ECA requirements spur carriers to accelerate newbuildings

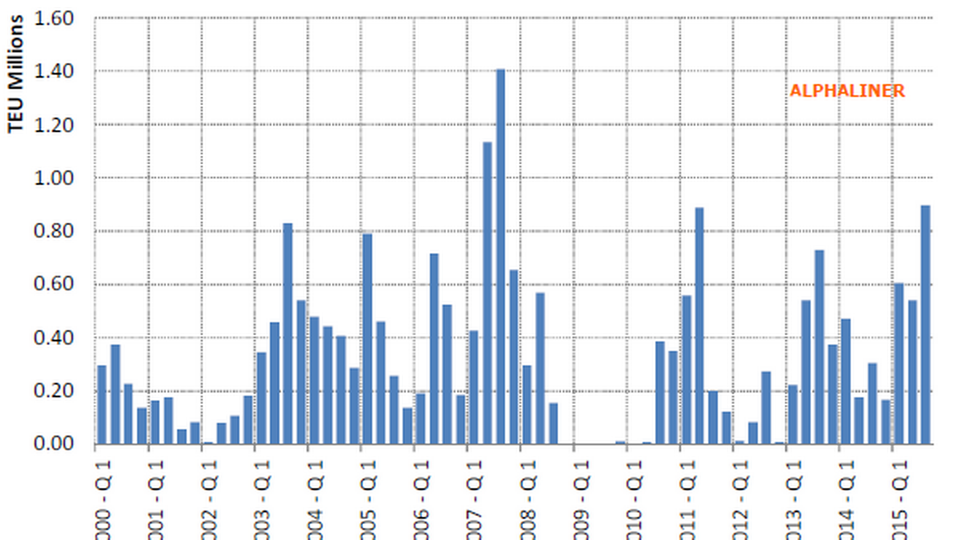

The number of newbuilding contracts for container ships in the first nine months of 2015 already stands at 190 vessels for a total capacity of 2.04 million teu. This is the highest level seen in the past seven full years.

A part of the reason that container carriers have rushed to place newbuilding orders ahead of January 1st 2016 is, according to analyst agency Alphaliner, that ships with keels laid before this date are not required to comply with tightened regulations concerning reduced nitrogen (NOx) emissions from fuel in coastal regions in the US and Canada, the so-called ECA zone.

Try a free 40-day trial subscription to ShippingWatch

These regulations are included in the IMO's Marpol Annex VI Tier III ruleset, which according to Alphaliner brings additional costs in the form of expensive equipment for engines and exhaust systems on newbuildings, costs that come to around 2-5 percent for small and large container vessels, respectively.

Cosco orders nine ultra-large vessels

New vessel orders must be placed before late October in order to meet this deadline, as shipyards need 2-3 months to prepare to lay down keels. This factor has resulted in significant newbuilding order activity in recent weeks, with Asian carriers such as Cosco, Evergreen, PIL and Yang Ming have placed orders for a total 34 new ships, and additional newbuilding contracts are expected announced in the immediate future.

Source: Alphaliner

The biggest of these orders comes from China Cosco, which recently signed contracts for 11 ultra-large container vessels, ULCVs, of 19,000 teu each, set for delivery in 2018. The combined order is worth USD 1.5 billion, or USD 137.2 million per ship.

Alphaliner: Maersk Line and MSC passive in rate war

Taiwanese Yang Ming, Cosco's partner in the CKYHE alliance, one of the four major alliances that currently dominate container traffic between Asia and Europe, has also confirmed orders for additional newbuildings as the carrier last week ordered a total of five 14,000 ships, set for delivery in 2018 and 2019. Similarly Taiwanese Evergreen has also in recent weeks placed orders for a series of 10 smaller wide beam container vessels to supplement the 10 ships the carrier ordered in July this year. Singapore-based PIL has also been active in the newbuilding market.

Intensifying rate war

The wave of ultra-large container ships, which are ascribed much of the blame for the current rate war among container carriers on the main trades between Far East and North Europe, looks set to intensify in the coming years and will likely continue into 2018.

Try a free 40-day trial subscription to ShippingWatch

Deployment of the ultra-large vessels is expected to have far-reaching consequences, increasing overcapacity and threatening the delicate balance between supply and demand.

China Cosco confirms billion dollar order for mega ships

Wave of mega-ships strains container carriers ahead of 2018

Related articles

China Cosco confirms billion dollar order for mega ships

For subscribers

Drewry: Inflexible mega-ships strain carriers' creativity

For subscribers

.jpg)