Maersk Line transfers thousands of contracts to SeaLand

One month ago, around 240 employees were unpacking boxes at a new office located a stone’s throw from the tropical US business hub of Miami. Maersk Line’s new inter-regional carrier for the Americas, SeaLand, has picked this city as its headquarters. More than half of the employees are full-blooded Maersk Line people. The rest come from sectors such as the railroad and port industry as well as from competing container carriers.

Maersk Line announced more than a year ago that the company was going to resurrect the name of the major, renowned US-based container carrier that Maersk Line acquired in October 1999. SeaLand would resonate with most players in the region and would serve as the company’s new inter-regional branch in the Americas, covering North, Central and South America as well as the Caribbean. One year has also passed since SeaLand CEO Craig Mygatt outlined the strategy for the new carrier in an interview with ShippingWatch, and some three months have elapsed since SeaLand launched its operations. In other words, it is time for a status check.

"We are now working to stabilize our processes," says Craig Mygatt on the phone to ShippingWatch.

Several thousand contracts

"We are transferring Maersk Line customers to SeaLand. We’re talking to them about our service, explaining who we are, and then they’ll sign contracts with SeaLand for this region. We’re looking at a few thousand contracts that need to be switched to SeaLand, and we’ve now done more than 62 percent in terms of volumes," he says.

SeaLand is especially focused on customers who need to ship less than 500 containers annually, as the intra-American market consists mainly of these types of customers. This was evident from a survey performed by Maersk Line back in 2013, which played a key part in the decision to establish the new intra-regional carrier, just as Maersk Line for instance has MCC handling the intra-Asian market for container traffic and feeder carrier Seago for the European market.

According to Craig Mygatt, the company is well underway to positioning itself specifically toward these customers, and the carrier is securing the optimal platform in this regard.

"You need to be very quick for these customers. Every request needs to be performed as quickly as possible, preferably in 15 minutes, as the routes are so short. Otherwise you’re not going to win their trust and their business. I’d say that we’re about 50 percent there. There’s still some that needs doing, but we’ll be fully settled during the summer," says Craig Mygatt.

For instance, customers require a completely different approach than on the Asia-Europe services, he explains. SeaLand’s employees must know the customers in detail, their family and personal relations, as this represents an integral part of the Latin American culture. This culture needs to be naturally reflected in the employees, which is why an important aspect has been to ensure the right mix of former Maersk employees along with people from elsewhere in the world.

Furthermore, the market landscape has not changed much, explains Mygatt. Competitors have been stable, and that is a good sign, he says.

"Sometimes people will react when a new player enters the market, but so far we haven’t seen this happen, so it’s a stable environment. However, rates have remained unchanged since early 2000."

The competition

The market has experienced some developments, for instance through acquisitions by two of Germany’s major container carriers, who are thus trying to strengthen their grip on South America. This includes the merger between Hapag-Lloyd and Chilean CSAV as well as Hamburg Süd’s acquisition of Compañía Chilena de Navegación Interoceánica S.A. (CCNI) – and SeaLand welcomes this development, says Craig Mygatt, citing the fact that SeaLand collaborates with numerous carriers in the region to draw on each other’s capacity:

"We like to exchange slots, and we believe that there’s enough capacity, so it’s a matter of how we use that capacity. Whether it’s our competitors’ or our own is not that important. We’re fine with this development, and now there are fewer carriers to navigate between. Fewer contracts and fewer meetings, so that’s fine for our markets," says Mygatt, describing the competition as engaging.

"Right now we’re actually our own biggest competitor. We need to put ourselves in a position where we can produce for our customers. That’s what we’re focused on right now. When we feel we have a solid base, and that customers are comfortable working with SeaLand, then maybe we’ll look into expanding."

SeaLand eyes market growth of 4-5 pct. this year

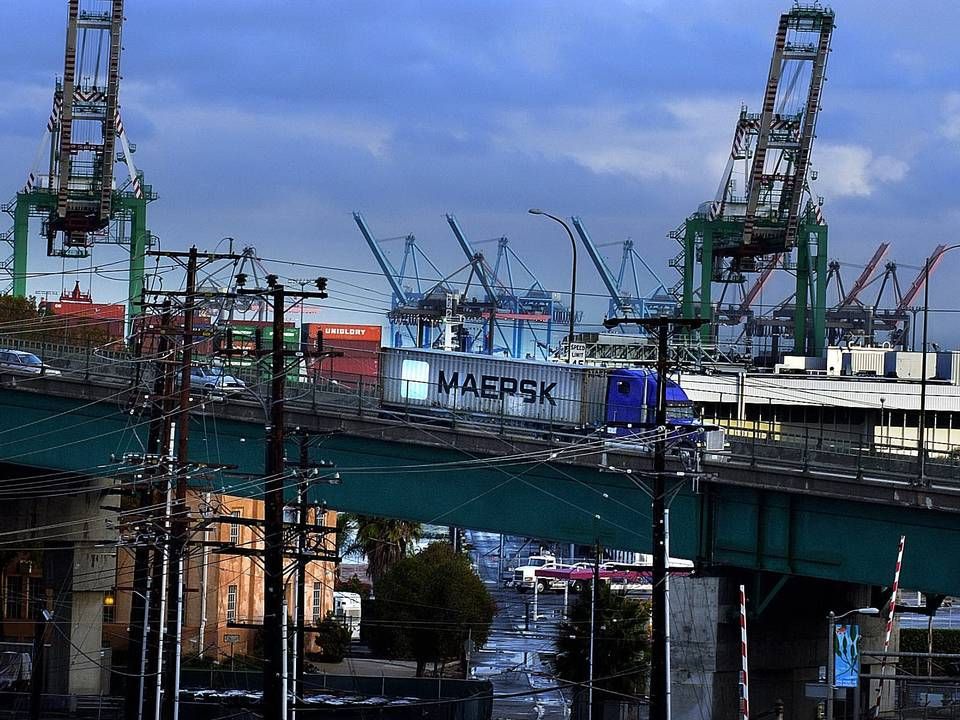

Shippers on US West Coast: We're approaching gridlock

SeaLand CEO has appointed his executive team

Related articles

SeaLand eyes market growth of 4-5 pct. this year

For subscribers

Shippers on US West Coast: We're approaching gridlock

For subscribers

SeaLand CEO has appointed his executive team

For subscribers