Maersk Drilling CEO: We'll takes things as they come

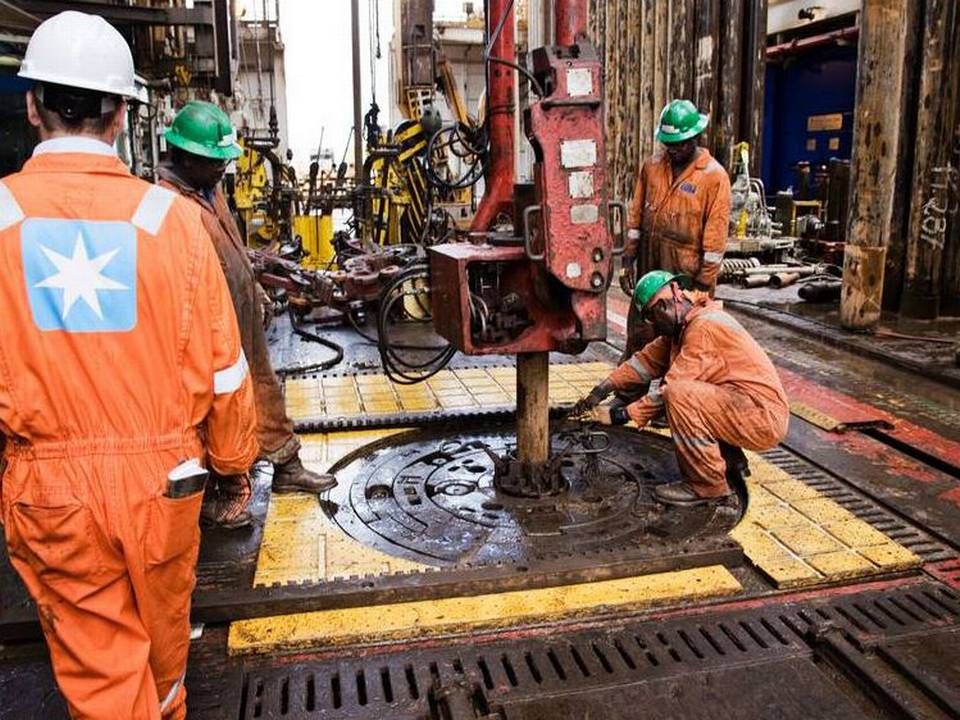

The good old days in the oil industry are still reflected in the annual report for the Maersk Group's drilling company, Maersk Drilling, even though the division's customers - the major oil companies - are announcing mass layoffs and major savings left and right as a result of the low oil price.

