Maersk chairman: Low debt could be a challenge

All surplus capital should be placed in acquisitions, A.P. Moeller-Maersk chairman Michael Pram Rasmussen tells newspaper Berlingske, explaining that the group favors long-term growth over shareholder dividends.

The Maersk Group's combined debt stands at USD 7.8 billion, but this is a somewhat low figure compared to the conglomerate's operating profit, which approaches USD 9.3 billion.

"This is a low level both in terms of historical debt levels as well as our earnings. If the debt remains low for several years, it could create challenges for the group. But we want to grow, and we see opportunities to supplement our organic growth with acquisitions in the current market," says Michael Pram Rasmussen in an email to Berlingske:

"The Maersk Group operates in somewhat volatile markets. We want to maintain strong financial resources in order to remain free to act, especially through downturns. As such, our priority is to maintain a solid credit rating, which gives access to more sources for financing, resulting in lower interest costs," explains Pram Rasmussen.

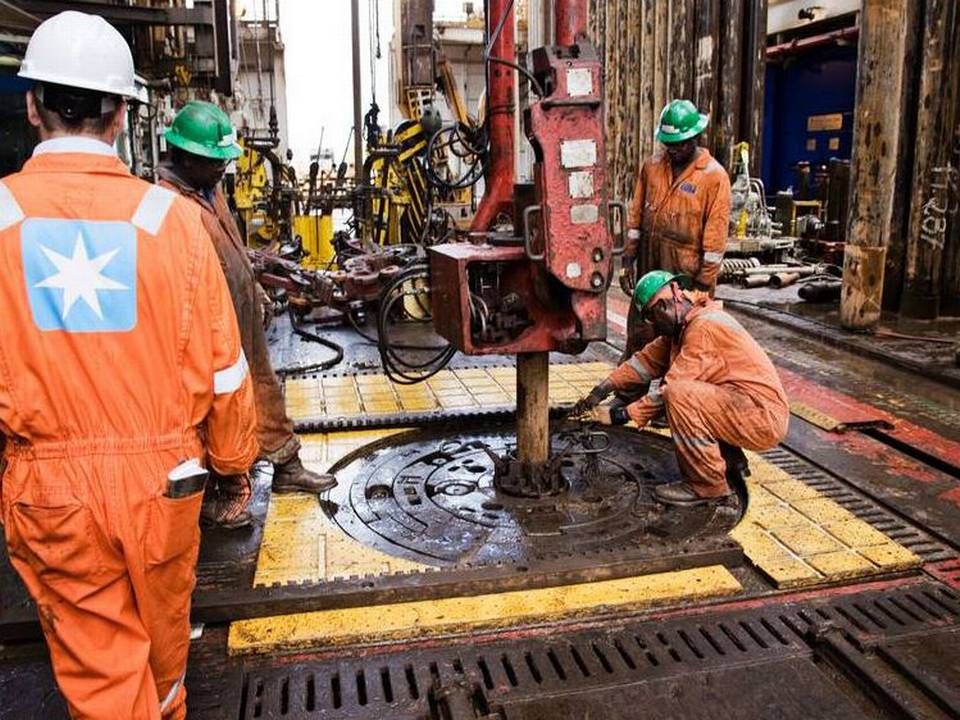

Maersk Oil CEO: More acquisitions to follow African deal

Maersk Oil buys fields for close to a billion dollars

This is how Maersk can use an unprofitable Singapore carrier

Related articles

Maersk Oil buys fields for close to a billion dollars

For subscribers

This is how Maersk can use an unprofitable Singapore carrier

For subscribers

.jpg)