Bimco projects huge bunker savings in 2015

2015 promises huge fuel savings for shipowners, operators and their customers, as there is - at this point - no indication that the price of oil or fuel will rise again anytime soon, explains chief analyst Peter Sand of Bimco.

He has outlined these predictions to ShippingWatch based on new calculations, which show both the annual savings for individual ship segments and an assessment of what these might mean for the global shipping industry.

Try a free 40-day trial subscription to ShippingWatch

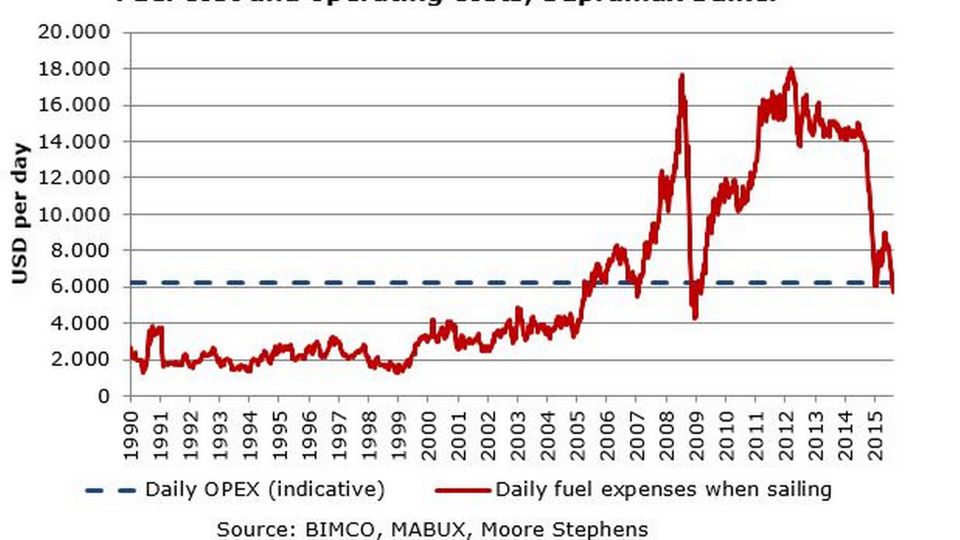

The graph below highlights shifting fuel prices in the past years for a Supramax bulker, showing that costs have plummeted in 2015.

In round numbers, this looks set to generate savings on a Supramax for no less than USD 1,43 million for all of 2015, based on the current bunker prices and that the ship is in operation roughly two-thirds of the time.

Savings of USD 1,7 million

The savings are even bigger for a Panamax ship, according to the calculations. With a daily fuel consumption of 30 tons, these ships look set for savings of USD 1.7 million when compared with last year.

"These savings will not necessarily benefit the company, as this entirely depends on the contract and whether it is an owned or chartered vessel. What's new is that operating costs have long been the minor factor in terms of overall costs, and this is no longer the case. Although companies are still focused on lowering fuel consumption, the pressure to save money on fuel has decreased, which has resulted in less pressure on the industry overall," says Peter Sand.

Try a free 40-day trial subscription to ShippingWatch

The savings per ship become even more apparent when taking into account the annual price to date. Last year, the price was USD 576 down to USD 278 this year. This gives a Panamax a saving of USD 2.13 million for the whole of 2015.

Astronomical savings

Until mid 2014, bunker prices hovered around USD 600 per ton. Until then, the industry was strongly focused on bringing fuel expenses down. Prior to 2015, the situation was the opposite whereby operating costs, OPEX, represented the largest single expense for shipowners and operators. Taking a single ship as an example, if a Supramax burns 25 tons of fuel per day to USD 200 per mt, it costs about USD 5,000 per day. The average price in 2014 amounted to USD 560, meaning that fuel expenses amounted to USD 14,000 per day last year. So far, this year the average price is at USD 336, 40 percent lower than in 2014.

Taking the entire global fleet into account, the impact is astronomical savings when the bunker price falls so low. Approximately 257 million tons of bunker are traded per day on the spot markets. With an average drop of USD 224 per ton, the global industry is looking at savings of USD 158 million per day, benefiting someone somewhere in the transport supply chain. Bimco made the same calculations in November last year, and got the amount saved to USD 117 million per day.

Retrofit continues

Besides the obvious savings, there are also signs within the industry that more shipping companies are working at faster speeds, since the savings from slow steaming are lower than the bunker price.

"We saw already in 2014, and we’re seeing it again this year especially among VLCCs, that customers are willing to pay the extra costs to have goods delivered faster," says Peter Sand.

Try a free 40-day trial subscription to ShippingWatch

The long-term goals to save on fuel, reduce costs and do something for the environment appear to remain intact among shipping companies, MAN Turbo and Diesel recently told ShippingWatch. The interest in retrofitting ships with the company’s key product, the Kappel Propeller, also appears to have steadily increased this year.

"We are seeing a steadily increasing interest and a growing order book. Besides the prospect of savings on individual ships, we are experiencing, for example, that German banks are pressuring companies to retrofit their fleets. The banks say that they want to ensure their collateral this way," said Thomas Leander, Head of Propulsion in MAN Diesel and Turbo.

Low oil price sends tankers south of Africa

Related articles

Low oil price sends tankers south of Africa

For subscribers

Team Tankers maintained momentum in Q2

For subscribers

Maersk to sell new technology to competition

For subscribers