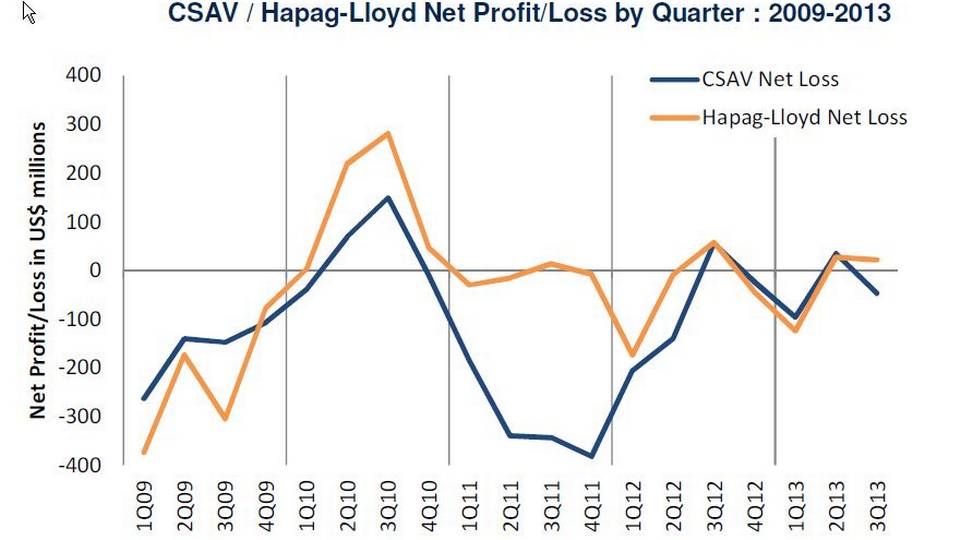

A merger or another form of close collaboration between German Hapag-Lloyd and Chilean CSAV already looks to be dead in the water due to the carriers' latest operating results and their ownerships, which seem to lack a clear strategic direction, says analysts Alphaliner.

Read the whole article

Get access for 7 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Chilean CSAV makes deficit

For subscribers

Hapag-Lloyd stays in black

For subscribers

Competitors respond to P3 alliance

For subscribers