P3 partners conquer large market shares

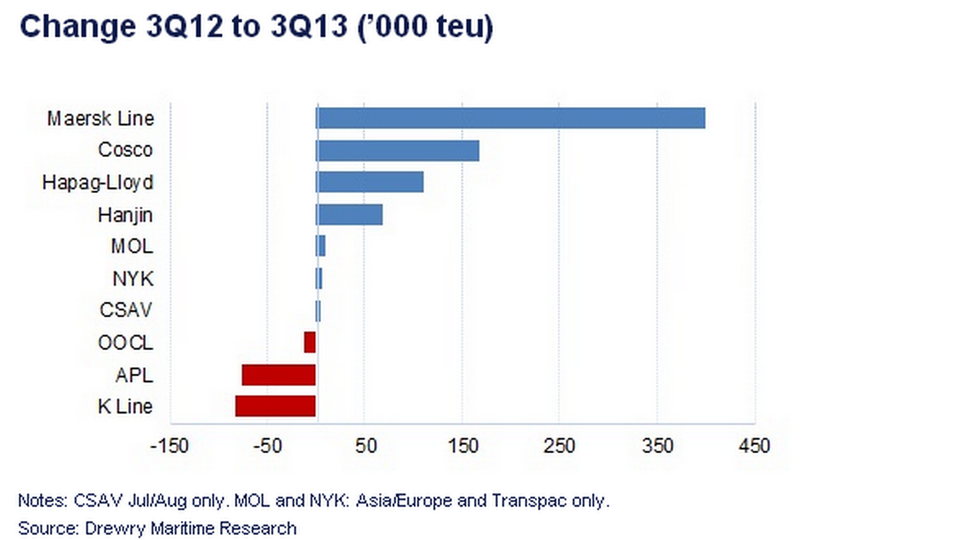

Third quarter 2013 interim reports from the global container carriers show that the biggest carriers are growing significantly faster than smaller carriers. Maersk Line's total freight volumes increased 9.5 percent compared to the same period 2012, or more than twice the global average of 4.2 percent, according to a new analysis by Drewry.

Following completion of the analysis, the interim report of French CMA CGM - the world's third largest container carrier and partner of Maersk Line and MSC in the coming P3 alliance - shows that the company's total freight volumes grew by a whopping 11 percent, for the biggest growth in the industry.

Carriers's reliability dives back down

German Hapag-Lloyd secured 8.7 percent growth in cargo volumes in the same quarter, while Chinese Cosco and Korean Hanjin increased their volumes by 7.8 percent and 5.8 percent, respectively, in the period.

At the other of the scale, Japanese K Line, for instance, saw its volumes decline 6.3 percent, APL's cargo volumes went down by 5.4 percent, and OOCL's volumes decreased 0.9 percent. As for MOL and NYK, whose volumes apply only to the key Asia-Europe route, the carriers achieved growth of 2.3 and 1.2 percent, respectively.

SeaIntel: 115 canceled container transports in 2013

Drewry points out the difficulties of determining how much of the growth comes from various services, such as reliability. Reduced prices could be part of the explanation that the carriers conquering market shares would normally lower the freight rates.

It is unlikely that this explanation applies here, as close to all of the carriers suffer equally from the declining rates, says Drewry, adding that the comparison between the 3rd quarters 2012 and 2013 should be treated with caution, as the period last year was unusual and devoid of an actual peak season on the east-west routes. Another explanation could be that the carriers in the 3rd quarter this year have tried to regain lost ground, rather than actually working to increase their market shares.

SeaIntel: EU faces difficult case against container carriers

SeaIntel: P3 just the first step toward consolidation

Related articles

SeaIntel: EU faces difficult case against container carriers

For subscribers

SeaIntel: P3 just the first step toward consolidation

For subscribers

More efficient Triple-E's in the pipeline

For subscribers