Alphaliner: New 2M competitor would have 20 percent on Asia-Europe

.jpg)

CMA CGM is left on its own following Maersk Line and MSC's announcement last week that the two carriers are forming a new collaborative agreement, a VSA, and are thus canceling their existing agreements with CMA CGM. This has made Drewry and SeaIntel speculate about whether CMA CGM was set to join forces with UASC and CSCL. Alphaliner presents a similar assessment in its weekly newsletter, pointing to the fact that UASC and CSCL are the only two competitors with the right size.

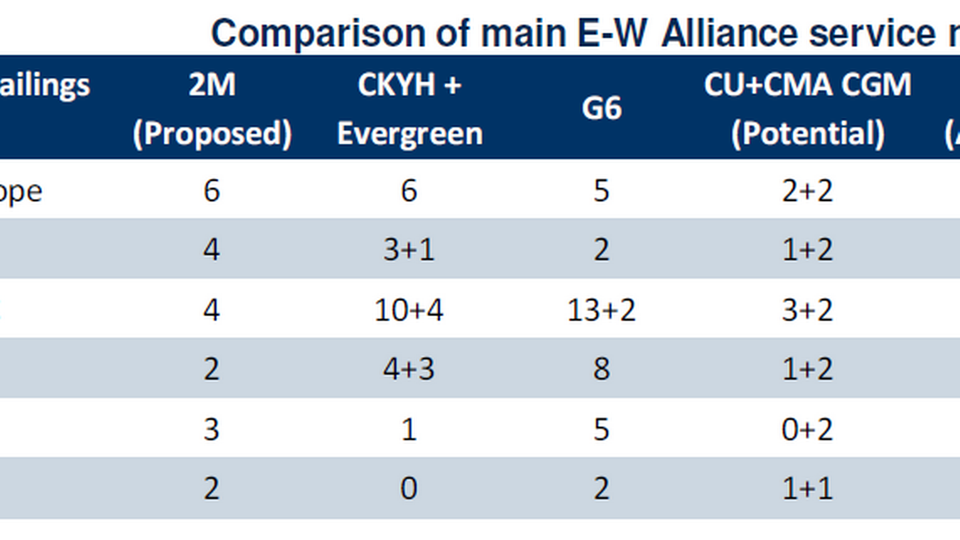

If CMA CGM decides to form an alliance with the two carriers - named 2CU by Alphaliner - it would mean that the new alliance could secure a 20 percent market share on Asia - Europe.

"The potential 2CU alliance would have a capacity share of 19 percent on the FE - North Europe route and 22 percent on the FE - Med route, which would be comparable to the CKYHE and G6 shares. In addition, the three carriers would have a combined fleet of 20 units of 16,000-19,000 teu which would fit well within an enlarged alliance," says Alphaliner.

The table below illustrates that CMA CGM would jump into the big leagues if the carrier forms a new alliance, while 2M would be the dominant player on Asia - Europe. Maersk Line and MSC combined have more than 30 percent of the capacity on these trades.

Source: Alphaliner

According to Alphaliner, Maersk Line and MSC's announcement of the 2M VSA came at a very bad time for CMA CGM, as the carrier is now left with very little time to find new collaborative partners. SeaIntel wrote yesterday, Monday, that CMA CGM was likely only invited into the P3 at the very last moment, as the original P3 alliance between Maersk Line and MSC did not include CMA CGM. However, Drewry has previously told ShippingWatch that 2M is not a disaster to CMA CGM. Rather, new thinking could benefit the carrier.

Analyst agency Platou estimates that Maersk Line and MSC with 2M agreement could save around 4 percent in unit costs, corresponding to millions of dollars in annual savings.

Platou: Maersk and MSC could save 4 percent on 2M

Related articles

Platou: Maersk and MSC could save 4 percent on 2M

For subscribers

SeaIntel: 2M could lead to four major alliances

For subscribers

Drewry: 2M not a disaster for competitors

For subscribers