Shell looking to find formula for LNG adventure

HAMBURG

Last year the production of liquified natural gas (LNG) surpassed the volume of oil at Royal Dutch Shell. And the oil and gas company sees major potential in LNG, which as a fuel represents one of several options for shipping in terms of complying with the numerous environmental regulations hitting the shipping industry in the coming years. One example is the SECA zone, set to come into force in Northern Europe in less than four months.

Today the fuel is cheaper than Diesel, though it is still unable to compete with traditional fuel oil. This is one of the barriers keeping several carriers from switching to LNG, as fuel represents the single biggest cost of operating vessels. But the ambition is to change this, says Surinderdeep Singh, General Manager of Shell Marine Products.

The technical division

“The trick is to make it more competitive compared to fuel oil, and this hasn’t been done yet. The technical challenge remains. How to create an engine that can run on LNG at a level at least as competitive as fuel oil. We’re working with partners such as Marine OEMs to solve this problem. We’re not there yet, and it’s still a challenge globally,” he explains to ShippingWatch at SMM in Hamburg, where thousands of participants have been visiting the massive conference halls throughout the week.

LNG is currently one of Shell’s fastest growing sectors in terms of production, and Surinderdeep Singh believes that natural gas is an obvious solution to bridge today’s shipping with the environmental future. Sustainable energy sources onboard ships, such as electrical batteries and solar power, are often mentioned as some of the solutions that can help reduce the environmental impact of shipping. And customer interest in LNG – including top global carriers, according to Singh – is starting to emerge. However, their interest in the alternative is not without reservation. And with good reason, says Singh:

“From their point of view, they’re investing in a ship that will be used for 25-30 years. What kind of energy will be available for so many years into the future? They’re concerned. It’s still a very uncertain area, because no one knows for sure where prices will be with certainty in say ten years from now. So customers are looking for partners who can enter very long term agreements with them, and Shell is one of these,” he says, adding:

“Shipowners are also interested in hybrid technologies such as dual-fuel engines, which can run on both LNG and diesel or LNG and fuel oil. This is another bridge that could provide time for development.”

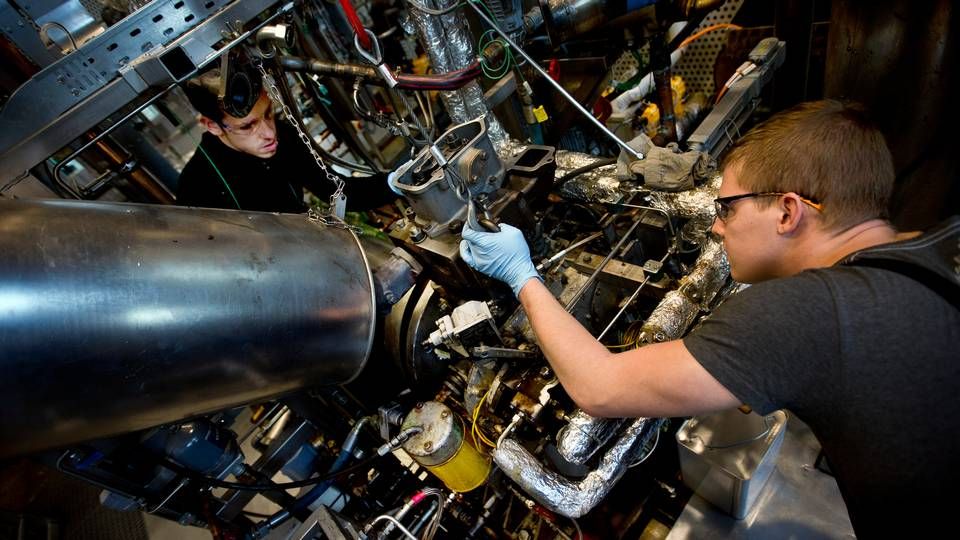

MAN Diesel & Turbo's gas engine

Last year Shell saw a growing interest from its biggest customers in 2-stroke gas engines. The supplier also believes strong uptake of MAN Diesel & Turbo’s gas engine, ME-GI, could be a turning point for the industry.

“It’s exciting because it could hold the key to some of our biggest customers converting to LNG more broadly,” says Surinderdeep Singh.

Many shipowners have been hesitant to invest in gas engines due to the fact there is still no well-developed LNG network in terms of fuel in most ports. The EU is working on plans to establish LNG terminals in several European ports. But according to European shipowners, the proposal has been watered down significantly, with the EU now aiming to have the network ready as late as by 2025 – five years later than originally planned. Other private players also see opportunities in the development, and Russia’s Gazprom has voiced ambitions of establishing a network in the Baltic Sea, while Lloyd’s Register recently predicted that the fuel could account for more than one quarter of the bunker market by 2025.

The major hubs

Surinderdeep Sing believes that the transition to LNG will at first take place in the major global hubs. Shell currently operates LNG terminals at major hubs such as Rotterdam and Houston.

“We’re looking at Singapore. They’re very determined to be a leader in the ship service market, so if there’s a new source of energy, they’ll invest in it. People are worried about distribution, but at Shell we believe that we can solve this problem,” he says, before adding:

“If we have hubs such as Shanghai, Singapore, Qatar, Rotterdam and Houston, it represents an LNG network that the major container carriers can start to use. From there it will spread to smaller units, but the catalyst is the commitment to some major investments. And Shell has the capability to do this.”

Wärtsilä to supply LNG engines for gas vessels

Nordic ports looking to join forces in the EU

Related articles

Nordic ports looking to join forces in the EU

For subscribers

Wärtsilä to supply LNG engines for gas vessels

For subscribers

Substantial discount for LNG ships in Gothenburg

For subscribers