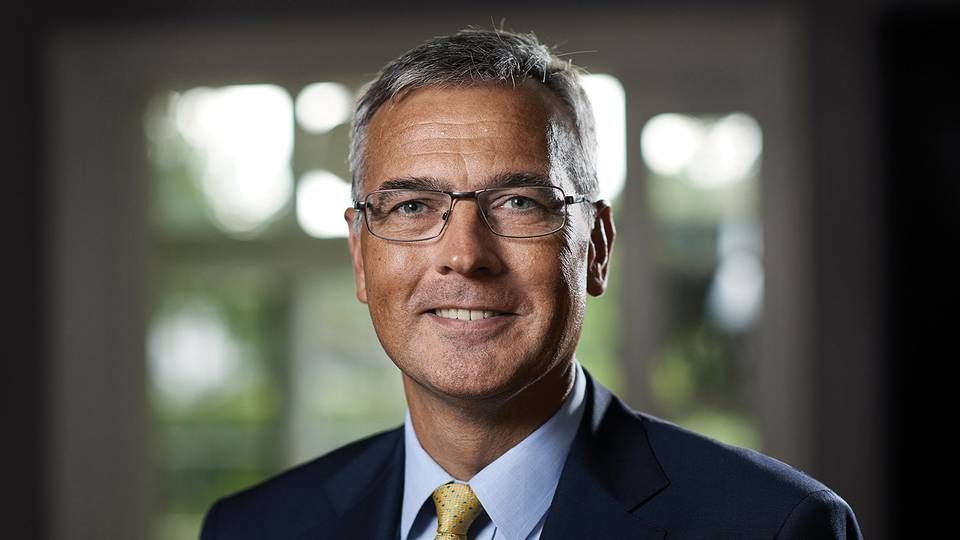

At Maersk Drilling, the result increased to USD 751 million in 2015 up from USD 478 million in 2014, and the return on invested capital (ROIC) was boosted to 9.3 percent, an increase form 7.1 percent in 2014. However, the result, which CEO Claus Hemmingsen describes as satisfactory, is related to the majority of the 22 vessels at Maersk Drilling operating on contracts during 2015 which were entered into before the oil price started its drastic decline.

Here is an overview of the Maersk Group annual report 2015

The company currently has a contract coverage of 77 percent for 2016, 52 percent for 2017 and 43 percent for 2018. Claus Hemmingsen does not hide the fact that contracts are now being entered into at very different rates compared to before, and that the drilling company does not project any improvement in the market "in the short or medium-long terms." He declines to speculate on how long this will be.

"There is a reason that we don't predict specific years, but of course it depends on the oil price. But we don't expect that anything will happen in the next few years which will make the relationship between supply and demand change," he tells ShippingWatch and adds:

"We'll take things as they come."

Idling could be necessary

In the meantime, the strategy is the same as before. The rigs must be kept on the water as much as possible in order to maintain employment for both staff and materials.

"I don't want it to sound like I expect that our rigs will be consistently employed over the next few years. There will be periods where we have idle rigs," Claus Hemmingsen says.

At the moment, three out of Maersk Drilling's 22 units are without employment - not including Maersk Guardian, which is under reconstruction to become an accommodation rig for a five-year contract - but including Maersk Venturer, which is headed to a contract off the coast of Uruguay. A suitable solution for the oversupply of drilling rigs characterizing the market could be moving up the scrapping of older rigs, but after Maersk Endurer was sent to scrapping, this is not a strategy that Hemmingsen wants to bet on.

Semco to rebuild Maersk Drilling's new oil rig

Maersk Drilling lays rig up in Gulf of Mexico

He emphasizes that both of the oldest, remaining rigs in the fleet - Giant and Guardian - have been lifespan-extended and thus have the prerequisites for staying on the market another 5-10 years. With the reconstruction of the Guardian to an accommodation rig, there is also another incentive to keep the sister-rig Giant on the market.

"This provides us with the opportunity to use the spare parts and machinery from Guardian which actually can help make a nice and competitive rig out of Giant," Claus Hemmingsen says, although he does not rule out scrapping.

"Of course, if the market gets even worse, then we will consider how long of a life these rigs should have. But fortunately these are the only two rigs that are even being considered in that respect."

Faith in the future

For the newest portion of the fleet, three out of four newly built drilling vessels, which cost Maersk Drilling about USD 2.6 billion combined, are on long-term contracts, while the last vessel - the previously mentioned Maersk Venturer - is on a four-month contract worth USD 44 million. However, Claus Hemmingsen is optimistic about finding employment when the four months are up.

Maersk Drilling lands new contract for drilling vessel

"We are having good talks with a couple of oil companies about work over the course of the second half of 2016, but it's not something that has resulted in a contract yet. So theoretically, the vessel will still be free on the market when the four months are up."

Regardless of the uncertainty which obviously affects the forecast of the future oil market, the Drilling CEO does seem to have faith that the market will recover. And before alternative energy sources may make the need for the black gold significantly less.

"The thing about oil fields is that they decline in production. So you have to find new fields and more wells must be drilled just to keep up the current production. And seeing as drilling rigs are getting older, the market will stabilize over time. But the question, of course, is when and how much, and that is what we would prefer not to speculate about right now."

Read more about Maersk Drilling

Maersk Oil in 2.6 billion dollar impairment

Related articles

Maersk Oil in 2.6 billion dollar impairment

For subscribers

Maersk Group's profit down 50 percent

For subscribers

Oil discovered in Maersk's new Africa licenses

For subscribers